Reebok 2011 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2011 Reebok annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adidas Group

2011 Annual Report

GROUP MANAGEMENT REPORT – FINANCIAL REVIEW

134

2011

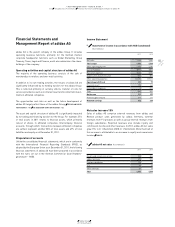

03.2 Group Business Performance Financial Statements and Management Report of adidas AG

03.2

Other operating income declines 2%

In 2011, other operating income of adidas AG declined 2% to

€ 1.254 billion. This was primarily due to a decrease in income from

currency conversion and lower income derived from services provided

to other Group companies. The result also reflects the conversion of

the Reebok Germany business from commission agent to principal. In

the prior year, this business was still being conducted by adidas AG

as commission agent; as such, the company generated income by

passing the operational costs on to the principal. The conversion to

principal meant that the income derived from passing on costs were

no longer achieved in 2011.

Other operating expenses increase 10%

In 2011, other operating expenses for adidas AG rose 10% to

€ 2.125 billion (2010: € 1.931 billion). The increase is largely attrib-

utable to higher marketing expenditure. This includes an increase in

promotional and advertising expenditure to support sales growth in

Germany, and higher expenditure for global marketing to strengthen

the adidas brand at an international level. Losses from currency

conversion were also up, as was expenditure for legal and other

consultancy services.

Depreciation and amortisation increases due to

completion of Laces

Depreciation and amortisation for adidas AG rose € 12 million in 2011

to € 69 million, mainly as a result of the opening of the new “Laces”

office building in Herzogenaurach, Germany.

Loss from operations

In 2011, adidas AG recorded a loss from operations in the amount of

€ 9 million compared to a profit of € 77 million in the prior year. This

was mainly due to the increase in other operating expenses.

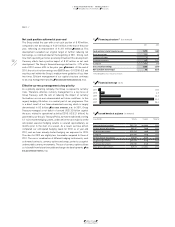

Financial result increases 25%

Net interest expense of adidas AG declined 9% to € 63 million in 2011

(2010: € 69 million). This positive development derives from interest

received from affiliated companies. At € 40 million, interest paid to

third parties increased € 1 million compared to the prior year.

Income from investments in affiliated companies increased

€ 58 million to € 147 million in 2011 from € 89 million in the prior year.

Profit and loss transfer agreements generated income of € 94 million

for adidas AG in 2011. As a result, the financial result of adidas AG

increased 25% to € 178 million from € 142 million in 2010.

Net income decreases 29%

Income from ordinary activities decreased 23% to € 169 million in

2011 from € 219 million in 2010, as increases in the financial result

were more than offset by the loss from operations. Net income for the

year after taxes of € 58 million was € 111 million (2010: € 157 million).

