Rite Aid 2016 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

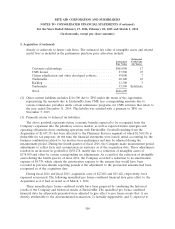

2. Acquisition (Continued)

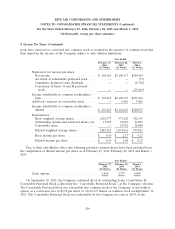

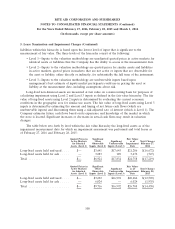

directly or indirectly to future cash flows. The estimated fair value of intangible assets and related

useful lives as included in the preliminary purchase price allocation include:

Estimated

Estimated Useful Life

Fair Value (In Years)

Customer relationships ............................ $465,000 17

CMS license .................................... 57,500 25

Claims adjudication and other developed software ......... 59,000 7

Trademarks ..................................... 20,100 10

Backlog ....................................... 11,500 3

Trademarks ..................................... 33,500 Indefinite

Total .......................................... $646,600

(2) Other current liabilities includes $116,500 due to TPG under the terms of the Agreement,

representing the amounts due to EnvisionRx from CMS, less corresponding amounts due to

various reinsurance providers under certain reinsurance programs, for CMS activities that relate to

the year ended December 31, 2014. This liability was satisfied with a payment to TPG on

November 5, 2015.

(3) Primarily relates to deferred tax liabilities.

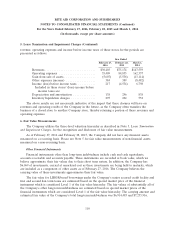

The above goodwill represents future economic benefits expected to be recognized from the

Company’s expansion into the pharmacy services market, as well as expected future synergies and

operating efficiencies from combining operations with EnvisionRx. Goodwill resulting from the

Acquisition of $1,637,351 has been allocated to the Pharmacy Services segment of which $1,360,156 is

deductible for tax purposes. At the time the financial statements were issued, initial accounting for the

business combination related to tax matters were preliminary and may be adjusted during the

measurement period. During the fourth quarter of fiscal 2016, the Company made measurement period

adjustments to reflect facts and circumstances in existence as of the acquisition date. These adjustments

resulted in an increase in goodwill of $158,278, mostly due to a reduction of intangible assets of

$178,500 and offset by certain corresponding tax adjustments. As a result of the reduction of intangible

assets during the fourth quarter of fiscal 2016, the Company recorded a reduction to its amortization

expense of $4,739, which adjusts the amortization expense to the amount that would have been

recorded in previous interim reporting periods if the adjustment to the provisional amounts had been

recognized as of the acquisition date.

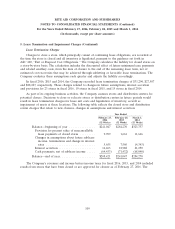

During fiscal 2016 and fiscal 2015, acquisition costs of $27,402 and $15,442, respectively, were

expensed as incurred. The following unaudited pro forma combined financial data gives effect to the

Acquisition as if it had occurred as of March 1, 2014.

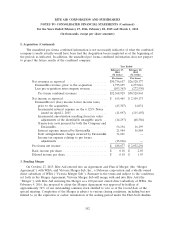

These unaudited pro forma combined results have been prepared by combining the historical

results of the Company and historical results of EnvisionRx. The unaudited pro forma combined

financial data for all periods presented were adjusted to give effect to pro forma events that 1) are

directly attributable to the aforementioned transaction, 2) factually supportable, and 3) expected to

100