Seagate 2002 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

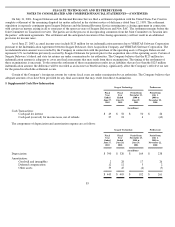

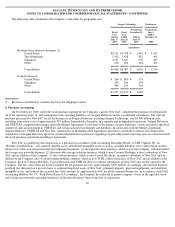

Trade names —The value of the trade names was based upon discounting to their net present value the licensing income that would arise

by charging the operating businesses that use the trade names.

Developed technologies —The value of this asset for each operating business was determined by discounting the expected future cash

flows attributable to all existing technologies which had reached technological feasibility, after considering risks relating to: (1) the

characteristics and applications of the technology, (2) existing and future markets, and (3) life cycles of the technologies. Estimates of future

revenues and expenses used to determine the value of developed technology were consistent with the historical trends in the industry and

expected outlooks.

Assembled workforces —The value of the assembled work force was determined by estimating the recruiting, hiring and training costs to

replace each group of existing employees.

In-process research and development —The value of in-process research and development was based on an evaluation of all

developmental projects using the guidance set forth in FIN 4 and SFAS No. 86, “Accounting for the Cost of Computer Software to Be Sold,

Leased, or Otherwise Marketed.” The amount was determined by: (1) obtaining management estimates of future revenues and operating profits

associated with existing developmental projects, (2) projecting the cash flows and costs to completion of the underlying technologies and

resultant products, and (3) discounting these cash flows to their net present value.

Estimates of future revenues and expenses used to determine the value of in-process research and development were consistent with the

historical trends in the industry and expected outlooks. The entire amount was charged to operations because related technologies had not

reached technological feasibility, and they had no alternative future use.

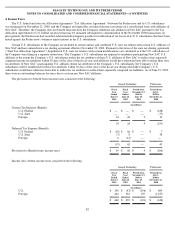

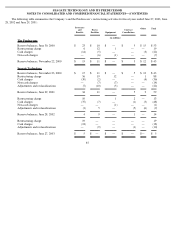

9. Equity

Share Capital

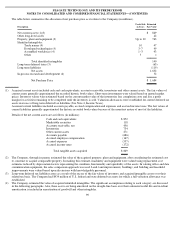

The Company’s authorized share capital is $13,500 and consists of 1,250,000,000 common shares, par value $0.00001, of which

438,870,267 shares were outstanding as of June 27, 2003 and 100,000,000 preferred shares, par value $0.00001, of which none were issued or

outstanding as of June 27, 2003.

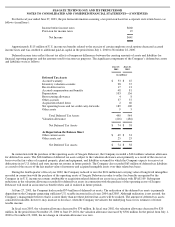

Common shares —Holders of common shares are entitled to receive dividends and distributions when and as declared by the Company’s

Board of Directors. Upon any liquidation, dissolution, or winding up of the Company, after required payments are made to holders of preferred

shares, any remaining assets of the Company will be distributed ratably to holders of the preferred and common shares. Holders of common

shares are entitled to one vote per share on all matters upon which the common shares are entitled to vote, including the election of directors.

Preferred shares —The Company is authorized to issue up to a total of 100 million shares of preferred stock in one or more series,

without stockholder approval. The Board of Directors is authorized to establish from time to time the number of shares to be included in each

series, and to fix the rights, preferences and privileges of the shares of each wholly unissued series and any of its qualifications, limitations or

restrictions. The Board of Directors can also increase or decrease the number of shares of a series, but not below the number of shares of that

series then outstanding, without any further vote or action by the stockholders.

The Board of Directors may authorize the issuance of preferred stock with voting or conversion rights that could harm the voting power

or other rights of the holders of the common stock. The issuance of preferred stock, while providing flexibility in connection with possible

acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of

the Company and might harm the market price of its common stock and the voting and other rights of the holders of common stock. As of June

27, 2003, there were no shares of preferred stock outstanding.

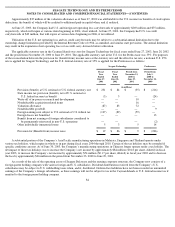

In connection with the Company’s initial public offering in December 2002, all previously outstanding shares of preferred stock

aggregating 400 million shares were converted by New SAC into the Company’

s common stock. In the event of any liquidation, dissolution, or

winding up of the Company, the holders of the previously outstanding preferred shares were entitled to receive, out of any remaining legally

available assets of the Company, a liquidation preference of $2.30 per share, less the aggregate amount of any distributions or dividends

already made per preferred share. After the payment in full of the liquidation preference the holders of preferred shares were entitled to share,

ratably with the holders of common shares, in any remaining assets available for distribution. To the extent there were not sufficient remaining

assets of the Company to pay the liquidation preference, holders of preferred shares would share ratably in the distribution of the Company’s

remaining assets. Upon payment of the liquidation preference and any other amounts payable on liquidation, dissolution or winding up, on each

preferred share, the preferred shares would be cancelled. During fiscal year 2002, holders of the preferred shares received approximately $199

million, or $0.50 per share, in distributions, which had the effect of reducing the liquidation preference to approximately $1.80 per share.

91