Seagate 2002 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

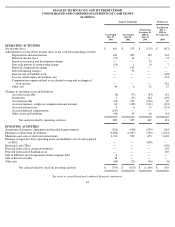

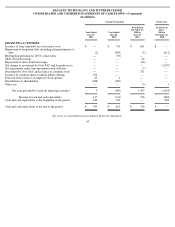

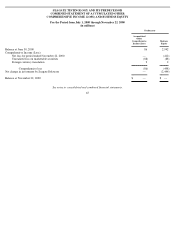

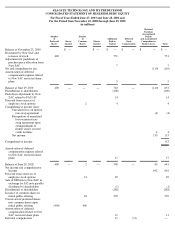

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

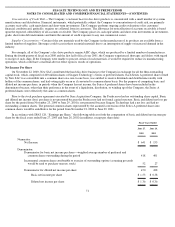

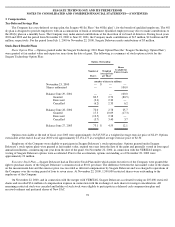

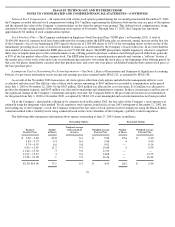

Stock-Based Compensation

In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure.” SFAS

148 amends SFAS 123 to provide alternative methods of transition to SFAS 123’s fair value method of accounting for stock-based employee

compensation. SFAS 148 also amends the disclosure provisions of SFAS 123 and APB Opinion No. 28, “Interim Financial Reporting,” to

require disclosure in the summary of significant accounting policies of the effects of an entity’s accounting policy with respect to stock-based

employee compensation on reported net income and earnings per share in annual and interim financial statements. While SFAS 148 does not

amend SFAS 123 or APBO 25 to require companies to account for employee stock options using the fair value method, the disclosure

provisions of SFAS 148 are applicable to all companies with stock-based employee compensation, regardless of whether they account for that

compensation using the fair value method of SFAS 123 or the intrinsic value method of APBO 25.

The Company continues to use the intrinsic value method under ABPO 25 and related interpretations in accounting for employee stock

options because the alternative fair value accounting method provided under SFAS 123 requires the use of option valuation models, such as the

Black-Scholes option-pricing model used by the Company, that were not developed for use in valuing employee stock options. The Black-

Scholes option-pricing model was developed for use in estimating the fair value of trade options that have no vesting restrictions and are fully

transferable. In addition, the Black-Scholes model requires the input of highly subjective assumptions, including the expected stock price

volatility. Because the Company’s stock-based awards have characteristics significantly different from those of traded options, and because

changes in the subjective input assumptions can materially affect the fair value estimate, in management’s opinion, the existing models do not

necessarily provide a reliable single measure of the fair value of its stock-based awards. The pro forma information under SFAS 123, as

amended by SFAS 148, is as follows:

No tax effects were included in the determination of pro forma net income because the deferred tax asset resulting from stock

-based employee

compensation would be offset by an additional valuation allowance for deferred tax assets. The effects on pro forma disclosures of applying

SFAS 123 may not be representative of the effects on pro forma disclosures in future periods because the Company only began granting

options to employees in July 2001. See Note 3, Compensation—Stock-Based Benefit Plans, for a discussion of the Company’s assumptions

used to estimate stock-based compensation expense under SFAS 123.

72

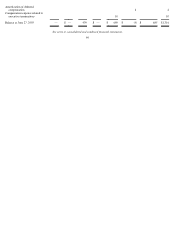

Fiscal Years Ended

June 27,

2003

June 28,

2002

Net income:

As reported

$

641

$

153

Add

-

back:

Stock

-

based employee compensation expense included in net income

2

—

Deduct:

Total stock-based employee compensation expense determined under fair value

method for all awards

(38

)

(16

)

Pro forma net income

$

605

$

137

Basic earnings per share:

As reported

$

1.53

$

0.38

Pro forma

$

1.45

$

0.34

Diluted earnings per share:

As reported

$

1.36

$

0.36

Pro forma

$

1.30

$

0.32