Rite Aid 2016 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

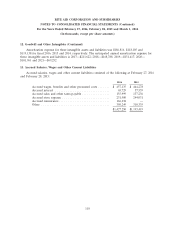

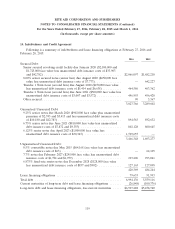

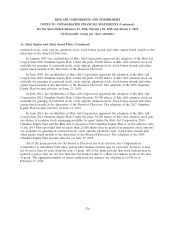

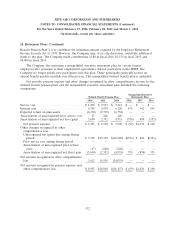

14. Indebtedness and Credit Agreement (Continued)

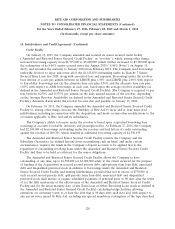

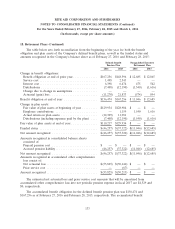

2014 Transactions

In June 2013, the Company completed a tender offer for its 7.5% senior secured notes due 2017 in

which $419,237 aggregate principal amount of the outstanding 7.5% notes were tendered and

repurchased. In July 2013, the Company redeemed the remaining 7.5% notes for $85,154, which

included the call premium and interest to the redemption date. The tender offer for, and redemption

of, the 7.5% notes were funded using the proceeds from the Tranche 2 Term Loan, borrowings under

the Company’s revolving credit facility and available cash.

On July 2, 2013, the Company issued $810,000 of its 6.75% senior notes due 2021. The Company’s

obligations under the notes are fully and unconditionally guaranteed, jointly and severally, on an

unsubordinated basis, by all of its subsidiaries that guarantee the Company’s obligations under the

senior secured credit facility, the second priority secured term loan facilities and the outstanding 8.00%

senior secured notes due 2020, 10.25% senior secured notes due 2019 and 9.25% senior notes due

2020. The Company used the net proceeds of the 6.75% notes, borrowings under its revolving credit

facility and available cash to repurchase and repay all of the Company’s outstanding $810,000 aggregate

principal of 9.5% senior notes due 2017.

In July 2013, the Company completed a tender offer for its 9.5% notes in which $739,642

aggregate principal amount of the outstanding 9.5% notes were tendered and repurchased. In August

2013, the Company redeemed the remaining 9.5% notes for $73,440, which included the call premium

and interest to the redemption date.

In connection with these refinancing transactions, the Company recorded a loss on debt

retirement, including tender and call premium and interest, unamortized debt issue costs and

unamortized discount of $62,172.

As of March 2, 2013, Rite Aid Lease Management Company, a 100 percent owned subsidiary of

the Company, had 213,000 shares of its Cumulative Preferred Stock, Class A, par value $100 per share

(‘‘RALMCO Cumulative Preferred Stock’’), outstanding. The carrying amount of the RALMCO

Cumulative Preferred Stock as of November 29, 2013 was $20,763 and was recorded in Other

Noncurrent Liabilities. On November 29, 2013, the Company repurchased all of the outstanding

RALMCO Cumulative Preferred Stock for $21,034. In connection with this transaction, the Company

recorded a loss on debt retirement of $271.

Interest Rates and Maturities

The annual weighted average interest rate on the Company’s indebtedness was 5.4%, 5.8%, and

6.4% for fiscal 2016, 2015, and 2014, respectively.

The aggregate annual principal payments of long-term debt for the five succeeding fiscal years are

as follows: 2017—$90; 2018—$0; 2019—$0; 2020—$2,100,000 and $4,905,000 in 2021 and thereafter.

123