Rite Aid 2016 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

7. Income Taxes (Continued)

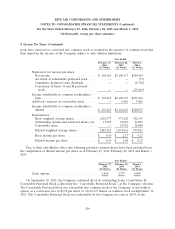

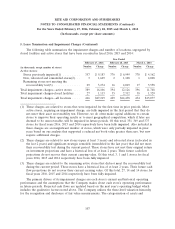

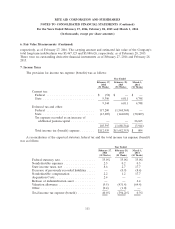

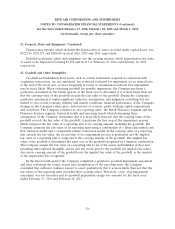

A reconciliation of the beginning and ending amount of unrecognized tax benefits was as follows:

2016 2015 2014

Unrecognized tax benefits ..................... $ 9,514 $10,143 $ 30,020

Increases to prior year tax positions ............ 1,667 1,003 —

Decreases to tax positions in prior periods ....... (577) (984) (3,215)

Increases to current year tax positions .......... 72 123 —

Settlements .............................. — (681) —

Lapse of statute of limitations ................ — (90) (16,662)

Unrecognized tax benefits balance ............... $10,676 $ 9,514 $ 10,143

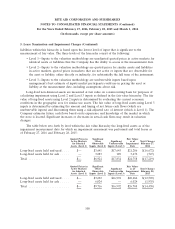

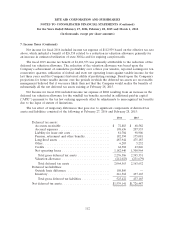

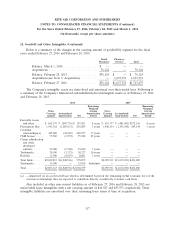

The amount of the above unrecognized tax benefits at February 27, 2016, February 28, 2015 and

March 1, 2014 which would impact the Company’s effective tax rate, if recognized, was $2,084, $440

and $876, respectively. Additionally, any impact on the effective rate may be mitigated by the valuation

allowance that is remaining against the Company’s net deferred tax assets.

While it is expected that the amount of unrecognized tax benefits will change in the next twelve

months, management does not expect the change to have a significant impact on the results of

operations or the financial position of the Company.

The Company recognizes interest and penalties related to tax contingencies as income tax expense.

Prior to the adoption of ASC 740, ‘‘Income Taxes,’’ the Company included interest as income tax

expense and penalties as an operating expense. The Company recognized an expense/(benefit) for

interest and penalties in connection with tax matters of $60, ($5,250) and ($16,833) for fiscal years

2016, 2015 and 2014, respectively. As of February 27, 2016 and February 28, 2015 the total amount of

accrued income tax-related interest and penalties was $539 and $115, respectively.

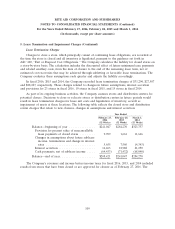

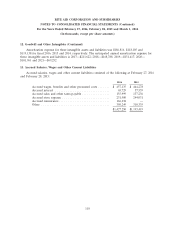

The Company files U.S. federal income tax returns as well as income tax returns in those states

where it does business. The consolidated federal income tax returns are closed for examination through

fiscal year 2012. However, any net operating losses that were generated in these prior closed years may

be subject to examination by the IRS upon utilization. Tax examinations by various state taxing

authorities could generally be conducted for a period of three to five years after filing of the respective

return. However, as a result of filing amended returns, the Company has statutes open in some states

from fiscal year 2005.

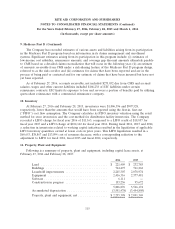

Net Operating Losses and Tax Credits

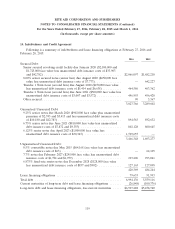

At February 27, 2016, the Company had federal net operating loss (NOL) carryforwards of

approximately $2,865,598. Of these, $1,673,912 will expire, if not utilized, between fiscal 2020 and 2028.

An additional $1,173,321 will expire, if not utilized, between fiscal 2029 and 2036.

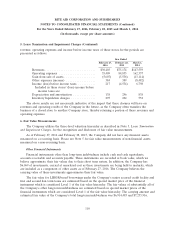

At February 27, 2016, the Company had state NOL carryforwards of approximately $4,538,030, the

majority of which will expire between fiscal 2023 and 2027.

113