Rite Aid 2016 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

1. Summary of Significant Accounting Policies (Continued)

the evaluation of whether limited partnerships and similar legal entities are variable interest entities

(VIEs), eliminates the presumption that a general partner should consolidate a limited partnership, and

affects the consolidation analysis of reporting entities that are involved with VIEs, especially those that

have fee arrangements and related party relationships. This ASU is effective for fiscal years beginning

after December 15, 2015, and for interim periods within those fiscal years. The Company is in the

process of assessing the impact of the adoption of ASU 2015-02 on its financial position, results of

operations and cash flows.

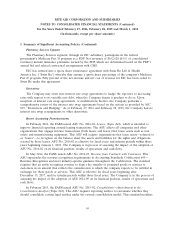

In April 2015, the FASB issued ASU No. 2015-03, Interest—Imputation of Interest

(Subtopic 835-30): Simplifying the Presentation of Debt Issuance Costs. This ASU simplifies the

presentation of debt issuance costs by requiring that debt issuance costs related to a recognized debt

liability be presented in the balance sheet as a direct reduction from the carrying amount of the debt

liability, which is consistent with the treatment of debt discounts. Recognition and measurement of debt

issuance costs were not affected by this amendment. The new guidance should be applied on a

retrospective basis, and upon transition, an entity is required to comply with the applicable disclosures

necessary for a change in accounting principle. This ASU is effective for fiscal years beginning after

December 15, 2015, and for interim periods within those fiscal years. As permitted, the Company early

adopted this standard beginning in the fourth quarter of fiscal 2016. The effect of the adoption of

ASU 2015-03 on the Company’s consolidated balance sheet is a reduction of other assets and long-term

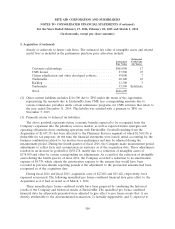

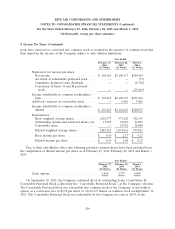

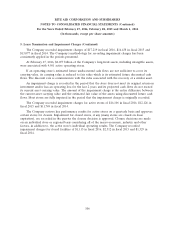

debt of $85,827 as of February 28, 2015. The following is a reconciliation of the effect of this

reclassification on the Company’s consolidated balance sheet as of February 28, 2015:

As Previously

Reported Adjustments As Revised

Other assets ......................... $ 286,172 $(85,827) $ 200,345

Total assets .......................... 8,863,252 (85,827) 8,777,425

Long-term debt, less current maturities ..... 5,483,415 (85,827) 5,397,588

Total liabilities ....................... 8,806,196 (85,827) 8,720,369

Total liabilities and stockholders’ equity ..... 8,863,252 (85,827) 8,777,425

In April 2015, the FASB issued ASU No. 2015-04, Compensation—Retirement Benefits (Topic 715):

Practical Expedient for the Measurement Date of an Employer’s Defined Benefit Obligation and Plan

Assets. This ASU allows an employer whose fiscal year-end does not coincide with a calendar

month-end, for example, an entity that has a 52-week or 53-week fiscal year, the ability as a practical

expedient, to measure defined benefit retirement obligations and related plan assets as of the

month-end that is closest to its fiscal year-end. This ASU is effective for fiscal years beginning after

December 15, 2015, and for interim periods within those fiscal years. Early adoption of this ASU is

permitted. The Company adopted this guidance in the fiscal fourth quarter of fiscal 2016 and

consequently measured its plan assets as of February 29, 2016. This adoption did not materially affect

the Company’s financial position, results of operations or cash flows.

In September 2015, the FASB issued ASU No. 2015-16, Business Combinations (Topic 805)—

Simplifying the Accounting for Measurement-Period Adjustments. This ASU requires an acquirer to

recognize provisional adjustments identified during the measurement period in the reporting period in

96