Reebok 2011 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

114

2011

03.1 Internal Group Management System

Internal Group Management System

The principal financial goal for increasing shareholder value at the adidas Group is maximising operating

cash flow. We strive to achieve this goal by continually improving our top- and bottom-line performance

while at the same time optimising the use of invested capital. Our Group’s planning and controlling system

is therefore designed to provide a variety of tools to assess our current performance and to align future

strategic and investment decisions to best utilise commercial and organisational opportunities.

03.1

Operating cash flow as Internal Group Management focus

We believe operating cash flow is the most important driver to increase

shareholder value. Operating cash flow is comprised of operating

profit, change in operating working capital and net investments

(capital expenditure less depreciation and amortisation)

DIAGRAM 01

.

To maximise operating cash flow generation across our organisation,

management of our operating segments together with management

at market level have responsibility for improving operating profit as

well as optimising operating working capital and capital expenditure.

To keep senior management focused on long-term performance

improvements we have adopted a modified economic value added (EVA)

model. The asset base of a market or operating unit within the Group

is subject to a percentage capital charge to the operating profit of the

respective business unit. The asset base includes operating working

capital as well as other assets needed by a market or operating unit in

its day-to-day operations. The resulting internal KPI is called Contri-

bution After Capital Charge (CACC) and is used as one of the primary

targets for the variable component of managers’ compensation. This

concept has been in place Group-wide since 2010.

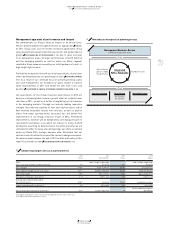

01 Operating cash flow components

Operating profit

Operating

cash flow

Change in operating working capital

Net investments 1)

1) Capital expenditure less depreciation and amortisation.

Operating margin as important KPI of operational

progress

Operating margin (defined as operating profit as a percentage of net

sales) is our Group’s most important measure of operational success.

It highlights the quality of our top line and operational efficiency. The

primary drivers central to enhancing operating margin are:

– Sales and gross margin development: Management focuses on

identifying and exploiting opportunities that not only provide for

future growth, but also have potential to increase gross margin

(defined as gross profit as a percentage of net sales). Major levers

for enhancing our Group’s sales and gross margin include:

– optimising our product mix

– increasing the quality of distribution, with a particular focus on

controlled space

– minimising clearance activities

– realising supply chain efficiency initiatives

– Operating expense control: We put high emphasis on tightly

controlling operating expenses to leverage the Group’s sales

growth through to the bottom line. This requires a particular focus

on ensuring flexibility in the Group’s cost base. Marketing working

budget is our largest operating expense. It is one of the most

important mechanisms for driving top-line growth sustainably.

Therefore, we are committed to improving the utilisation of our

marketing expenditure. This includes concentrating our communi-

cation efforts (including advertising, retail presentation and public

relations) on key global brand initiatives and focusing our promotion

spend on well-selected partnerships with top events, leagues, clubs

and athletes.

We also aim to increase operational efficiency and reduce operating

overhead expenses as a percentage of sales. In this respect, we

regularly review our operational structure – streamlining business

processes, eliminating redundancies and leveraging the scale of our

organisation. These measures may also be supplemented by short-

term initiatives such as temporarily curtailing operational invest-

ments, for example staff hiring.