Reebok 2011 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

TO OUR SHAREHOLDERS

54

2011

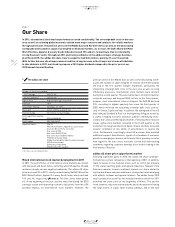

01.8 Our Share

Our Share

In 2011, international stock market performance varied considerably. The sovereign debt crisis in the euro

area as well as a slowing global economic outlook were major concerns and catalysts for volatile markets

throughout the year. The political unrest in the Middle East and Northern Africa as well as the devastating

earthquake and tsunami in Japan also weighed on financial markets. As a result, the DAX-30 and the MSCI

World Textiles, Apparel & Luxury Goods Index decreased 15% and 4%, respectively. Due to consistently

strong financial results throughout 2011 and rising confidence in the adidas Group’s strategic business

plan Route 2015, the adidas AG share clearly outperformed both indices, gaining 3% over the period.

With further balance sheet improvements and the strong increase in the Group’s net income attributable

to shareholders in 2011, we intend to propose a 25% higher dividend compared to the prior year at our

2012 Annual General Meeting.

01.8

Mixed international stock market development in 2011

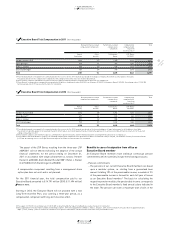

In 2011, the performance of international stock markets was mixed,

with European and Asian indices suffering, while US equities showed

resilience despite various negative headwinds. The adidas AG share

price increased 3% in 2011, clearly outperforming the DAX-30 and the

MSCI World Textiles, Apparel & Luxury Goods Index, which declined

15% and 4%, respectively

DIAGRAM 02

. The Dow Jones Index gained

6%. At the beginning of the year, positive news flow during the 2010

earnings season and improving economic data points from the USA

provided impetus for international stock markets. However, the

political unrest in the Middle East as well as the devastating earth-

quake and tsunami in Japan weighed on investor sentiment towards

the end of the first quarter. Despite headwinds, particularly the

sharpening sovereign debt crisis in the euro area as well as rising

inflationary pressures, international stock markets were resilient

during the second quarter. This was mainly due to strong first quarter

corporate earnings and buoyant M&A activity. In the third quarter,

however, most international indices collapsed. The DAX-30 declined

25%, recording its highest quarterly loss since the third quarter of

2002, which reflected the escalating sovereign debt crisis, particu-

larly in Greece, Spain and Italy. In addition, the downgrade of the US

debt rating by Standard & Poor’s at the beginning of August as well as

a slump in leading economic indicators added to intensifying reces-

sionary fears and unsettled equity markets. Following these massive

losses, global stock markets recovered in the fourth quarter as the

instalment of new governments in Spain, Greece and Italy increased

investor confidence in the ability of policymakers to resolve the

crisis. Furthermore, surprisingly robust US economic data provided

additional support. Nevertheless, signals of a slowdown of economic

growth in emerging economies, particularly China, growing concerns

with regard to the euro area’s economic outlook and deteriorating

comments regarding corporate earnings led to volatile trading in the

final weeks of the year.

adidas AG share price outperforms market

Following significant gains in 2010, the adidas AG share underper-

formed more cyclical companies at the beginning of 2011. In addition,

rapid increases in raw material prices such as cotton put pressure

on the overall sporting goods and apparel industries. However, from

February onwards, investor sentiment towards our share started to

improve amid more and more evidence of strong sales trends emerging

with athletic footwear and apparel retailers. The adidas Group 2010

results publication as well as the increased revenue outlook for 2011

benefited the share price at the beginning of March. The positive

trend, however, was reversed towards the end of the quarter following

the tragic events in Japan. After trading sideways, and in line with

01 The adidas AG share

Number of shares outstanding

2011 average 209,216,186

At year-end 2011 1) 209,216,186

Type of share Registered no-par-value share

Free float 100%

Initial Public Offering November 17, 1995

Share split June 6, 2006 (in a ratio of 1: 4)

Stock exchange All German stock exchanges

Stock registration number

(ISIN) DE000A1EWWW0

Stock symbol ADS, ADSGn.DE

Important indices

DAX-30

MSCI World Textiles, Apparel & Luxury Goods

Deutsche Börse Prime Consumer

Dow Jones STOXX

Dow Jones EURO STOXX

Dow Jones Sustainability Indexes

FTSE4Good Europe Index

Ethibel Sustainability Index Excellence Europe

ASPI Eurozone Index

ECPI Ethical Index EMU

STOXX Global ESG Leaders

1) All shares carry full dividend rights.