Rite Aid 2016 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2016 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

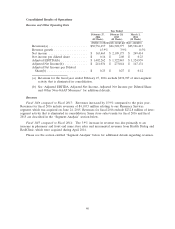

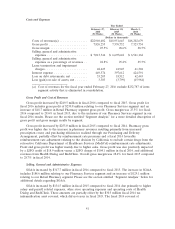

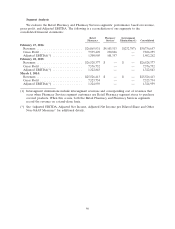

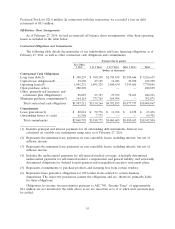

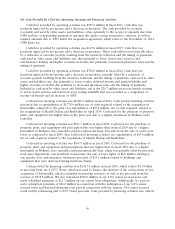

Retail Pharmacy Segment Results of Operations

Revenues and Other Operating Data

Year Ended

February 27, February 28, March 1,

2016 2015 2014

(52 Weeks) (52 Weeks) (52 Weeks)

(Dollars in thousands)

Revenues ...................................... $26,865,931 $26,528,377 $25,526,413

Revenue growth ................................. 1.3% 3.9% 0.5%

Same store sales growth ........................... 1.3% 4.3% 0.7%

Pharmacy sales growth ............................ 1.8% 5.1% 0.9%

Same store prescription count increase (decrease) ........ 0.5% 3.5% (0.3)%

Same store pharmacy sales growth .................... 1.8% 5.8% 1.2%

Pharmacy sales as a % of total sales .................. 69.1% 68.8% 67.9%

Third party sales as a % of total pharmacy sales .......... 97.8% 97.5% 97.0%

Front-end sales growth (decline) ..................... 0.1% 0.8% (0.4)%

Same store front-end sales growth (decline) ............. 0.2% 1.2% (0.2)%

Front-end sales as a % of total sales .................. 30.9% 31.2% 32.1%

Adjusted EBITDA(*) ............................. $ 1,300,905 $ 1,322,843 $ 1,324,959

Store data:

Total stores (beginning of period) ................... 4,570 4,587 4,623

New stores ................................... 5 2 —

Store acquisitions ..............................691

Closed stores ................................. (20) (28) (37)

Total stores (end of period) ....................... 4,561 4,570 4,587

Relocated stores ............................... 20 14 11

Remodeled and expanded stores ................... 414 445 409

(*) See ‘‘Adjusted EBITDA, Adjusted Net Income, Adjusted Net Income per Diluted Share and Other

Non-GAAP Measures’’ for additional details.

Revenues

Fiscal 2016 compared to Fiscal 2015: The 1.3% increase in revenue was due primarily to an

increase in pharmacy and front end same store sales. Same store sales trends for fiscal 2016 and fiscal

2015 are described in the following paragraphs. We include in same store sales all stores that have been

open at least one year. Stores in liquidation are considered closed. Relocation stores are not included

in same store sales until one year has lapsed.

Pharmacy same store sales increased 1.8%. Pharmacy same store sales were positively impacted by

an increase of 0.5% in same store prescription count, which reflects higher utilization in Medicaid

expansion states and an increase in immunizations, and brand drug inflation. The increases were

partially offset by the continued impact of increases in generic drugs, which have a substantially lower

selling price than their brand counterparts but higher gross profit. Pharmacy same store sales were also

negatively impacted by continued reimbursement rate pressures. We expect lower reimbursement rates

to continue to have a negative impact on our revenues.

Front end same store sales increased 0.2%. The increase in same store front end sales was

impacted by incremental sales from our 2,042 Wellness format stores, and other management initiatives

to increase front end sales.

47