Rite Aid 2016 Annual Report Download - page 97

Download and view the complete annual report

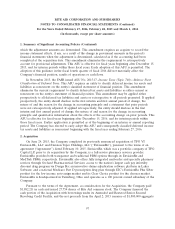

Please find page 97 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

1. Summary of Significant Accounting Policies (Continued)

which the adjustment amounts are determined. This amendment requires an acquirer to record the

income statement effects, if any, as a result of the change in provisional amounts in the period’s

financial statements when the adjustment is determined, calculated as if the accounting had been

completed at the acquisition date. This amendment eliminates the requirement to retrospectively

account for provisional adjustments. This ASU is effective for fiscal years beginning after December 15,

2015, and for interim periods within those fiscal years. Early adoption of this ASU is permitted. The

adoption of this guidance in the fiscal fourth quarter of fiscal 2016 did not materially affect the

Company’s financial position, results of operations or cash flows.

In November 2015, the FASB issued ASU No. 2015-17, Income Taxes (Topic 740)—Balance Sheet

Classification of Deferred Taxes. This ASU requires an entity to classify deferred income tax assets and

liabilities as noncurrent on the entity’s classified statement of financial position. This amendment

eliminates the current requirement to classify deferred tax assets and liabilities as either current or

noncurrent on the entity’s statement of financial position. This amendment may be applied either

prospectively to all deferred tax liabilities and assets or retrospective to all periods presented. If applied

prospectively, the entity should disclose in the first interim and first annual period of change, the

nature of and the reason for the change in accounting principle and a statement that prior periods

were not retrospectively adjusted. If applied retrospectively, the entity should disclose in the first

interim and first annual period of change, the nature of and reason for the change in accounting

principle and quantitative information about the effects of the accounting change on prior periods. This

ASU is effective for fiscal years beginning after December 15, 2016, and for interim periods within

those fiscal years. Earlier application is permitted as of the beginning of an interim or annual reporting

period. The Company has elected to early adopt this ASU and consequently classified deferred income

tax assets and liabilities as noncurrent beginning with the fiscal year ending February 27, 2016.

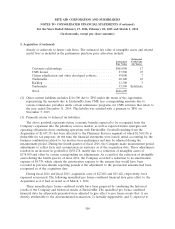

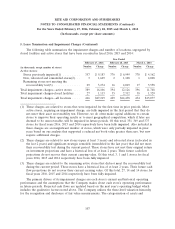

2. Acquisition

On June 24, 2015, the Company completed its previously announced acquisition of TPG VI

Envision BL, LLC and Envision Topco Holdings, LLC (‘‘EnvisionRx’’), pursuant to the terms of an

agreement (‘‘Agreement’’) dated February 10, 2015. EnvisionRx, which was a portfolio company of TPG

Capital L.P. prior to its acquisition by the Company, is a full-service pharmacy services provider.

EnvisionRx provides both transparent and traditional PBM options through its EnvisionRx and

MedTrak PBMs, respectively. EnvisionRx also offers fully integrated mail-order and specialty pharmacy

services through Orchard Pharmaceutical Services; access to the nation’s largest cash pay infertility

discount drug program via Design Rx; an innovative claims adjudication software platform in Laker

Software; and a national Medicare Part D prescription drug plan through EIC’s EnvisionRx Plus Silver

product for the low income auto-assign market and its Clear Choice product for the chooser market.

EnvisionRx is headquartered in Twinsburg, Ohio and operates as a 100 percent owned subsidiary of the

Company.

Pursuant to the terms of the Agreement, as consideration for the Acquisition, the Company paid

$1,882,211 in cash and issued 27,754 shares of Rite Aid common stock. The Company financed the

cash portion of the Acquisition with borrowings under its Amended and Restated Senior Secured

Revolving Credit Facility, and the net proceeds from the April 2, 2015 issuance of $1,800,000 aggregate

97