Seagate 2002 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

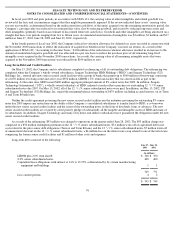

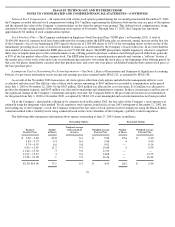

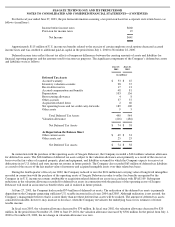

Approximately $35 million of the valuation allowance as of June 27, 2003 was attributable to the U.S. income tax benefits of stock option

deductions, the benefit of which will be credited to additional paid-in capital when, and if, realized.

At June 27, 2003, the Company had U.S. and foreign net operating loss carryforwards of approximately $269 million and $75 million,

respectively, which will expire at various dates beginning in 2004, if not utilized. At June 27, 2003, the Company had U.S. tax credit

carryforwards of $49 million, that will expire at various dates beginning in 2006, if not utilized.

Utilization of the U.S. net operating loss and tax credit carryforwards may be subject to a substantial annual limitation due to the

ownership change limitations provided by the Internal Revenue Code of 1986, as amended, and similar state provisions. The annual limitation

may result in the expiration of net operating loss or tax credit carry-forwards before utilization.

