Rite Aid 2016 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

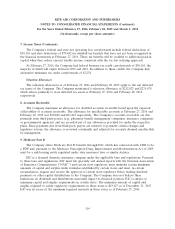

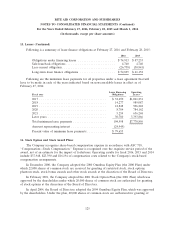

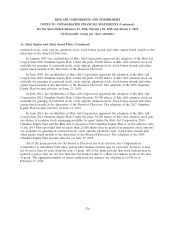

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended February 27, 2016, February 28, 2015 and March 1, 2014

(In thousands, except per share amounts)

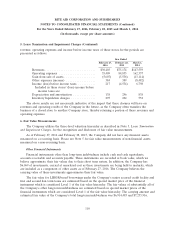

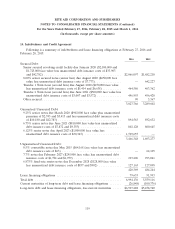

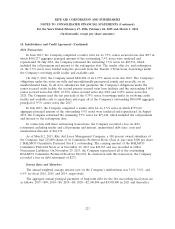

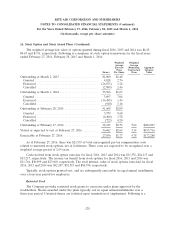

14. Indebtedness and Credit Agreement (Continued)

Credit Facility

On January 13, 2015, the Company amended and restated its senior secured credit facility

(‘‘Amended and Restated Senior Secured Credit Facility’’ or ‘‘revolver’’), which, among other things,

increased borrowing capacity from $1,795,000 to $3,000,000 (which further increased to $3,700,000 upon

the redemption of its 8.00% senior secured notes due August 2020 (‘‘8.00% Notes’’) on August 15,

2015), and extended the maturity to January 2020 from February 2018. The Company used borrowings

under the revolver to repay and retire all of the $1,143,650 outstanding under its Tranche 7 Senior

Secured Term Loan due 2020, along with associated fees and expenses. Borrowings under the revolver

bear interest at a rate per annum between (i) LIBOR plus 1.50% and LIBOR plus 2.00% with respect

to Eurodollar borrowings and (ii) the alternate base rate plus 0.50% and the alternate base rate plus

1.00% with respect to ABR borrowings, in each case, based upon the average revolver availability (as

defined in the Amended and Restated Senior Secured Credit Facility). The Company is required to pay

fees between 0.250% and 0.375% per annum on the daily unused amount of the revolver, depending

on the Average Revolver Availability (as defined in the Amended and Restated Senior Secured Credit

Facility). Amounts drawn under the revolver become due and payable on January 13, 2020.

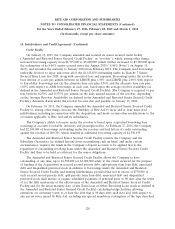

On February 10, 2015, the Company amended the Amended and Restated Senior Secured Credit

Facility to, among other things, increase the flexibility of Rite Aid to incur and/or issue unsecured

indebtedness, including in connection with the Acquisition, and made certain other modifications to the

covenants applicable to Rite Aid and its subsidiaries.

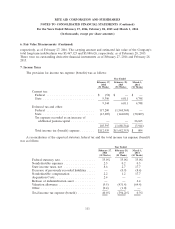

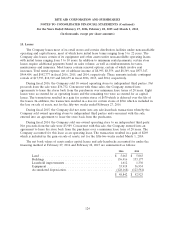

The Company’s ability to borrow under the revolver is based upon a specified borrowing base

consisting of accounts receivable, inventory and prescription files. At February 27, 2016, the Company

had $2,100,000 of borrowings outstanding under the revolver and had letters of credit outstanding

against the revolver of $69,301, which resulted in additional borrowing capacity of $1,530,699.

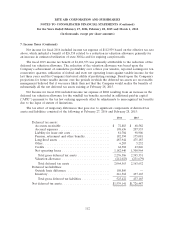

The Amended and Restated Senior Secured Credit Facility restricts the Company and the

Subsidiary Guarantors (as defined herein) from accumulating cash on hand, and under certain

circumstances, requires the funds in the Company’s deposit accounts to be applied first to the

repayment of outstanding revolving loans under the Amended and Restated Senior Secured Credit

Facility and then to be held as collateral for the senior obligations.

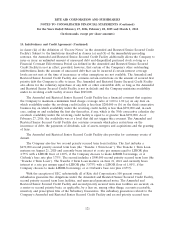

The Amended and Restated Senior Secured Credit Facility allows the Company to have

outstanding, at any time, up to $1,500,000 (or $1,800,000 solely to the extent incurred for the purpose

of funding of the Acquisition) in secured second priority debt, split-priority term loan debt, unsecured

debt and disqualified preferred stock in addition to borrowings under the Amended and Restated

Senior Secured Credit Facility and existing indebtedness, provided that not in excess of $750,000 of

such secured second priority debt, split-priority term loan debt, unsecured debt and disqualified

preferred stock shall mature or require scheduled payments of principal prior to 90 days after the latest

of (a) the fifth anniversary of the effectiveness of the Amended and Restated Senior Secured Credit

Facility and (b) the latest maturity date of any Term Loan or Other Revolving Loan (each as defined in

the Amended and Restated Senior Secured Credit Facility) (excluding bridge facilities allowing

extensions on customary terms to at least the date that is 90 days after such date and, with respect to

any escrow notes issued by Rite Aid, excluding any special mandatory redemption of the type described

120