Shutterfly 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

Fair Value of Financial Instruments

The carrying amount of certain of the Company’s financial instruments, including accounts receivable and

accounts payable, are carried at cost, which approximates their fair value because of their short-term maturities.

Based on borrowing rates available to the Company for loans with similar terms, the carrying value of borrowings,

including capital lease obligations, approximates fair value.

Concentration of Credit Risk

Financial instruments that potentially subject the Company to credit risk consist principally of cash, cash

equivalents and accounts receivable. Most of the Company’s cash and cash equivalents as of December 31, 2006

were deposited with financial institutions in the United States and Company policy restricts the amount of credit

exposure to any one issuer and to any one type of investment. Deposits held with financial institutions may exceed

federally insured limits.

The Company’s accounts receivable are derived primarily from sales to customers located in the United States

who make payments through credit cards. Credit card receivables settle relatively quickly. The Company maintains

allowances for potential credit losses on customer accounts when deemed necessary. To date, such losses have not

been material and have been within management’s expectations. As of December 31, 2006, one customer accounted

for 14% of the Company’s net accounts receivable and as of December 31, 2005, another customer accounted for

18% of the Company’s net accounts receivable.

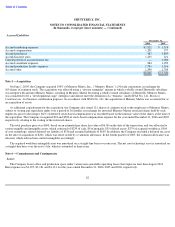

Inventories

Inventories are stated at the lower of cost on a first-in, first-out basis or net realizable value. The value of

inventories is reduced by estimates for excess and obsolete inventories. The estimate for excess and obsolete

inventories is based upon management’

s review of utilization of inventories in light of projected sales, current market

conditions and market trends. Inventories are primarily raw materials and consist principally of paper, photo book

covers and packaging supplies.

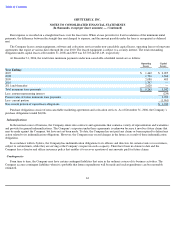

Property and Equipment

Property and equipment, including equipment under capital leases, are stated at historical cost, less accumulated

depreciation and amortization. Depreciation and amortization are computed using the straight-line method over the

estimated lives of the assets, generally three to five years. Amortization of equipment acquired under capital lease

obligations is computed using the straight-line method over the shorter of the remaining lease term or the estimated

useful life of the related assets, generally three to four years. Leasehold improvements are amortized over their

estimated useful lives, or the lease term if shorter, generally three to five years. Upon retirement or sale, the cost and

related accumulated depreciation are removed from the balance sheet and the resulting gain or loss is reflected in

operating expenses. Major additions and improvements are capitalized, while replacements, maintenance and repairs

that do not extend the life of the asset are charged to expense as incurred.

Website Development Costs

The Company capitalizes eligible costs associated with software developed or obtained for internal use in

accordance with AICPA Statement of Position 98-1, Accounting for the Costs of Computer Software Developed or

Obtained for Internal Use , and EITF 00-02, Accounting for Web Site Development Costs. Accordingly, the

Company expenses all costs that relate to the planning and post implementation phases. Costs incurred in the

development phase are capitalized and amortized over the product’s estimated useful life. The Company has

capitalized website development costs incurred in the application development phase and unamortized cost is

included in property and equipment and totaled approximately $2,582 and $2,187 at December 31, 2006 and 2005,

54