Red Lobster 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Red Lobster annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis

of Financial Condition and Results of Operations

Darden

26 Darden Restaurants, Inc. 2013 Annual Report

We maintain a $750.0 million revolving Credit Agreement (Revolving Credit

Agreement), with Bank of America, N.A. (BOA) as administrative agent, and the

lenders and other agents party thereto. The Revolving Credit Agreement is a

senior unsecured credit commitment to the Company and contains customary

representations and affirmative and negative covenants (including limitations

on liens and subsidiary debt and a maximum consolidated lease adjusted total

debt to total capitalization ratio of 0.75 to 1.00) and events of default customary

for credit facilities of this type. As of May 26, 2013, we were in compliance with

the covenants under the Revolving Credit Agreement.

The Revolving Credit Agreement matures on October 3, 2016, and the proceeds

may be used for commercial paper back-up, working capital and capital expen-

ditures, the refinancing of certain indebtedness, certain acquisitions and general

corporate purposes. Loans under the Revolving Credit Agreement bear interest at

a rate of LIBOR plus a margin determined by reference to a ratings-based pricing

grid (Applicable Margin), or the base rate (which is defined as the higher of the

BOA prime rate or the Federal Funds rate plus 0.500 percent) plus the Applicable

Margin. Assuming a “BBB” equivalent credit rating level, the Applicable Margin

under the Revolving Credit Agreement will be 1.075 percent for LIBOR loans and

0.075 percent for base rate loans.

As of May 26, 2013, we had no outstanding balances under the Revolving

Credit Agreement. As of May 26, 2013, $164.5 million of commercial paper was

outstanding, which was backed by this facility. After consideration of commercial

paper backed by the Revolving Credit Agreement, as of May 26, 2013, we had

$585.5 million of credit available under the Revolving Credit Agreement.

On October 4, 2012, we issued $450.0 million aggregate principal amount

of unsecured 3.350 percent senior notes due November 2022 (the New Senior

Notes) under a registration statement filed with the Securities and Exchange

Commission (SEC) on October 6, 2010. Discount and issuance costs, which

totaled $4.7 million, are being amortized over the term of the New Senior Notes

using the straight-line method, the results of which approximate the effective

interest method. Interest on the New Senior Notes is payable semi-annually in

arrears on May 1 and November 1 of each year, and commenced May 1, 2013. We

may redeem the New Senior Notes at any time in whole or from time to time in

part, at the principal amount plus a make-whole premium. If we experience a

change in control triggering event, unless we have previously exercised our right

to redeem the New Senior Notes, we may be required to purchase the New

Senior Notes from the holders at a purchase price equal to 101 percent of their

principal amount plus accrued and unpaid interest.

On August 22, 2012, we entered into a Term Loan Agreement (the Term Loan

Agreement) with BOA, as administrative agent, and the lenders and other agents

party thereto. During the second quarter of fiscal 2013, we made borrowings

under this agreement in a total aggregate principal amount of $300.0 million.

The Term Loan Agreement is a senior unsecured term loan commitment to the

Company and contains customary representations, events of default and affirma-

tive and negative covenants (including limitations on liens and subsidiary debt

and a maximum consolidated lease adjusted total debt to total capitalization

ratio of 0.75 to 1.00) for facilities of this type.

The Term Loan Agreement matures on August 22, 2017, and the proceeds

may be used for the refinancing of certain indebtedness, certain acquisitions and

general corporate purposes. The loans under the Term Loan Agreement are subject

to annual amortization of principal of 5 percent, 5 percent, 5 percent and 85 percent,

payable on the second, third, fourth and fifth anniversaries, respectively, of the

effective date of the Term Loan Agreement. Additional information regarding

terms and conditions of the Term Loan Agreement is incorporated by reference

from Note 9 to our consolidated financial statements in Part II, Item 8 of this report.

On August 28, 2012, we closed on the issuance of $80.0 million unsecured

3.790 percent senior notes due August 2019 and $220.0 million unsecured

4.520 percent senior notes due August 2024, pursuant to a Note Purchase Agreement

dated June 18, 2012. The Note Purchase Agreement contains customary represen-

tations, events of default and affirmative and negative covenants (including

limitations on liens and priority debt and a maximum consolidated total debt to

capitalization ratio of 0.75 to 1.00, as such may be adjusted in certain circumstances)

for facilities of this type.

On May 15, 2013 we repaid, prior to maturity, a $4.9 million unsecured

commercial bank loan which was used to support a loan from us to the Employee

Stock Ownership Plan portion of the Darden Savings Plan.

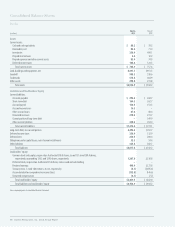

At May 26, 2013, our long-term debt consisted principally of:

• $100.0millionofunsecured7.125percentdebenturesdueinFebruary2016;

• $300.0millionunsecured,variable-ratetermloanmaturinginAugust2017;

• $500.0millionofunsecured6.200percentseniornotesdueinOctober2017;

• $80.0millionofunsecured3.790percentseniornotesdueinAugust2019;

• $400.0millionofunsecured4.500percentseniornotesdueinOctober2021;

• $450.0millionofunsecured3.350percentseniornotesdueinNovember2022;

• $220.0millionofunsecured4.520percentseniornotesdueinAugust2024;

• $150.0millionofunsecured6.000percentseniornotesdueinAugust

2035;and

• $300.0millionofunsecured6.800percentseniornotesdueinOctober2037.

The interest rates on our $500.0 million 6.200 percent senior notes due

October 2017 and $300.0 million 6.800 percent senior notes due October 2037

are subject to adjustment from time to time if the debt rating assigned to such

series of notes is downgraded below a certain rating level (or subsequently

upgraded). The maximum adjustment is 2.000 percent above the initial interest

rate and the interest rate cannot be reduced below the initial interest rate. As of

May 26, 2013, no adjustments to these interest rates had been made.

All of our long-term debt currently outstanding is expected to be repaid

entirely at maturity with interest being paid semi-annually over the life of the

debt. The aggregate maturities of long-term debt for each of the five fiscal years

subsequent to May 26, 2013 and thereafter are $0.0 million in fiscal 2014,

$15.0 million in fiscal 2015, $115.0 million in fiscal 2016, $15.0 million in

fiscal 2017, $755.0 million in fiscal 2018 and $1.6 billion thereafter.

From time to time we enter into interest rate derivative instruments to manage

interest rate risk inherent in our operations. See Note 10 to our consolidated

financial statements in Part II, Item 8 of this report, incorporated herein by reference.

Through our shelf registration statement on file with the SEC, depending on

conditions prevailing in the public capital markets, we may issue unsecured debt

securities from time to time in one or more series, which may consist of notes,

debentures or other evidences of indebtedness in one or more offerings.

We may from time to time repurchase our outstanding debt in privately

negotiated transactions. Such repurchases, if any, will depend on prevailing

market conditions, our liquidity requirements and other factors.