Rite Aid 2016 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

proceeds from the issuance of common stock and excess tax benefit on stock options, partially offset by

a reduction in our zero balance bank accounts.

Cash used in financing activities was $85.8 million in fiscal 2015, which reflects proceeds from the

issuance of our $1,152.3 million Tranche 7 Term Loan due 2020 (‘‘Tranche 7 Term Loan’’), net proceeds

from our revolver of $1,325.0 million (which includes borrowings for the repayment and retirement of

our $1,143.7 million Tranche 7 Term Loan), the repayment of our $1,152.3 million Tranche 6 Term

Loan due 2020 and the redemption of $270.0 million of our 10.25% Senior Secured Notes due 2019.

We also made scheduled payments of $21.1 million on our capital lease obligations and $8.6 million on

our Tranche 7 Term Loan. Additionally, we paid an early redemption premium of $13.8 million in

connection with the redemption of our 10.25% Senior Secured Notes due 2019 and deferred financing

costs of $1.5 million and $18.8 million in connection with our Tranche 7 Term Loan due 2020 and

January 2015 Senior Secured Credit Facility refinancing, respectively. Cash provided by financing

activities also reflects proceeds from the issuance of common stock and excess tax benefit on stock

options and an increase in our zero balance bank accounts.

Cash used in financing activities was $320.2 million in fiscal 2014, which reflects financing fees of

$45.6 million paid for early debt retirement and deferred financing costs of $17.9 million paid in

connection with the issuance of our $500.0 million Tranche 2 Term Loan and $810.0 million of our

6.75% senior notes due 2021 and the corresponding retirement of $500.0 million of our 7.5% senior

secured notes due 2017 and $810.0 million of our 9.5% senior notes due 2017. We also made scheduled

payments of $21.7 million and $8.7 million on our capital lease obligations and our Tranche 6 Term

Loan and we used cash of $21.0 million to repurchase the RALMCO Cumulative Preferred Stock

described above. Also included in cash used in financing activities was a cash inflow of $26.7 million

relating to the excess tax benefit on stock option exercises and restricted stock vesting, which is

completely offset by a cash outflow in cash provided by operating activities.

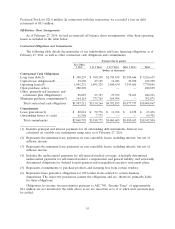

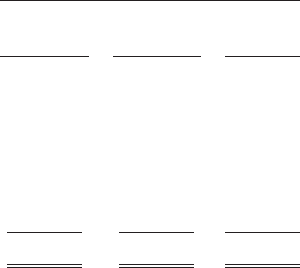

Capital Expenditures

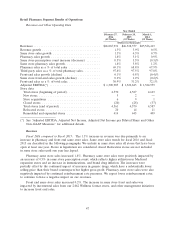

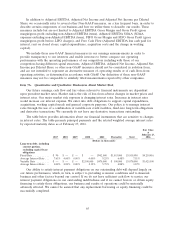

During the fiscal years ended February 27, 2016, February 28, 2015 and March 1, 2014 capital

expenditures were as follows:

Year Ended

February 27, February 28, March 1,

2016 2015 2014

(52 weeks) (52 weeks) (52 weeks)

New store construction, store relocation and

store remodel projects .................. $311,820 $280,679 $218,454

Technology enhancements, improvements to

distribution centers and other corporate

requirements ........................ 229,527 146,149 115,416

Purchase of prescription files from other retail

pharmacies .......................... 128,648 112,558 87,353

Total capital expenditures ................. $669,995 $539,386 $421,223

Future Liquidity

We are highly leveraged. Our high level of indebtedness could: (i) limit our ability to obtain

additional financing; (ii) limit our flexibility in planning for, or reacting to, changes in our business and

the industry; (iii) place us at a competitive disadvantage relative to our competitors with less debt;

(iv) render us more vulnerable to general adverse economic and industry conditions; and (v) require us

to dedicate a substantial portion of our cash flow to service our debt. Based upon our current levels of

operations and after giving effect to limitations in the Merger Agreement, we believe that cash flow

57