Red Lobster 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

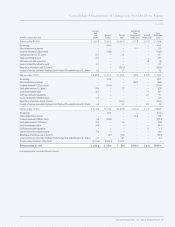

Notes to Consolidated Financial Statements

Darden

Darden Restaurants, Inc. 2013 Annual Report 47

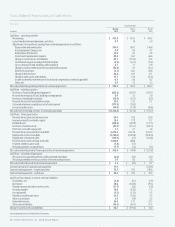

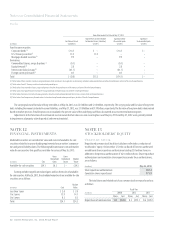

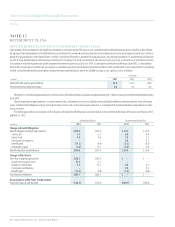

NOTE 6

OTHER ASSETS

The components of other assets are as follows:

(in millions)

May 26, 2013 May 27, 2012

Trust-owned life insurance (1) $ 85.7 $ 68.9

Capitalized software costs, net (2) 40.4 20.9

Liquor licenses 49.6 47.3

Acquired below-market leases, net 21.4 16.9

Loan costs, net 19.1 15.3

Marketable securities 22.3 33.0

Deferred-tax charge (3) 21.3–

Insurance-related 18.0 16.7

Miscellaneous 21.0 12.8

Total other assets $298.8 $231.8

(1) The increase is attributable to market-driven changes in the value of our trust-owned life insurance.

(2) The increase is attributable to upgrades to our information technology platform in support of technology initiatives.

(3) The deferred tax charge is related to U.S. federal and state income taxes paid on the sale of intellectual property

related to our foreign franchise and lobster aquaculture business to foreign subsidiaries in fiscal 2013.

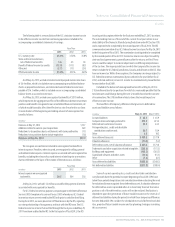

NOTE 7

SHORT-TERM DEBT

As of May 26, 2013, amounts outstanding as short-term debt, which consist of

unsecured commercial paper borrowings, bearing an interest rate of 0.20 percent,

were $164.5 million. As of May 27, 2012, amounts outstanding as short-term debt,

which consist of unsecured commercial paper borrowings, bearing an interest

rate of 0.32 percent, were $262.7 million.

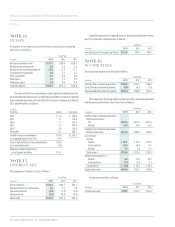

NOTE 8

OTHER CURRENT LIABILITIES

The components of other current liabilities are as follows:

(in millions)

May 26, 2013 May 27, 2012

Non-qualified deferred compensation plan $224.3 $201.4

Sales and other taxes 74.3 60.6

Insurance-related 40.8 35.2

Employee benefits 44.7 59.7

Derivative liabilities 2.2 45.3

Accrued interest 17.7 15.6

Miscellaneous 46.3 36.6

Total other current liabilities $450.3 $454.4

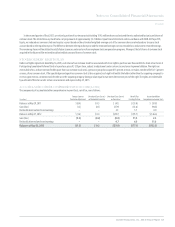

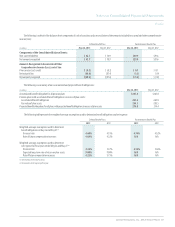

NOTE 9

LONG-TERM DEBT

The components of long-term debt are as follows:

(in millions)

May 26, 2013 May 27, 2012

5.625% senior notes due October 2012 $ – $ 350.0

7.125% debentures due February 2016 100.0 100.0

Variable-rate term loan (1.44% at May 26, 2013)

due August 2017 300.0–

6.200% senior notes due October 2017 500.0 500.0

3.790% senior notes due August 2019 80.0–

4.500% senior notes due October 2021 400.0 400.0

3.350% senior notes due November 2022 450.0–

4.520% senior notes due August 2024 220.0–

6.000% senior notes due August 2035 150.0 150.0

6.800% senior notes due October 2037 300.0 300.0

ESOP loan – 5.9

Total long-term debt $2,500.0 $1,805.9

Fair value hedge 1.9 3.2

Less issuance discount (5.7) (5.5)

Total long-term debt less issuance discount $2,496.2 $1,803.6

Less current portion – (349.9)

Long-term debt, excluding current portion $2,496.2 $1,453.7

We maintain a $750.0 million revolving Credit Agreement (Revolving Credit

Agreement), with Bank of America, N.A. (BOA) as administrative agent, and the

lenders and other agents party thereto. The Revolving Credit Agreement is a

senior unsecured credit commitment to the Company and contains customary

representations and affirmative and negative covenants (including limitations

on liens and subsidiary debt and a maximum consolidated lease adjusted total

debt to total capitalization ratio of 0.75 to 1.00) and events of default customary

for credit facilities of this type. As of May 26, 2013, we were in compliance with

the covenants under the Revolving Credit Agreement.