Rite Aid 2016 Annual Report Download - page 44

Download and view the complete annual report

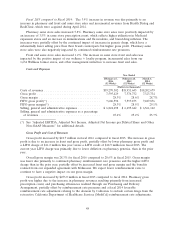

Please find page 44 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.To the extent that actual future cash flows may differ from our projections materially certain stores

that are either not impaired or partially impaired in the current period may be further impaired in

future periods. A 50 basis point decrease in our future sales assumptions as of February 27, 2016 would

have resulted in an additional fiscal 2016 impairment charge of $1.6 million. A 50 basis point increase

in our future sales assumptions as of February 27, 2016 would have reduced the fiscal 2016 impairment

charge by $0.4 million. A 100 basis point decrease in our future sales assumptions as of February 27,

2016 would have resulted in an additional fiscal 2016 impairment charge of $4.5 million. A 100 basis

point increase in our future sales assumptions as of February 27, 2016 would have reduced the fiscal

2016 impairment charge by $0.8 million.

Lease Termination Charges: Charges to close a store, which principally consist of continuing lease

obligations, are recorded at the time the store is closed and all inventory is liquidated, pursuant to the

guidance set forth in ASC 420, ‘‘Exit or Disposal Cost Obligations.’’ We calculate our liability for

closed stores on a store-by-store basis. The calculation includes the discounted effect of future

minimum lease payments and related ancillary costs, from the date of closure to the end of the

remaining lease term, net of estimated cost recoveries that may be achieved through subletting

properties or through favorable lease terminations. We evaluate these assumptions each quarter and

adjust the liability accordingly. As part of our ongoing business activities, we assess stores and

distribution centers for potential closure and relocation. Decisions to close or relocate stores or

distribution centers in future periods would result in lease termination charges for lease exit costs and

liquidation of inventory, as well as impairment of assets at these locations.

In fiscal 2016, 2015 and 2014, we recorded lease termination charges of $31.2 million, $27.5 million

and $28.2 million, respectively. These charges related to changes in future assumptions, interest

accretion and provisions for 23 stores in fiscal 2016, 10 stores in fiscal 2015 and 15 stores in fiscal 2014.

We have no plans to close a significant number of stores in future periods.

Interest Expense

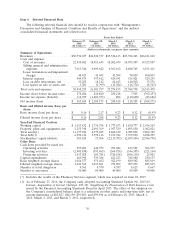

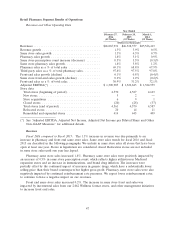

In fiscal 2016, 2015, and 2014, interest expense was $449.6 million, $397.6 million and

$424.6 million, respectively. The increase in interest expense was a result of the $1.8 billion aggregate

principal amount borrowings from the issuance of our 6.125% Notes, which were used to finance the

majority of the cash portion of our acquisition of EnvisionRx and the amortization of the bridge loan

commitment fee from the EnvisionRx acquisition, partially offset by interest expense reductions from

the August 2015 redemption of the outstanding $650.0 million aggregate principal amount of our 8.00%

Notes, and the refinancing of our senior secured credit facility during the fourth quarter of fiscal 2015.

The reduction in interest expense in fiscal 2015 was a result of the redemption of our outstanding

$270.0 million aggregate principal amount of 10.25% senior notes due October 2019 in the third

quarter of fiscal 2015 and refinancing activities during the first quarter of fiscal 2015 and the first and

second quarters of fiscal 2014.

The annual weighted average interest rates on our indebtedness in fiscal 2016, 2015 and 2014 were

5.4%, 5.8% and 6.4%, respectively.

Income Taxes

Income tax expense of $112.9 million, income tax benefit of $1,682.4 million and income tax

expense of $0.8 million, has been recorded for fiscal 2016, 2015 and 2014, respectively. Net income for

fiscal 2016 included a provision for income tax based on an overall tax rate of 40.6%.

ASC 740, ‘‘Income Taxes’’ requires a company to evaluate its deferred tax assets on a regular basis

to determine if a valuation allowance against the net deferred tax assets is required. We take into

account all available positive and negative evidence with regard to the recognition of a deferred tax

asset including our past earnings history, expected future earnings, the character and jurisdiction of

44