Reebok 2011 Annual Report Download - page 213

Download and view the complete annual report

Please find page 213 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

CONSOLIDATED FINANCIAL STATEMENTS

209

2011

209

2011

04.8 Notes Notes to the Consolidated Income Statement

Depreciation and amortisation expense for tangible and intangible

assets (excluding goodwill) and impairment losses were € 252 million

and € 263 million for the years ending December 31, 2011 and 2010,

respectively. Thereof, € 3 million and € 3 million were recorded within

the cost of sales as they are directly assigned to the production costs.

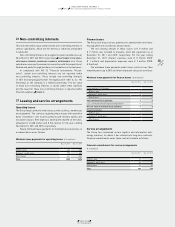

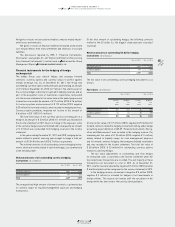

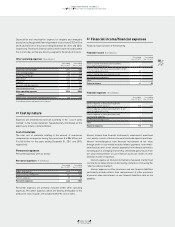

Other operating expenses (€ in millions)

Year ending

Dec. 31, 2011

Year ending

Dec. 31, 2010

Marketing working budget 1,361 1,288

Sales working budget 338 308

Marketing overhead 1) 402 380

Sales force 1) 1,653 1,496

Logistics 1) 678 617

Research and development 1) 115 102

Central administration 1) 977 855

Other operating expenses 5,524 5,046

Thereof:

Depreciation, amortisation and impairment losses 249 260

1) Including personnel and administration expenses.

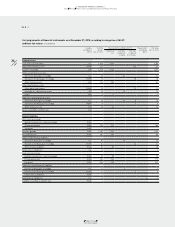

31 Cost by nature

Expenses are presented by function according to the “cost of sales

method” in the income statement. Supplementary information on the

expenses by nature is detailed below.

Cost of materials

The total cost of materials relating to the amount of inventories

recognised as an expense during the period was € 6.884 billion and

€ 6.165 billion for the years ending December 31, 2011 and 2010,

respectively.

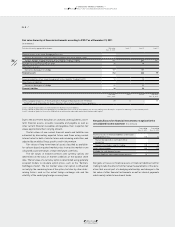

Personnel expenses

Personnel expenses were as follows:

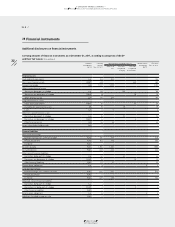

Personnel expenses (€ in millions)

Year ending

Dec. 31, 2011

Year ending

Dec. 31, 2010

Wages and salaries 1,439 1,338

Social security contributions 152 132

Pension expenses 55 51

Personnel expenses 1,646 1,521

Personnel expenses are primarily included within other operating

expenses. Personnel expenses which are directly attributable to the

production costs of goods are included within the cost of sales.

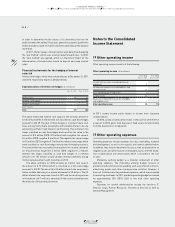

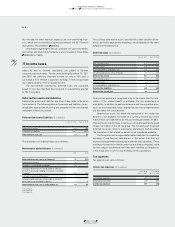

32 Financial income/financial expenses

Financial result consists of the following:

Financial income (€ in millions)

Year ending

Dec. 31, 2011

Year ending

Dec. 31, 2010

Interest income from financial instruments

measured at amortised cost 12 16

Interest income from financial instruments at fair

value through profit or loss 18 7

Interest income from non-financial assets 0 0

Net foreign exchange gains – 2

Other 1 0

Financial income 31 25

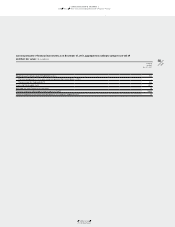

Financial expenses (€ in millions)

Year ending

Dec. 31, 2011

Year ending

Dec. 31, 2010

Interest expense on financial instruments

measured at amortised cost 108 112

Interest expense on financial instruments at fair

value through profit or loss 0 0

Interest expense on other provisions and

non-financial liabilities 0 0

Net foreign exchange losses 7 –

Other 0 1

Financial expenses 115 113

Interest income from financial instruments, measured at amortised

cost, mainly consists of interest income from bank deposits and loans.

Interest income/expense from financial instruments at fair value

through profit or loss mainly includes interest payments from invest-

ment funds as well as net interest payments from interest derivatives

not being part of a hedging relationship. Unrealised gains/losses from

fair value measurement of such financial assets are shown in other

financial income or expenses.

Interest expense on financial instruments measured at amortised

cost mainly includes interest on borrowings and effects from using the

“effective interest method”.

Interest expense on other provisions and non-financial liabilities

particularly includes effects from measurement of other provisions

at present value and interest on non-financial liabilities such as tax

payables.