Seagate 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

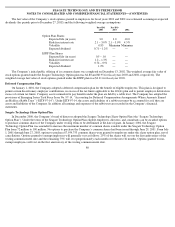

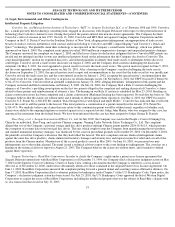

On July 31, 2001, Seagate Delaware and the Internal Revenue Service filed a settlement stipulation with the United States Tax Court in

complete settlement of the remaining disputed tax matter reflected in the statutory notice of deficiency dated June 12, 1998. The settlement

stipulation is expressly contingent upon Seagate Delaware and the Internal Revenue Service entering into a closing agreement in connection

with certain tax matters arising in all or some part of the open tax years of Seagate Delaware and New SAC. The settlement remains before the

Joint Committee on Taxation for review. The parties are in the process of incorporating comments from the Joint Committee on Taxation into

the parties’ settlement agreements. The settlement and the anticipated execution of the closing agreement(s) will not result in an additional

provision for income taxes.

As of June 27, 2003, accrued income taxes include $125 million for tax indemnification amounts due to VERITAS Software Corporation

pursuant to the Indemnification Agreement between Seagate Delaware, Suez Acquisition Company and VERITAS Software Corporation. The

tax indemnification amount was recorded by the Company in connection with the purchase of the operating assets of Seagate Delaware and

represents U.S. tax liabilities previously accrued by Seagate Delaware for periods prior to the acquisition date of the operating assets. Certain of

Seagate Delaware’s federal and state tax returns are under examination by tax authorities. The Company believes that the $125 million tax

indemnification amount is adequate to cover any final assessments that may result from these examinations. The timing of the settlement of

these examinations is uncertain. To the extent the settlement of these examinations results in tax liabilities that are less than the $125 million

indemnification amount, the difference will be recorded as an income tax benefit and may significantly affect the Company’s effective tax rate

for the period in which the settlement occurs.

Certain of the Company’

s foreign tax returns for various fiscal years are under examination by tax authorities. The Company believes that

adequate amounts of tax have been provided for any final assessment that may result from these examinations.

