Seagate 2002 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

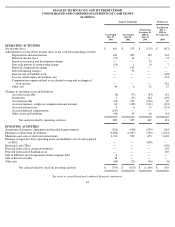

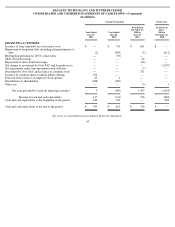

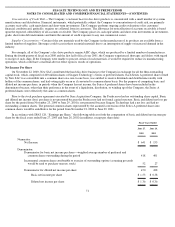

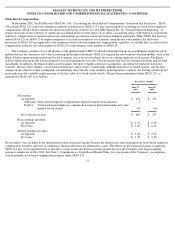

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

For Fiscal Years Ended June 27, 2003 and June 28, 2002 and

For the Period from November 23, 2000 through June 29, 2001

(in millions)

Number

of

Preferred

Shares

Shares

Amount

Number

of

Common

Shares

Shares

Amount

Additional

Paid-in

Capital

Deferred

Stock

Compensation

Retained

Earnings

(Accumulated

Deficit)

and Accumulated

Comprehensive

Income (Loss)

Total

Balance at November 23, 2000

$

—

$

—

$

—

$

—

$

—

$

—

Investment by New SAC and

issuance of stock

400

751

751

Adjustment for pushdown of

purchase price allocation from

New SAC

7

7

Net and comprehensive loss

(110

)

(110

)

Amortization of deferred

compensation expense related

to New SAC restricted share

plans

5

5

Balance at June 29, 2001

400

—

—

—

763

—

(

110

)

653

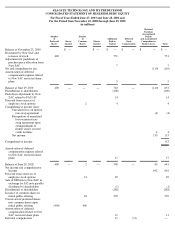

Distributions to shareholders

(200

)

(200

)

Push down adjustment by New

SAC related to FAS 109

14

14

Proceeds from exercise of

employee stock options

2

4

4

Comprehensive income (loss):

Unrealized loss on interest

rate swap agreement

(4

)

(4

)

Recognition of unrealized

loss on interest rate

swap agreement upon

extinguishment of

former senior secured

credit facilities

4

4

Net income

153

153

Comprehensive income

153

Amortization of deferred

compensation expense related

to New SAC restricted share

plans

17

17

Balance at June 28, 2002

400

—

2

—

598

—

43

641

Net income and comprehensive

Income

642

642

Proceeds from exercises of

employee stock options

13

29

29

Sale of XIOtech to New SAC in

exchange for $32 note payable

distributed to shareholders

(1

)

(1

)

Distributions to shareholders

(288

)

(288

)

Issuance of common shares in

initial public offering

24

270

270

Conversion of preferred shares

into common shares upon

initial public offering

(400

)

400

Amortization of deferred

compensation related to New

SAC restricted share plans

11

11

Deferred compensation

11

(11

)

—