Balance Sheet

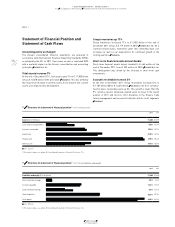

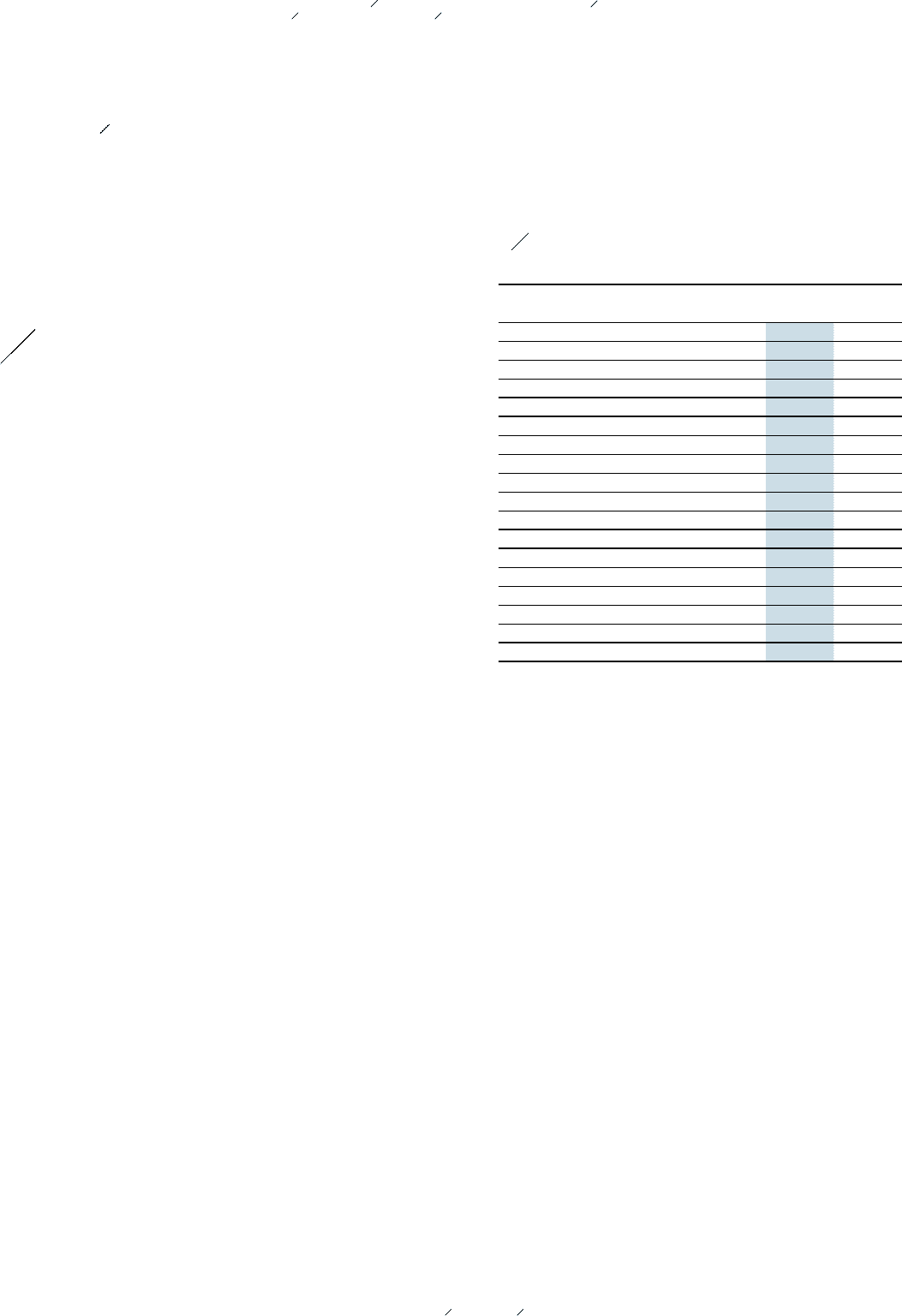

Total assets decline 4%

At the end of December 2011, total assets declined 4% to € 6.046 billion

versus € 6.265 billion in the prior year. The most significant changes

were in cash and cash equivalents, which decreased € 299 million.

This was partly offset by additions to fixed assets in an amount of

€ 54 million, mainly due to the new “Laces” office building, as well

as an increase of € 27 million in receivables and other current assets.

Shareholders’ equity declines 2%

Shareholders’ equity declined 2% to € 2.322 billion at the end of

December 2011 versus € 2.378 billion in the prior year. The decrease

was mainly due to the decline in net income and the distribution of

dividends for the financial year 2010. Taking into account the dividend

distribution from the prior year retained earnings and the net income

generated for the year, the equity ratio remained stable at 38%.

Provisions increase 8%

Provisions were up € 24 million to € 339 million at the end of 2011

(2010: € 315 million). This increase is primarily attributable to

provisions for pensions and similar commitments, which were up

€ 11 million, and an increase of € 13 million in other provisions, which

were mainly personnel-related.

56 Balance sheet in accordance with HGB (condensed)

(€ in millions)

2011 2010

Assets

Intangible assets 154 161

Property, plant and equipment 255 229

Financial assets 3,429 3,395

Fixed assets 3,838 3,785

Inventories 30 21

Receivables and other assets 1,767 1,740

Cash and cash equivalents, securities 383 682

Current assets 2,180 2,443

Prepaid expenses 28 37

Total assets 6,046 6,265

Equity and liabilities

Shareholders’ equity 2,322 2,378

Provisions 339 315

Liabilities and other items 3,385 3,572

Total equity and liabilities 6,046 6,265