Shutterfly 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

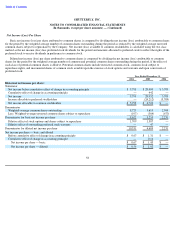

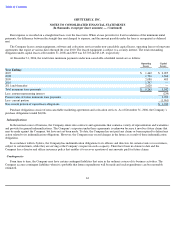

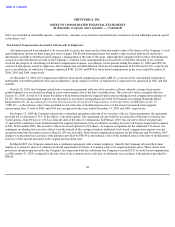

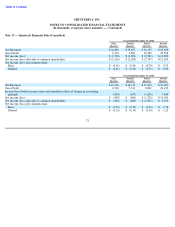

Accrued Liabilities

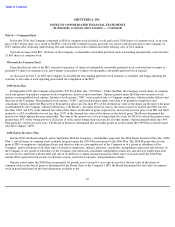

On June 1, 2005, the Company acquired 100% of Memory Matrix, Inc., (“Memory Matrix”) a Nevada corporation, in exchange for

109 shares of common stock. The acquisition was effected using a “reverse triangular” merger in which a wholly owned Shutterfly subsidiary

was merged with and into Memory Matrix, resulting in Memory Matrix becoming a wholly owned subsidiary of Shutterfly. Memory Matrix

was considered to be a “developmental stage” enterprise and did not meet the definition of a “business” under SFAS No. 141, Business

Combinations , for business combination purposes. In accordance with SFAS No. 141, the acquisition of Memory Matrix was accounted for as

an acquisition of assets.

As additional consideration for the acquisition, the Company also issued 121 shares of common stock to the employees of Memory Matrix,

subject to vesting and repurchase rights over a period of 18 months, in exchange for unvested Memory Matrix restricted shares held by such

employees prior to the merger. $671 of deferred stock-

based compensation was recorded based on the intrinsic value of the shares at the time of

the acquisition. The Company recognized $94 and $500 of stock-

based compensation expense for the year ended December 31, 2006 and 2005,

respectively, relating to the vesting of the restricted shares.

The total purchase price was $690, based on an estimated per share fair value of $6.00 on the date of the transaction, and was allocated to

various tangible and intangible assets, which consisted of $239 of cash, $9 of prepaids, $35 of fixed assets, $279 of acquired workforce, $564

of core technology, related deferred tax liability of $336 and assumed liabilities of $100. In addition, the Company recorded a deferred tax asset

on the date of acquisition of $201, which was offset in full by a valuation allowance. In the fourth quarter of 2005, the valuation allowance was

released, which reduced non-current intangibles accordingly.

The acquired workforce intangible asset was amortized on a straight-

line basis over one year. The net core technology asset is amortized on

a straight-line basis over the asset’s life, which is estimated as three years.

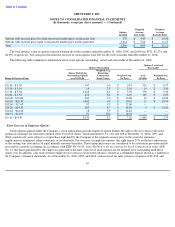

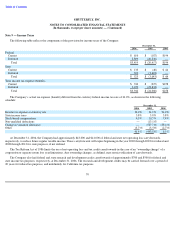

Leases

The Company leases office and production space under various non-cancelable operating leases that expire no later than August 2014.

Rent expense was $1,295, $1,181 and $1,131, for the years ended December 31, 2006, 2005 and 2004, respectively.

62

December 31,

2006

2005

Accrued marketing expenses

$

1,822

$

1,318

Accrued compensation

1,201

977

Accrued purchases

483

3,845

Accrued income taxes

1,235

221

Current portion of accrued license fee

—

1,000

Accrued consultant expenses

884

1,059

Accrued production facility expenses

1,784

1,316

Accrued other

1,399

1,784

$

8,808

$

11,520

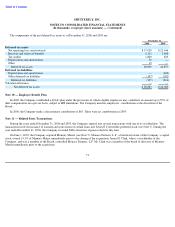

Note 5

—

Acquisition

Note 6

—

Commitments and Contingencies