Reebok 2011 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

TO OUR SHAREHOLDERS

55

2011

01.8 Our Share

the general market at the beginning of the second quarter, positive

analyst previews with regard to our first quarter results provided

stimulus to our share. As a result of better than expected top- and

bottom-line results, the share price closed at a then all-time high

on May 5, the day of the results release. Throughout the rest of the

quarter, several analyst upgrades and target price increases helped

to sustain positive momentum in an otherwise sluggish market, which

also continued into the third quarter. This resulted in the adidas AG

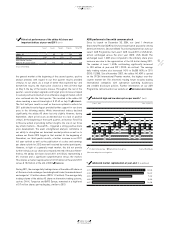

share reaching a new all-time high of € 57.42 on July 15

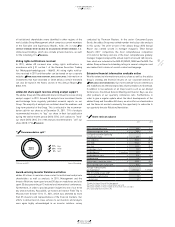

DIAGRAM 03

.

The first half year results as well as the more optimistic outlook for

2011 published in early August provided further support for our share

price in the following weeks. While international indices declined

significantly, the adidas AG share lost only slightly. However, during

September, share price losses accelerated due to a lack of positive

stimuli. At the beginning of the fourth quarter, an Investor Field Trip

to Moscow aimed at providing further insights into one of our three

key attack markets – Russia/CIS – triggered a strong positive share

price develop ment. The event strengthened analysts’ confidence in

our ability to strengthen our dominant market position as well as to

achieve our Route 2015 targets in that market. At the beginning of

November, our third quarter results, a further increase in our 2011

full year outlook as well as the publication of a sales and earnings

per share outlook for 2012 were well received by market participants.

However, in light of a generally weak market, this did not provide

further stimulus to our share price towards the end of the year. Never-

theless, the adidas AG share closed 2011 at € 50.26, representing a

3% increase and a significant outperformance versus the market.

This implies a market capitalisation of € 10.5 billion at the end of 2011

versus € 10.2 billion at the end of 2010

DIAGRAM 04

.

During 2011, the average daily trading volume of the adidas AG share on

all German stock exchanges (excluding bank trades) remained almost

unchanged at 1.2 million shares (2010: 1.2 million). The average daily

trading volume of the adidas AG share on alternative trading systems,

such as CHI-X, Turquoise and BATS Europe, remained at a high level

of 0.7 million shares per trading day, similar to 2010.

ADR performs in line with common stock

Since its launch on December 30, 2004, our Level 1 American

Depositary Receipt (ADR) facility has enjoyed great popularity among

American investors. Deutsche Bank Trust Company Americas runs our

Level 1 ADR Programme. Our Level 1 ADR closed 2011 at US $ 32.61,

almost unchanged versus the prior year (2010: US $ 32.60). The

unchanged Level 1 ADR price compared to the ordinary share price

increase was due to the appreciation of the US dollar during 2011.

The number of Level 1 ADRs outstanding significantly increased

to 10.0 million at year-end 2011 (2010: 6.4 million). The average

daily trading volume also increased 143% to 36,000 ADRs in 2011

(2010: 15,000). Since November 2007, the adidas AG ADR is quoted

on the OTCQX International Premier market, the highest over-the-

counter market tier. This electronic trading forum includes leading

international companies with substantial operating businesses

and credible disclosure policies. Further information on our ADR

Programme can be found on our website at :

WWW.ADIDAS-GROUP.COM/ADR

.

04 adidas AG market capitalisation at year-end (€ in millions)

2011 10,515

2010 10,229

2009 7,902

2008 5,252

2007 10,438

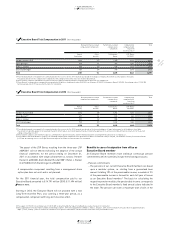

02 Historical performance of the adidas AG share and

important indices at year-end 2011 (in %)

1 year 3 years 5 years 10 years Since IPO

adidas AG 3 85 33 138 420

DAX-30 (15) 23 (11) 14 169

MSCI World Textiles,

Apparel & Luxury Goods (4) 110 32 203 228

Source: Bloomberg.

03 adidas AG high and low share prices per month 1) (in €)

| Jan. 1, 2011 Dec. 31, 2011 |

60

50

40

30-day moving average ■ High and low share prices Source: Bloomberg.

1) Based on daily Xetra closing prices.

48.94

49.35

47.65

50.26

53.50

54.95

57.42

51.19

49.82

52.31

52.65

52.06

44.75

45.65

43.22

44.65

49.89

49.00

51.79

44.11

44.25

43.95

48.10

47.89