Shutterfly 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

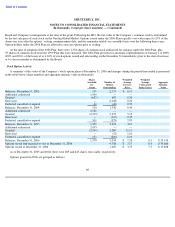

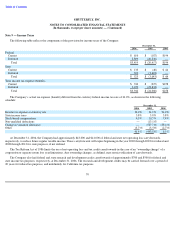

The total intrinsic value of options exercised during the twelve months ended December 31, 2006, 2005, and 2004 was $531, $3,274, and

$4,259, respectively. Net cash proceeds from the exercise of stock options were $83 for the twelve months ended December 31, 2006.

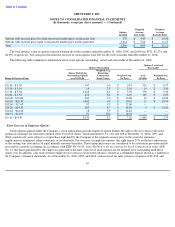

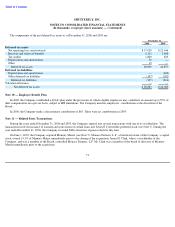

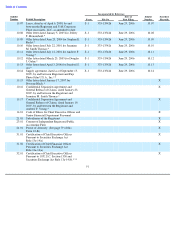

The following table summarizes information about stock options outstanding, vested and exercisable at December 31, 2006:

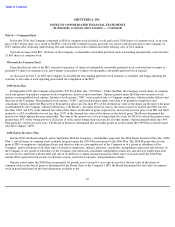

Early Exercise of Employee Options

Stock options granted under the Company’s stock option plans provide employee option holders the right to elect to exercise unvested

options in exchange for restricted common stock. Unvested shares, which amounted to 31, 138, and 698 at December 31, 2006, 2005, and

2004, respectively, were subject to a repurchase right held by the Company at the original issuance price in the event the optionees’

employment is terminated either voluntarily or involuntarily. For exercises of employee options, this right lapses 25% on the first anniversary

of the vesting start date and in 36 equal monthly amounts thereafter. These repurchase terms are considered to be a forfeiture provision and do

not result in variable accounting. In accordance with EITF No. 00-23, Issues Related to the Accounting for Stock Compensation under APB

No. 25,

the shares purchased by the employees pursuant to the early exercise of stock options are not deemed to be outstanding until those

shares vest. In addition, cash received from employees for exercise of unvested options is treated as a refundable deposit shown as a liability in

the Company’s financial statements. As of December 31, 2006, 2005, and 2004, cash received for early exercise of options of $9, $38, and

67

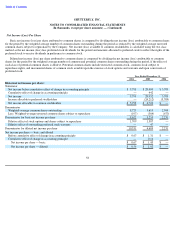

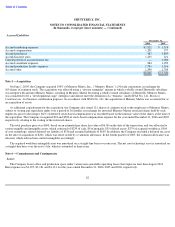

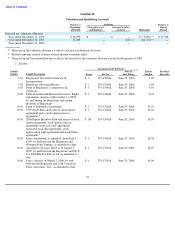

Weighted

Weighted

Options

Average

Average

Granted

Fair Value

Exercise Price

Options with exercise price less than reassessed market price on the grant date

255

$

4.43

$

10.00

Options with exercise price equal to reassessed market price on the grant date

2,014

$

5.06

$

11.25

Total

2,269

$

4.99

$

11.11

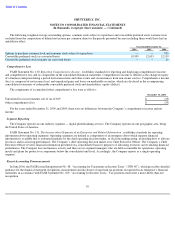

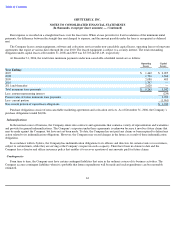

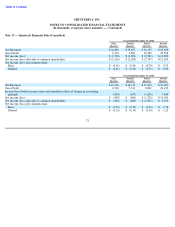

Options Vested and

Options Outstanding

Exercisable

Weighted Avg.

Shares Underlying

Remaining

Outstanding Options

Contractual

Weighted Avg.

As of

Weighted Avg.

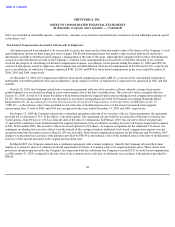

Range of Exercise Prices

as of 12/31/06

Term (Years)

Ex Price

12/31/06

Ex Price

$ 0.10

-

$ 0.50

747

6.3

$

0.35

551

$

0.37

$ 3.50

-

$ 3.50

14

3.3

$

3.50

14

$

3.50

$ 5.50

-

$ 5.50

1,622

8.1

$

5.50

739

$

5.50

$ 6.00

-

$ 6.56

412

8.6

$

6.10

145

$

6.09

$10.00

-

$10.00

269

9.0

$

10.00

21

$

10.00

$10.39

-

$

10.39

1,482

9.4

$

10.39

11

$

10.39

$12.00

-

$

12.00

97

9.5

$

12.00

—

—

$14.20

-

$

14.20

282

9.7

$

14.20

4

$

14.20

$14.62

-

$

14.62

18

9.9

$

14.62

—

—

$14.91

-

$

14.91

91

10.0

$

14.91

—

—

$ 0.10

-

$

14.91

5,034

8.5

$

7.28

1,485

$

3.75