Seagate 2002 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON STOCK AND RELATED SHAREHOLDER MATTERS

Market Information

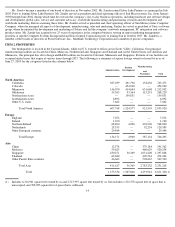

Our common shares have traded on the New York Stock Exchange under the symbol “STX” since December 11, 2002. Prior to that time

there was no public market for our common shares. The high and low sales prices of our common shares, as reported by the New York Stock

Exchange, are set forth below for the periods indicated.

The closing price of our common shares as reported by the New York Stock Exchange on August 15, 2003 was $20.70 per share. As of

August 15, 2003 there were approximately 1,041 holders of record of our common shares. There were no sales of our equity securities during

fiscal year 2003 that were not registered under the Securities Act of 1933.

Dividends

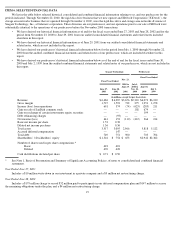

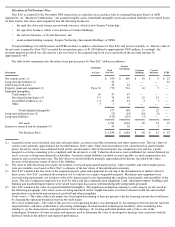

Price Range

Fiscal year 2003

High

Low

Quarter ending December 27, 2002 (commencing December 11, 2002)

$

11.78

$

9.86

Quarter ending March 28, 2003

$

12.95

$

7.78

Quarter ending June 27, 2003

$

18.49

$

9.98

On June 27, 2003, our board of directors amended our quarterly dividend policy and, pursuant to our amended policy, we expect to pay

our shareholders a quarterly distribution of up to $0.04 per share ($0.16 annually) so long as the aggregate amount of the distribution does not

exceed 50% of our consolidated net income for the quarter in which the distribution is declared, as determined under generally accepted

accounting principles in the United States and reflected in our publicly filed financial statements for the quarter.

We are restricted in our ability to pay distributions by the covenants contained in the indenture governing our senior notes and the credit

agreement governing our senior secured credit facilities. Our declaration of distributions is also subject to Cayman Islands law and the

discretion of our board of directors. Under the terms of the Seagate Technology shareholders agreement, at least seven members of our board of

directors must approve the payment of distributions in excess of 15% of our net income in the prior fiscal year. In deciding whether or not to

declare quarterly distributions, our directors will take into account such factors as general business conditions within the rigid disc drive

industry, our financial results, our capital requirements, contractual and legal restrictions on the payment of distributions by our subsidiaries to

us or by us to our shareholders, the impact of paying distributions on our credit ratings and such other factors as our board of directors may

deem relevant.

On July 14, 2003, our board of directors declared a quarterly distribution of $0.04 per share to be paid on or before August 22, 2003 to

our shareholders of record as of August 8, 2003. Since the closing of our initial public offering, we have made distributions, pursuant to our

quarterly dividend policy in effect at such time, of $0.03 per share to our shareholders of record as of each of February 14, 2003 and May 9,

2003. These distributions have totaled approximately $26 million in the aggregate.

Since the closing of the November 2000 transactions, we have made additional distributions unrelated to our quarterly dividend policy.

These include:

•

distributions of approximately $33 million and $167 million to our shareholders of record as of March 19, 2002 and May 17, 2002,

respectively;

•

an in-kind distribution of a $32 million promissory note to our shareholders of record immediately following our sale of our XIOtech

subsidiary on November 4, 2002; and

17

•

a distribution of approximately $262 million to our shareholders of record immediately prior to our initial public offering.