Seagate 2002 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for at least the next 12

months. Our ability to fund these requirements and comply with the financial covenants under our debt agreements will depend on our future

operations, performance and cash flow and is subject to prevailing economic conditions and financial, business and other factors, some of

which are beyond our control. In addition, as part of our strategy, we intend to selectively pursue strategic alliances, acquisitions and

investments that are complementary to our business. Any material future acquisitions, alliances or investments will likely require additional

capital. We cannot assure you that additional funds from available sources will be available on terms acceptable to us, or at all.

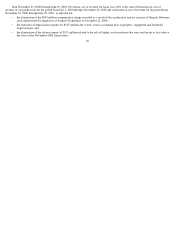

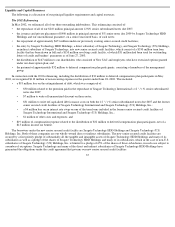

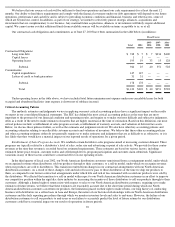

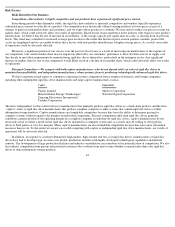

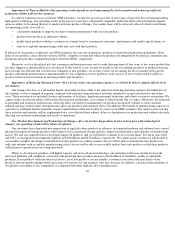

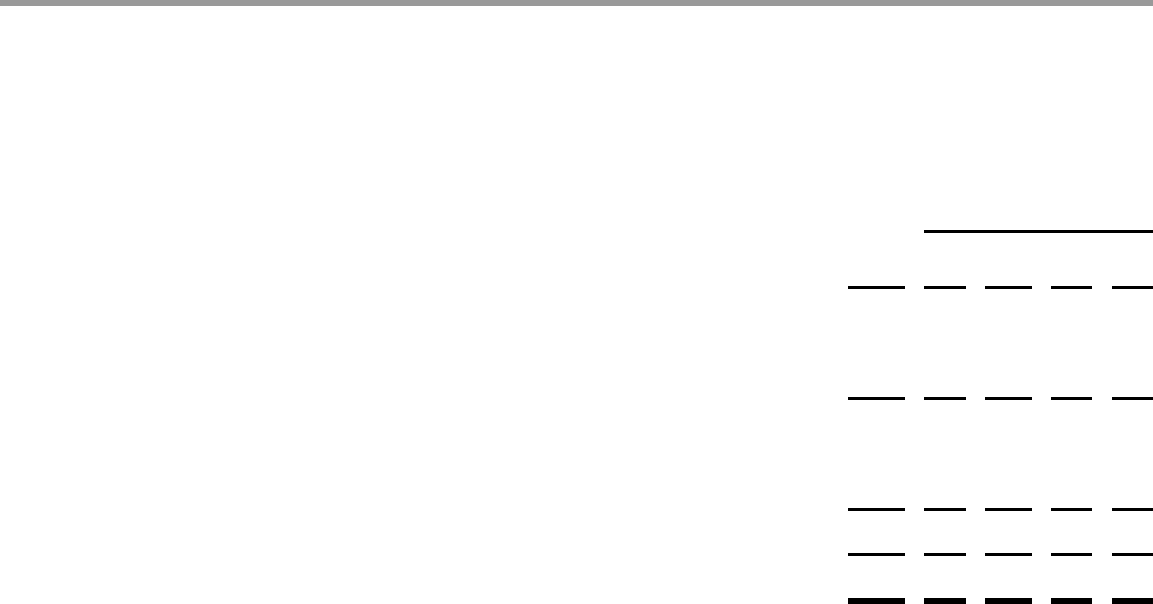

Our contractual cash obligations and commitments as of June 27, 2003 have been summarized in the table below (in millions):

Under operating leases in the table above, we have included total future minimum rent expense under non-cancelable leases for both

occupied and abandoned facilities (rent expense is shown net of sublease income).

Critical Accounting Policies

Fiscal Year(s)

Total

2004

2005-

2006

2007-

2008

After

2008

Contractual Obligations:

Long term debt

$

748

$

5

$

7

$

336

$

400

Capital leases

1

1

—

—

—

Operating leases

195

19

33

15

128

Subtotal

944

25

40

351

528

Commitments:

Capital expenditures

147

147

—

—

—

Letters of credit or bank guarantees

31

31

—

—

—

Subtotal

178

178

—

—

—

Total

$

1,122

$

203

$

40

$

351

$

528

The methods, estimates and judgments we use in applying our most critical accounting policies have a significant impact on the results

we report in our consolidated financial statements. The SEC has defined the most critical accounting policies as the ones that are most

important to the portrayal of our financial condition and operating results, and require us to make our most difficult and subjective judgments,

often as a result of the need to make estimates of matters that are highly uncertain at the time of estimation. Based on this definition, our most

critical policies include: establishment of sales program accruals, establishment of warranty accruals, and valuation of deferred tax assets.

Below, we discuss these policies further, as well as the estimates and judgments involved. We also have other key accounting policies and

accounting estimates relating to uncollectible customer accounts and valuation of inventory. We believe that these other accounting policies

and other accounting estimates either do not generally require us to make estimates and judgments that are as difficult or as subjective, or it is

less likely that they would have a material impact on our reported results of operations for a given period.

Establishment of Sales Program Accruals. We establish certain distributor sales programs aimed at increasing customer demand. These

programs are typically related to a distributor’s level of sales, order size and advertising or point of sale activity. We provide for these contra-

revenues at the time that revenue is recorded based on estimated requirements. These estimates are based on various factors, including

estimated future price erosion, customer orders and sell-through levels, program participation and customer claim submittals. Significant

variations in any of these factors could have a material effect on our operating results.

In the third quarter of fiscal year 2002, our North American distribution customers transitioned from a consignment model, under which

we recognized revenue when distributors sold our products through to their customers, to a sell-in model, under which we recognize revenue

when our products are sold to distributors. This transition resulted from changes in our contractual arrangements with our North American

distribution customers. As a result of these changes, title and risk of loss now pass to those distributors at the time we ship our products to

them, as compared to our former contractual arrangements under which title and risk of loss remained with us until our products were sold by

the distributors. We effected the transition to a sell-in model with respect to our North American distribution customers in an effort to improve

our competitive position within the rigid disc drive industry by increasing the incentive of those distributors to sell our products through to their

customers. Although a limited right of return exists with respect to sales to our North American distribution customers, requiring us to make

estimates of future returns, we believe that these estimates are reasonably accurate due to the short time period during which our North

American distribution customers can return our products, the limitations placed on their right to make returns, our long history of conducting

business with distributors on a sell-in basis in Asia and Europe, the nature of our historical relationships with our North American distribution

customers and the daily reporting procedures through which we monitor inventory levels and sales to end-users. However, the failure of our

distribution customers to sell our products to end-users or our failure to accurately predict the level of future returns by our distribution

customers could have a material impact on our results of operations in future periods.

39