Seagate 2002 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

17. Subsequent Events

Consummation of Secondary Public Offering

Under the Seagate Technology shareholders agreement among New SAC, the Company’s financial sponsors and the Company, New

SAC has demand registration rights to request from time to time that the Company register and sell shares of its common stock held by New

SAC. New SAC exercised this right and on July 30, 2003, the Company completed the secondary public offering of 69,000,000 of its common

shares, including 9,000,000 shares subject to the over-allotment option, all of which were sold by New SAC, as selling shareholder, at a price

of $18.75 per share. New SAC received proceeds of approximately $1.3 billion, after deducting underwriting discounts and commissions of

approximately $39 million. Direct expenses of the offering were borne by the Company aggregating approximately $1 million. New SAC

distributed its net proceeds to holders of its ordinary shares including approximately $245 million distributed to officers and employees of the

Company who hold ordinary shares of New SAC.

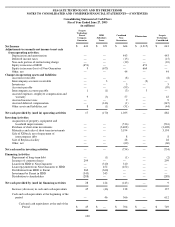

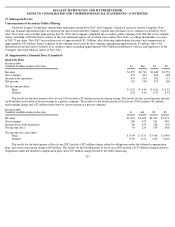

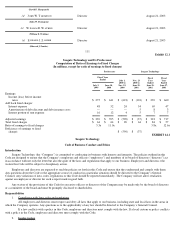

18. Supplementary Financial Data (Unaudited)

Quarterly Data

The results for the first quarter of fiscal year 2003 include a $7 million net restructuring charge. The results for the second quarter include

an $8 million write-down of an investment in a private company. The results for the fourth quarter of fiscal year 2003 include a $2 million

restructuring charge and a $2 million write-down of an investment in a private company.

The results for the third quarter of fiscal year 2002 include a $32 million charge related to obligations under the deferred compensation

plan, and a net restructuring charge of $4 million. The results for the fourth quarter of fiscal year 2002 include a $147 million charge related to

obligations under the deferred compensation plan, and a $93 million charge related to the debt refinancing.

103

Fiscal Year 2003

Unaudited, in millions except per share data

1st

2nd

3rd

4th

Revenue

$

1,579

$

1,734

$

1,620

$

1,553

Gross margin

372

493

434

428

Income from operations

119

219

182

171

Net income

110

198

174

160

Net income per share:

Basic

$

0.27

$

0.49

$

0.41

$

0.37

Diluted

0.24

0.43

0.37

0.33

Fiscal Year 2002

Unaudited, in millions except per share data

1st

2nd

3rd

4th

Revenue

$

1,294

$

1,629

$

1,691

$

1,473

Gross margin

298

437

511

348

Income (loss) from operations

46

159

228

(59

)

Net income (loss)

34

124

193

(198

)

Net income (loss) per share:

Basic

$

0.09

$

0.31

$

0.48

$

(0.49

)

Diluted

0.09

0.31

0.45

(0.49

)