Seagate 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

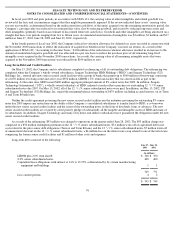

In December 2002, the FASB issued SFAS No. 148, “Accounting for Stock-Based Compensation—Transition and Disclosure” (“SFAS

148”). SFAS 148 amends SFAS No. 123, “Accounting for Stock-Based Compensation” (“SFAS 123”), to provide alternative methods of

transition to SFAS 123’s fair value method of accounting for stock-based employee compensation. SFAS 148 also amends the disclosure

provisions of SFAS 123 and APB Opinion No. 28, “Interim Financial Reporting,” to require disclosure in the summary of significant

accounting policies of the effects of an entity’s accounting policy with respect to stock-based employee compensation on reported net income

and earnings per share in annual and interim financial statements. While SFAS 148 does not amend SFAS 123 to require companies to account

for employee stock options using the fair value method, the disclosure provisions of SFAS 148 are applicable to all companies with stock-

based employee compensation, regardless of whether they account for that compensation using the fair value method of SFAS 123 or the

intrinsic value method of APBO 25. The Company adopted the disclosure requirements of SFAS 148 in the quarter ended March 28, 2003 and

will continue to use the intrinsic value method described in APB Opinion No. 25, “Accounting for Stock Issued to Employees” (“ABPO 25”),

in accounting for the fair value of stock awards issued to employees.

In January 2003, the FASB issued FIN 46, “Consolidation of Variable Interest Entities, an Interpretation of ARB No. 51” (“FIN 46”).

FIN 46 requires certain variable interest entities to be consolidated by the primary beneficiary of the entity if the equity investors in the entity

do not have the characteristics of a controlling financial interest or do not have sufficient equity at risk for the entity to finance its activities

without additional subordinated financial support from other parties. FIN 46 is effective for all new variable interest entities created or acquired

after January 31, 2003. For variable interest entities created or acquired prior to February 1, 2003, the provisions of FIN 46 must be applied for

the first interim or annual period beginning after June 15, 2003. The Company does not believe that the adoption of FIN 46 will have a material

impact on the Company’s financial position or results of operations.

In April 2003, the FASB issued SFAS No. 149, “Amendment of Statement 133 on Derivative Instruments and Hedging Activities” (“

FAS

149”), which amends and clarifies financial accounting and reporting for derivative instruments, including certain derivative instruments

embedded in other contracts and for hedging activities under SFAS 133. SFAS 149 is effective for contracts entered into or modified after June

30, 2003 except for the provisions that were cleared by the FASB in prior pronouncements. The Company does not expect the provision of this

statement to have a significant impact on its results of operations or financial position.

In May 2003, the FASB issued SFAS No. 150, “Accounting for Certain Financial Instruments with Characteristics of both Liabilities and

Equity”. This statement established standards for how an issuer classifies and measures in its statement of financial position certain financial

instruments with characteristics of both liabilities and equity. In accordance with the standard, financial instruments that embody obligations

for the issuer are required to be classified as liabilities. This statement shall be effective for financial instruments entered into or modified after

May 31, 2003, and otherwise shall be effective for the Company’s first quarter of fiscal year 2004. The Company does not expect the provision

of this statement to have a significant impact on the Company’s results of operations or financial position.

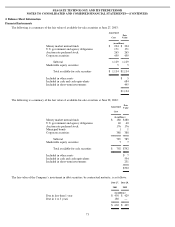

Cash, Cash Equivalents and Short-Term Investments —The Company considers all highly liquid investments with a remaining maturity

of 90 days or less at the time of purchase to be cash equivalents. Cash equivalents are carried at cost, which approximates fair value. The

Company’s short-term investments are primarily comprised of readily marketable debt securities with remaining maturities of more than 90

days at the time of purchase. The Company has classified its entire investment portfolio as available-for-sale. Available-for-sale securities are

classified as cash equivalents or short-term investments and are stated at fair value with unrealized gains and losses included in accumulated

other comprehensive income, which is a component of shareholders’ equity. The amortized cost of debt securities is adjusted for amortization

of premiums and accretion of discounts to maturity. Such amortization and accretion are included in interest income. Realized gains and losses

are included in other income (expense). The cost of securities sold is based on the specific identification method.

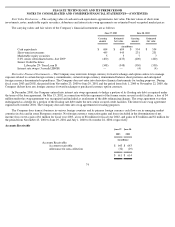

Strategic Investments —The Company enters into certain strategic investments for the promotion of business and strategic objectives and

typically does not attempt to reduce or eliminate the inherent market risks on these investments. Both marketable and non-marketable

investments are included in other assets. A substantial majority of the Company’s marketable investments are classified as available-for-sale as

of the balance sheet date and are reported at fair value, with unrealized gains and losses, net of tax, recorded in shareholder’s equity. The cost

of securities sold is based on the specific identification method. Realized gains or losses and declines in value, if any, judged to be other than

temporary on available-for-sale securities are reported in other income or expense. Non-marketable investments are recorded at cost. The

Company’s results of operations for the year ended June 27, 2003 included a write-down of $10 million in an investment in a private company.

70