Porsche 2007 Annual Report Download - page 180

Download and view the complete annual report

Please find page 180 of the 2007 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.177

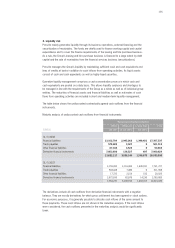

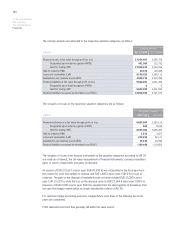

4.3 Interest rate risk

The interest risk in the Group from financial services is minimized by using suitable business

models or interest swaps to keep financing and refinancing balanced as far as possible. In

this division there is thus no significant risk due to changes in interest rates.

The interest risk for the rest of the Porsche Group stems from changes in market interest rates.

This particularly affects the current tax expense for call money and medium and long-term

floating-rate receivables and liabilities, but can equally also impact on the market value recognized

for fixed-interest receivables and liabilities. Depending on the market situation, these are hedged

either using interest swaps or interest contracts.

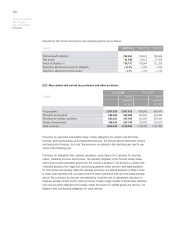

Sensitivity analyses are used to determine interest risks within the meaning of IFRS 7. For this pur-

pose, effects of changes in market interest rates on the financial result are presented. If the mar-

ket interest level had been valued 100 base points higher as of 31 July 2008, the reserve in equity

would have been EUR 3 million lower (prior year: EUR 1 million higher). If the market interest level

had been valued 100 base points lower as of 31 July 2008, the reserve in equity would have been

EUR 3 million higher (prior year: EUR 1 million lower). If the market interest level had been valued

100 base points higher as of July 31, 2008, the profit would have been EUR 8 million higher (prior

year: EUR 14 million). If the market interest level had been valued 100 base points higher as of

31 July 2008, the profit would have been EUR 6 million lower (prior year: EUR 13 million).

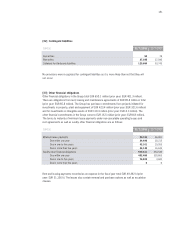

4.4 Stock price hedging risk

Stock price hedges have been entered into to secure the step-up of the shareholding in

Volkswagen AG. These are stock options and, to a lesser extent, equity forward contracts.

Porsche purchased these stock price hedges in order to secure a fixed subscription price

for the planned share step-up. Profit and loss effects above and beyond this are not part of

the hedging strategy.

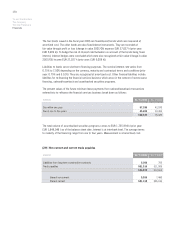

Based on an historical simulation for the last 360 days and a retention period of ten days and a

confidence level of 95%, the value-at-risk for the stock options and forward transactions amounted

to EUR 1.834 million (prior year: EUR 539 million).

4.5 Fund price risk

Porsche has invested part of its liquid funds for the medium and long-term in securities special

funds and money market funds. These investments are highly diversified and are partly managed

via loss limit systems. Here too, Porsche’s investment policy complies with the basic principle that

investment security takes clear precedence over any attempt to obtain an extraordinary return on

investment. With a retention period of 30 days and a confidence level of 95%, the value-at-risk for

the investment risk came to EUR 6 million (prior year: EUR 7 million).