Rite Aid 2016 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

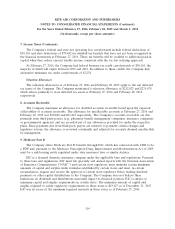

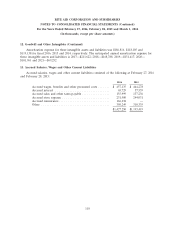

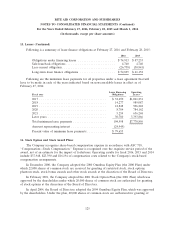

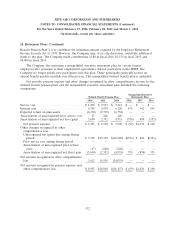

15. Leases

The Company leases most of its retail stores and certain distribution facilities under noncancellable

operating and capital leases, most of which have initial lease terms ranging from 5 to 22 years. The

Company also leases certain of its equipment and other assets under noncancellable operating leases

with initial terms ranging from 3 to 10 years. In addition to minimum rental payments, certain store

leases require additional payments based on sales volume, as well as reimbursements for taxes,

maintenance and insurance. Most leases contain renewal options, certain of which involve rent

increases. Total rental expense, net of sublease income of $8,995, $8,559, and $8,369, was $973,347,

$964,484, and $952,777 in fiscal 2016, 2015, and 2014, respectively. These amounts include contingent

rentals of $17,755, $18,919 and $18,679 in fiscal 2016, 2015, and 2014, respectively.

During fiscal 2016, the Company sold 10 owned operating stores to independent third parties. Net

proceeds from the sale were $36,732. Concurrent with these sales, the Company entered into

agreements to lease the stores back from the purchasers over minimum lease terms of 20 years. Eight

leases were accounted for as operating leases and the remaining two were accounted for as capital

leases. The transactions resulted in a gain for certain stores of $670 which is deferred over the life of

the leases. In addition, the transaction resulted in a loss for certain stores of $546 which is included in

the loss on sale of assets, net for the fifty-two weeks ended February 27, 2016.

During fiscal 2015, the Company did not enter into any sale-leaseback transactions whereby the

Company sold owned operating stores to independent third parties and concurrent with the sale,

entered into an agreement to lease the store back from the purchasers.

During fiscal 2014, the Company sold one owned operating store to an independent third party.

Net proceeds from the sale were $3,989. Concurrent with this sale, the Company entered into an

agreement to lease the store back from the purchaser over a minimum lease term of 20 years. The

Company accounted for this lease as an operating lease. The transaction resulted in a gain of $269

which is included in the gain on sale of assets, net for the fifty-two weeks ended March 1, 2014.

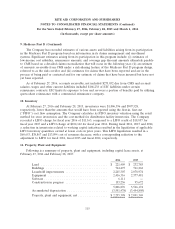

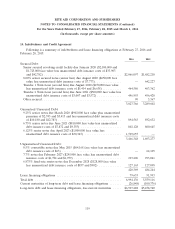

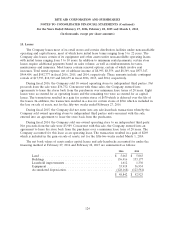

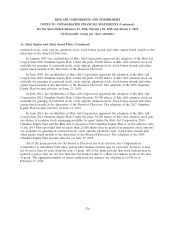

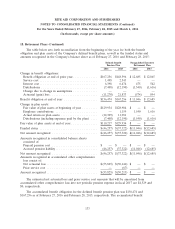

The net book values of assets under capital leases and sale-leasebacks accounted for under the

financing method at February 27, 2016 and February 28, 2015 are summarized as follows:

2016 2015

Land......................................... $ 5,063 $ 5,063

Buildings ...................................... 136,416 133,177

Leasehold improvements ........................... 1,612 1,330

Equipment ..................................... 33,919 36,934

Accumulated depreciation .......................... (128,168) (123,581)

$ 48,842 $ 52,923

124