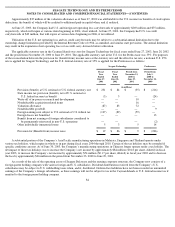

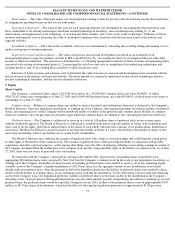

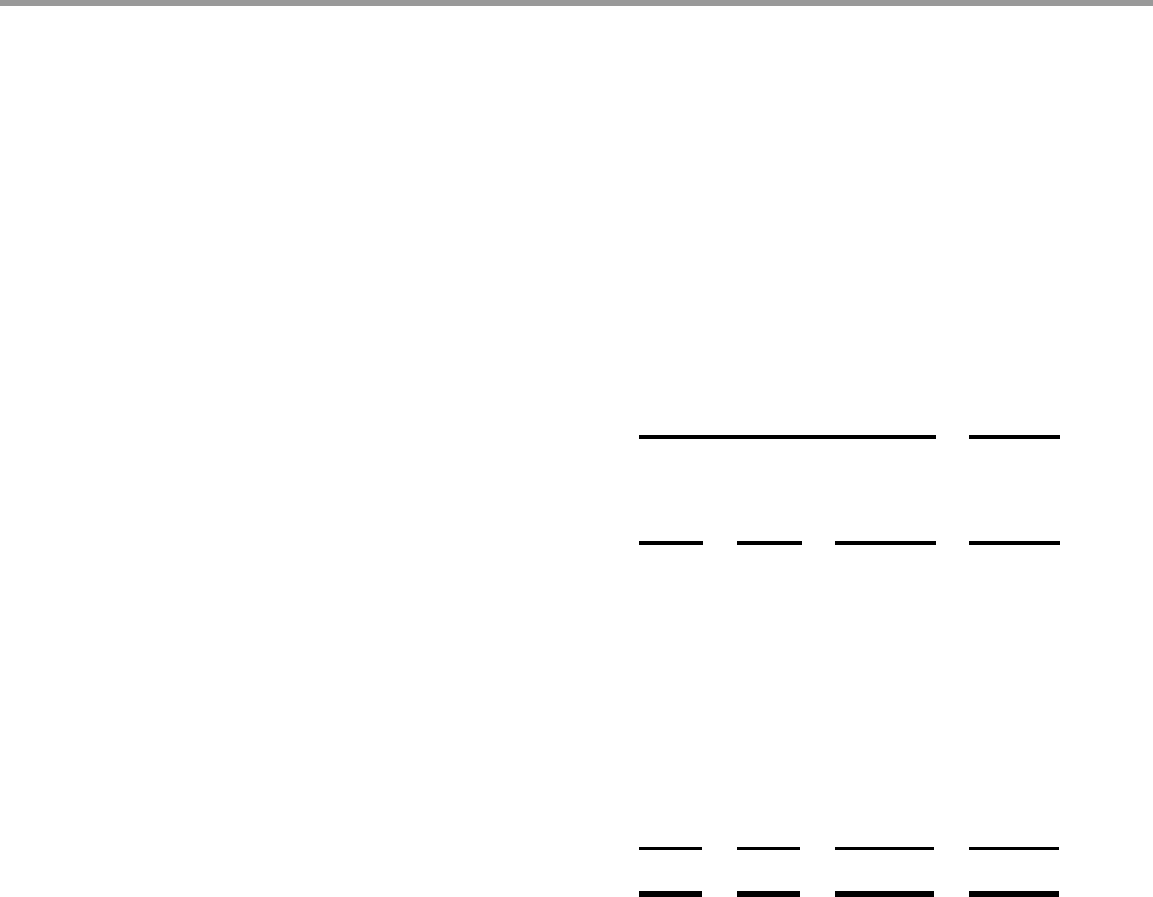

The applicable statutory rate in the Cayman Islands was zero for Seagate Technology for fiscal years ended June 27, 2003, June 28, 2002

and the period from November 23, 2000 to June 29, 2001. The applicable statutory rate in the U.S. for the Predecessor was 35%. For purposes

of the reconciliation between the provision for (benefit from) income taxes at the statutory rate and the effective tax rate, a notional U.S. 35%

rate is applied for Seagate Technology and the U.S. federal statutory rate of 35% is applied for the Predecessor as follows:

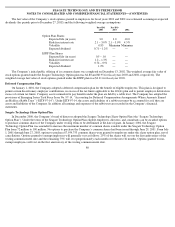

A substantial portion of the Company’s Asia Pacific manufacturing operations in Malaysia, Singapore and Thailand operate under

various tax holidays, which expire in whole or in part during fiscal years 2004 through 2010. Certain of the tax holidays may be extended if

specific conditions are met. As of June 30, 2003, the Company’s manufacturing operations in China no longer operate under a tax holiday. The

net impact of these tax holidays was to increase the Company’s net income by approximately $84 million ($0.18 per share, diluted) in fiscal

year 2003, to increase the Company

’s net income by approximately $74 million ($0.17 per share, diluted) in fiscal year 2002 and to decrease

the loss by approximately $36 million in the period from November 23, 2000 to June 29, 2001.

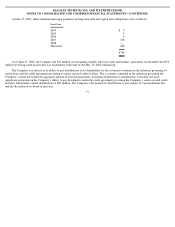

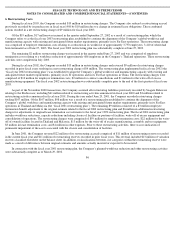

As a result of the sale of the operating assets of Seagate Delaware and the ensuing corporate structure, the Company now consists of a

foreign parent holding company with various foreign and U.S. subsidiaries. Dividend distributions received from the Company’s U.S.

subsidiaries may be subject to U.S. withholding taxes when, and if, distributed. Deferred tax liabilities have not been recorded on unremitted

earnings of the Company’s foreign subsidiaries, as these earnings will not be subject to tax in the Cayman Islands or U.S. federal income tax if

remitted to the foreign parent holding company.

84

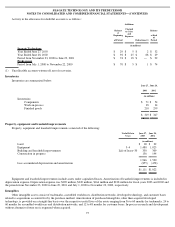

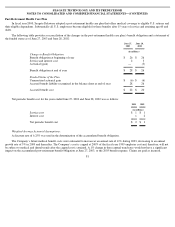

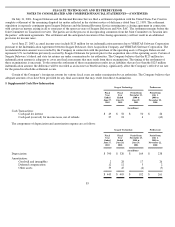

Seagate Technology

Predecessor

Fiscal

Year

Ended

June 27,

2003

Fiscal

Year

Ended

June 28,

2002

Period from

November 23,

2000 to

June 29,

2001

Period from

July 1,

2000 to

November 22,

2000

(in millions)

Provision (benefit) at U.S. notional or U.S. federal statutory rate

$

231

$

84

$

(35

)

$

(216

)

State income tax provision (benefit), net of U.S. notional or

U.S. federal income tax benefit

(3

)

5

—

(

24

)

Write

-

off of in

-

process research and development

—

—

10

—

Nondeductible acquisition related items

—

—

16

—

Valuation allowance

(87

)

83

72

—

Nondeductible goodwill

—

—

—

9

Foreign earnings not subject to U.S. notional or U.S. federal tax

(127

)

(89

)

(59

)

—

Foreign losses not benefited

—

—

—

13

Benefit from net earnings of foreign subsidiaries considered to

be permanently reinvested in non

-

U.S. operations

—

—

—

(

2

)

Other individually immaterial items

5

3

5

14

Provision for (Benefit from) income taxes

$

19

$

86

$

9

$

(206

)