Rite Aid 2016 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

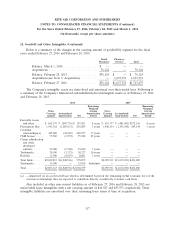

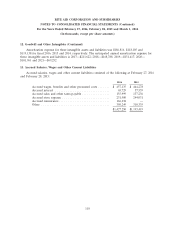

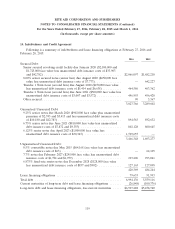

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

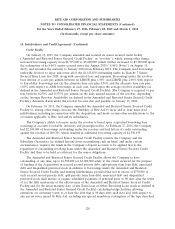

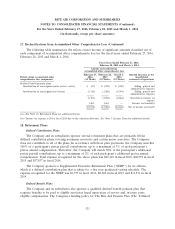

14. Indebtedness and Credit Agreement (Continued)

loan facilities and, on an unsecured basis, the unsecured guaranteed notes, are full and unconditional

and joint and several, and there are no restrictions on the ability of the Company to obtain funds from

its subsidiaries. The Company has no independent assets or operations. Additionally, prior to the

Acquisition, the subsidiaries, including joint ventures, that did not guarantee the Amended and

Restated Senior Secured Credit Facility, the credit facility, second priority secured term loan facilities

and applicable notes, were minor. Accordingly, condensed consolidating financial information for the

Company and subsidiaries is not presented for those periods. Subsequent to the Acquisition, other than

EIC, the subsidiaries, including joint ventures, that do not guarantee the credit facility, second priority

secured term loan facilities and applicable notes, are minor. As such, condensed consolidating financial

information for the Company, its guaranteeing subsidiaries and non-guaranteeing subsidiaries is

presented for those periods subsequent to the Acquisition. See Note 24 ‘‘Guarantor and

Non-Guarantor Condensed Consolidating Financial Information’’ for additional disclosure.

Other 2016 Transactions

On April 2, 2015, the Company issued $1,800,000 aggregate principal amount of its 6.125% Notes,

the net proceeds of which, along with other available cash and borrowings under its Amended and

Restated Senior Secured Credit Facility, were used to finance the cash portion of the Acquisition,

which closed on June 24, 2015. The Company’s obligations under the notes are fully and

unconditionally guaranteed, jointly and severally, on an unsubordinated basis, by all of its subsidiaries

that guarantee the Company’s obligations under the Amended and Restated Senior Secured Credit

Facility, second priority secured term loan facilities, the 9.25% senior notes due 2020 (the ‘‘9.25%

Notes’’) and the 6.75% senior notes due 2021 (the ‘‘6.75% Notes’’) (the ‘‘Rite Aid Subsidiary

Guarantors’’), including EnvisionRx and certain of its domestic subsidiaries other than, among others,

EIC (the ‘‘EnvisionRx Subsidiary Guarantors’’ and, together with the Rite Aid Subsidiary Guarantors,

the ‘‘Subsidiary Guarantors’’). The guarantees are unsecured. The 6.125% Notes are unsecured,

unsubordinated obligations of Rite Aid Corporation and rank equally in right of payment with all of its

other unsecured, unsubordinated indebtedness.

During May 2015, $64,089 of the Company’s 8.5% convertible notes due 2015 were converted into

24,762 shares of common stock, pursuant to their terms. The remaining $79 of the Company’s 8.5%

convertible notes due 2015 were repaid by the Company upon maturity.

On August 15, 2015, the Company completed the redemption of all of its outstanding $650,000

aggregate principal amount of its 8.00% Notes. In connection with the redemption, the Company

recorded a loss on debt retirement, including call premium and unamortized debt issue costs, of

$33,205 during the second quarter of fiscal 2016.

2015 Transactions

On October 15, 2014, the Company completed the redemption of all of its outstanding $270,000

aggregate principal amount of its 10.25% senior notes due October 2019 at their contractually

determined early redemption price of 105.125% of the principal amount, plus accrued interest. The

Company funded this redemption with borrowings under its revolving credit facility. The Company

recorded a loss on debt retirement of $18,512 related to this transaction.

122