Seagate 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

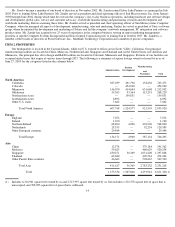

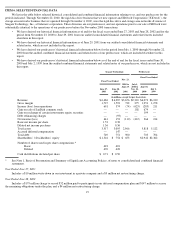

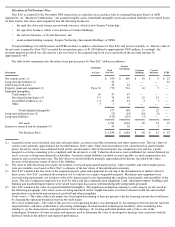

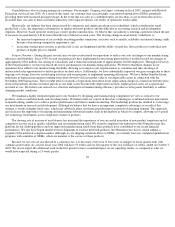

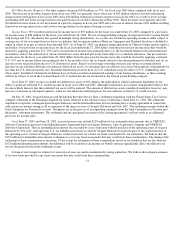

Allocation of Net Purchase Price

New SAC accounted for the November 2000 transactions as a purchase in accordance with Accounting Principles Board, or APB,

Opinion No. 16, “Business Combinations.”

All acquired tangible assets, identifiable intangible assets and assumed liabilities were valued based

on their relative fair values and reorganized into the following businesses:

•

the rigid disc drive and storage area networks business, which is now Seagate Technology;

•

the tape drive business, which is now known as Certance Holdings;

•

the software business, or Crystal Decisions; and

Certance Holdings, Crystal Decisions and STIH are direct or indirect subsidiaries of New SAC and are not owned by us. The fair value of

the net assets acquired by New SAC exceeded the net purchase price of $1.840 billion by approximately $909 million. Accordingly, the

resultant negative goodwill was allocated on a pro rata basis to the acquired long-lived assets and reduced the recorded amounts by

approximately 46%.

The table below summarizes the allocation of net purchase price by New SAC (dollars in millions).

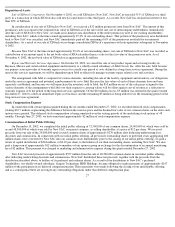

Trade names —The value of the trade names was based upon discounting to their net present value the licensing income that would arise

by charging the operating businesses that use the trade names.

Developed technologies—The value of this asset for each operating business was determined by discounting to their net present value the

expected future cash flows attributable to all existing technologies that had reached technological feasibility, after considering risks

relating to: (a) the characteristics and applications of the technology, (b) existing and future markets and (c) life cycles of the

technologies. Estimates of future revenues and expenses used to determine the value of developed technology were consistent with the

historical trends in the industry and expected performance.

•

an investment holding company, Seagate Technology Investments Holdings, or STIH.

Description

Useful Life

in Years

Total

New SAC

Seagate

Technology

Certance

Holdings

Crystal

Decisions

STIH

Net current assets (1)

$

939

$

869

$

36

$

9

$

25

Long

-

term investments (2)

42

—

—

—

42

Other long

-

lived assets

42

42

—

—

—

Property, plant and equipment (3)

Up to 30

778

763

10

5

—

Identified intangibles:

Trade names (4)

10

47

47

—

—

—

Developed technologies (4)

3

-

7

76

49

12

15

—

Assembled workforces (4)

1

-

3

53

43

3

7

—

Other

5

1

1

—

—

—

Total identified intangibles

177

140

15

22

—

Long

-

term deferred taxes (5)

(75

)

(63

)

(10

)

(2

)

—

Long

-

term liabilities

(122

)

(119

)

(3

)

—

—

Net assets

1,781

1,632

48

34

67

In

-

process research and development (4)

59

52

—

7

—

Net Purchase Price

$

1,840

$

1,684

$

48

$

41

$

67

(1)

Acquired current assets included cash and cash equivalents, accounts receivable, inventories and other current assets. The fair values of

current assets generally approximated the recorded historic book values. Short-term investments were valued based on quoted market

prices. Inventory values were estimated based on the current market value of the inventories less completion costs and less a profit

margin for activities remaining to be completed until the inventory is sold. Valuation allowances were established for current deferred tax

assets in excess of long-term deferred tax liabilities. Assumed current liabilities included accounts payable, accrued compensation and

expenses and accrued income taxes. The fair values of current liabilities generally approximated the historic recorded book values

because of the monetary nature of most of the liabilities.

(2)

The value of individual long-term equity investments was based upon quoted market prices, where available, and where market prices

were not available, was based on New SAC

’

s estimates of the fair values of the individual investments.

(3)

New SAC estimated the fair value of the acquired property, plant and equipment. In arriving at the determination of market value for

these assets, New SAC considered the estimated cost to construct or acquire comparable property. Machinery and equipment were

assessed using replacement cost estimates reduced by depreciation factors representing the condition, functionality and operability of the

assets. The sales comparison approach was used for office and data communication equipment. Land, land improvements, buildings and

building and leasehold improvements were valued based upon discussions with knowledgeable independent personnel.

(4)

New SAC estimated the value of acquired identified intangibles. The significant assumptions relating to each category are discussed in

the following paragraphs. Also, these assets are being amortized on the straight-line basis over their estimated useful life and resultant

amortization is included in amortization of goodwill and other intangibles.