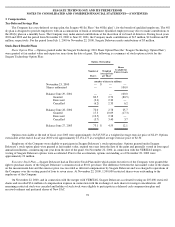

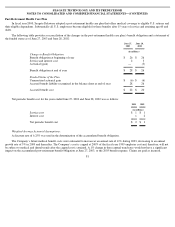

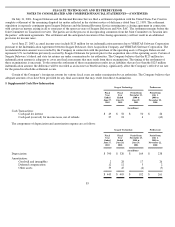

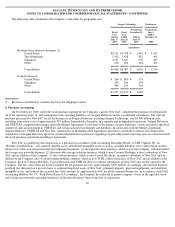

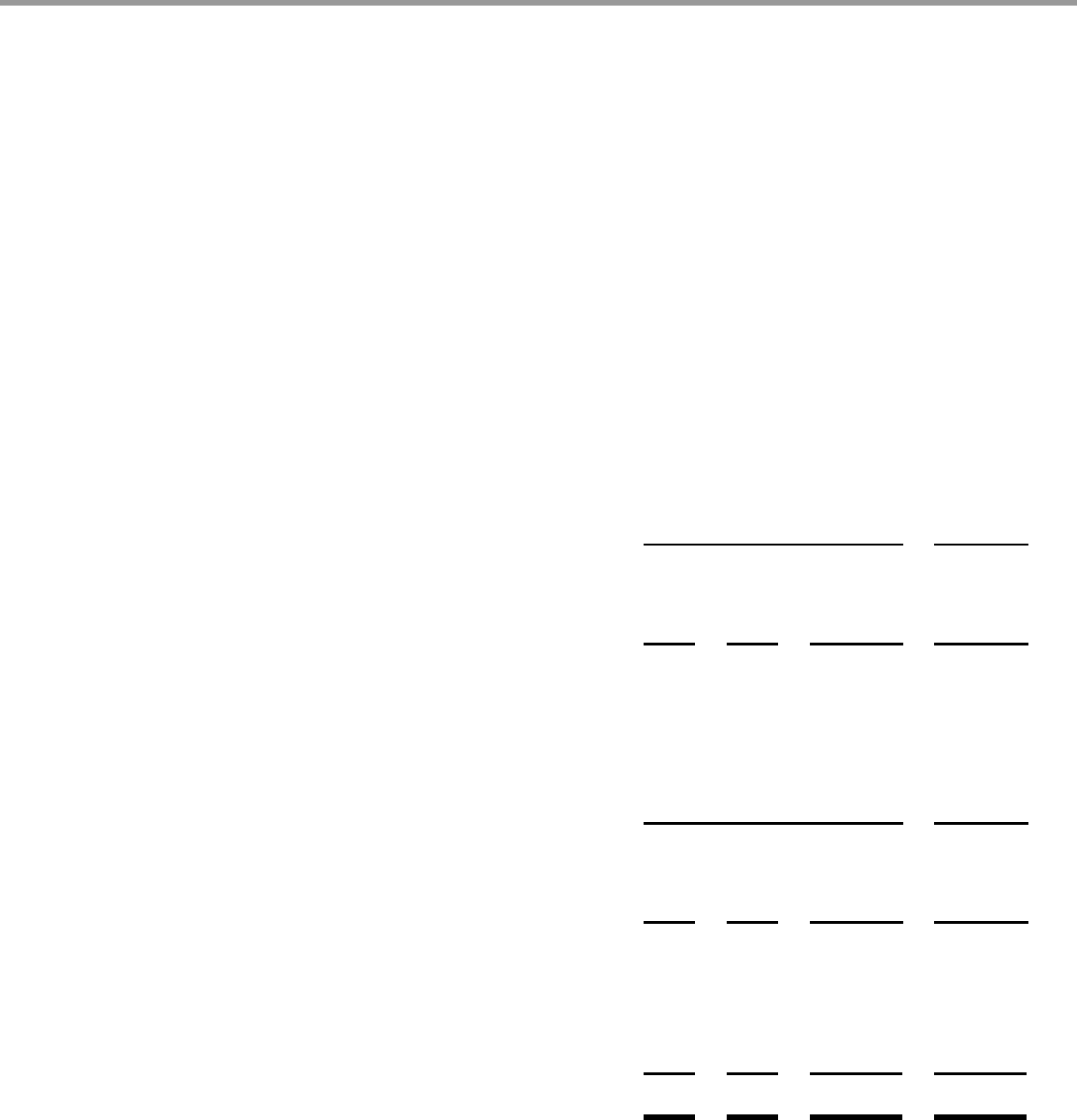

5. Supplemental Cash Flow Information

85

Seagate Technology

Predecessor

Fiscal

Year

Ended

June 27,

2003

Fiscal

Year

Ended

June 28,

2002

Period from

November 23,

2000 to

June 29,

2001

Period from

July 1,

2000 to

November 22,

2000

(in millions)

Cash Transactions:

Cash paid for interest

$

49

$

58

$

50

$

26

Cash paid (received) for income taxes, net of refunds

27

18

6

(63

)

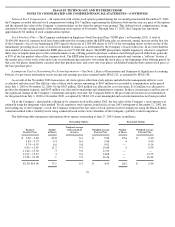

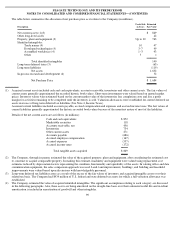

The components of depreciation and amortization expense are as follows:

Seagate Technology

Predecessor

Fiscal

Year

Ended

June 27,

2003

Fiscal

Year

Ended

June 28,

2002

Period from

November 23,

2000 to

June 29,

2001

Period from

July 1,

2000 to

November 22,

2000

(in millions)

Depreciation

$

390

$

320

$

164

$

238

Amortization:

Goodwill and intangibles

2

28

17

26

Deferred compensation

12

12

5

2

Other assets

39

45

(4

)

(5

)

$

443

$

405

$

182

$

261