Shutterfly 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Shutterfly annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SHUTTERFLY, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts) — (Continued)

Advertising costs are expensed as incurred. Such costs are included in selling and marketing expenses and totaled approximately $5,710,

$4,878 and $2,361 during the years ended December 31, 2006, 2005 and 2004, respectively.

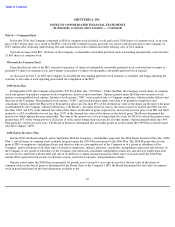

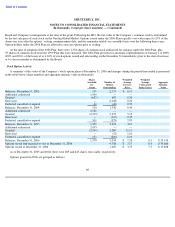

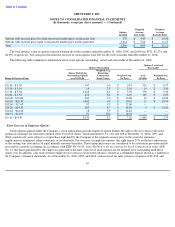

Stock-Based Compensation

Prior to January 1, 2006, the Company accounted for stock-based employee compensation arrangements in accordance with the provisions

of Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to Employees (“APB No. 25”), and related interpretations, and

followed the disclosure provisions of Statement of Financial Accounting Standards No. 123, Accounting for Stock-Based Compensation

(“SFAS No. 123”).

Under APB No. 25, compensation expense is based on the difference, if any, on the date of the grant, between the fair value

of the Company’s stock and the exercise price. Employee stock-based compensation determined under APB No. 25 is recognized based on

guidance provided in Financial Accounting Standards Board Interpretation No. 28, Accounting for Stock Appreciation Rights and Other

Variable Stock Option or Award Plans (“FIN 28”), which provides for accelerated expensing over the option vesting period.

The Company accounts for equity instruments issued to non-employees in accordance with the provisions of SFAS No. 123, Emerging

Issues Task Force Abstract No. 96-18, Accounting for Equity Instruments that are Issued to Other than Employees for Acquiring, or in

Conjunction with Selling, Goods or Services (“EITF 96-18”), and FIN 28.

Effective January 1, 2006, the Company adopted the fair value provisions of Statement of Financial Accounting Standards No. 123R,

Share-Based Payment (“SFAS No. 123R”), which supersedes its previous accounting under APB 25. SFAS No. 123R requires the recognition

of compensation expense, using a fair-value based method, for costs related to all share-based payments including stock options.

SFAS No. 123R requires companies to estimate the fair value of share-based payment awards on the date of grant using an option-pricing

model. The Company adopted SFAS No. 123R using the prospective transition method, which requires that for nonpublic entities that used the

minimum value method for either pro forma or financial statement recognition purposes, SFAS No. 123R shall be applied to option grants after

the required effective date. For options granted prior to the SFAS No. 123R effective date, which the requisite service period has not been

performed as of January 1, 2006, the Company will continue to recognize compensation expense on the remaining unvested awards under the

intrinsic-value method of APB 25. In addition, the Company will continue amortizing those awards valued prior to January 1, 2006 utilizing an

accelerated amortization schedule while all option grants valued after January 1, 2006 will be expensed on a straight-line basis over the

requisite period.

In November 2005, the Financial Accounting Standards Board (“FASB”) issued FASB Staff Position No. FAS 123R-3, Transition

Election Related to Accounting for Tax Effects of Share

-Based Payment Awards. The Company has elected to adopt the prospective transition

method provided in the FASB Staff Position for calculating the tax effects of stock-based compensation pursuant to SFAS No. 123R.

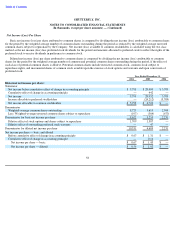

Income Taxes

The Company accounts for income taxes under the liability method. Under this method, deferred tax assets and liabilities are determined

based on the difference between the financial statement and tax basis of assets and liabilities and net operating loss and credit carryforwards

using enacted tax rates in effect for the year in which the differences are expected to reverse. Valuation allowances are established when

necessary to reduce deferred tax assets to the amounts expected to be realized.

57