Seagate 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Assembled workforces —The value of the assembled workforce was determined by estimating the recruiting, hiring and training costs to

replace each group of existing employees.

In-process research and development —The value of in-process research and development was based on an evaluation of all

developmental projects using the guidance set forth in Interpretation No. 4 of Financial Accounting Standards Board, or FASB, Statement

No. 2, “Accounting for Research and Development Costs” and FASB Statement No. 86, “Accounting for the Cost of Computer Software

to Be Sold, Leased, or Otherwise Marketed.”

The amount was determined by: (a) obtaining management estimates of future revenues and operating profits associated with existing

developmental projects, (b) projecting the cash flows and costs to completion of the underlying technologies and resultant products and

(c) discounting these cash flows to their net present value.

Estimates of future revenues and expenses used to determine the value of in-process research and development were consistent with the

historical trends in the industry and expected performance. The entire amount was charged to operations because related technologies had

not reached technological feasibility and they had no alternative future use.

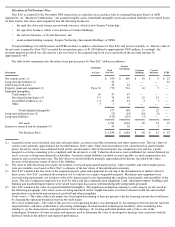

Allocation of Purchase Price to Us Pursuant to the Application of Push Down Accounting

(5)

Long-term deferred tax liabilities arose as a result of the excess of the fair values of inventory and acquired intangible assets over their

related tax basis. We had $434 million of U.S. federal and state deferred tax assets for which a full valuation allowance was established.

The November 2000 transactions constituted a purchase transaction by New SAC of substantially all the operating assets and liabilities of

Seagate Delaware. Under purchase accounting rules, the net purchase price has been allocated to the acquired assets and liabilities of Seagate

Delaware and its subsidiaries based on their estimated fair values at the date of the November 2000 transactions. New SAC estimated the fair

values, including in-process research and development. However, the estimated fair values of identifiable tangible and intangible assets and

liabilities acquired from Seagate Delaware and its subsidiaries were greater than the amount paid, resulting in negative goodwill. The negative

goodwill was allocated to the long-lived tangible and intangible assets, as well as in-process research and development. This includes amounts

relating to Seagate Technology, on the basis of relative fair values. Subsequently, in the fourth quarter of fiscal year 2002, in accordance with

SFAS 109 we reduced the net carrying value of the long-lived intangibles from $104 million to zero to reflect the recognition of tax benefits.

See Note 5 of the audited consolidated and combined financial statements of Seagate Technology and its Predecessor.

In accordance with SEC Staff Accounting Bulletin No. 54, “Push Down Basis of Accounting Required in Certain Limited

Circumstances,” the accounting for the purchase transaction has been “pushed down” from New SAC to our financial statements. Our

condensed consolidated financial statements as of and for all periods subsequent to November 23, 2000 reflect the new basis in our assets and

liabilities at that date, including the pushed down purchase accounting adjustments.

As a result of the November 2000 transactions and the push down accounting, our results of operations following the November 2000

transactions, particularly the depreciation and amortization charges, are not necessarily comparable to our predecessor’s results of operations

prior to the November 2000 transactions. Depreciation charges following the November 2000 transactions are lower as a result of write-downs

of our depreciable assets pursuant to purchase accounting rules. The favorable effect on results of operations from these lower charges will

gradually decrease in future periods as our older assets become fully depreciated and new, higher-priced assets are acquired.

Current Trends Affecting Our Results of Operations

Industry Dynamics. Our industry is characterized by several trends that have a material impact on our strategic planning, financial

condition and results of operations. One key trend has been the decline in spending on information technology by enterprises and consumers as

a result of the weakened global economy. The slowdown in enterprise expenditures is also a result of the extensive investments that many

enterprises had already made in recent years before the global economic slowdown. Currently, demand for rigid disc drives in the enterprise

sector is being adversely impacted as a result of the weakened economy and because enterprises have shifted their focus from making new

equipment purchases to more efficiently using their existing information technology infrastructure through, among other things, adopting new

storage architectures.

Simultaneously with this economic weakness, there has been continued consolidation and attrition among our competitors. For instance,

in 2001 Maxtor merged with Quantum’s rigid disc drive operations and IBM recently merged its rigid disc drive business with that of Hitachi.

Also in 2001, Fujitsu ceased manufacturing rigid disc drives for the personal storage market. This consolidation among our competitors has

contributed to shifts in market share as newly combined companies focus on integrating their operations and OEMs maintain diversity by

shifting their purchasing allocations to new suppliers. Also, as manufacturers merge or exit the rigid disc drive industry, they frequently

liquidate their excess inventory leading to competitive pressure which has resulted in even lower selling prices.

25