Porsche 2007 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2007 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.176

To our shareholders

The Company

The new Panamera

Financials

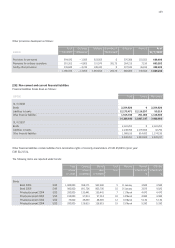

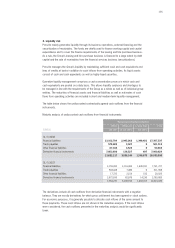

4. Market risk

4.1 Hedging policy and financial derivatives

In the ordinary course of business, the Porsche Group is exposed to risks relating to currency,

interest, raw materials prices, stock prices and fund prices. The risks result from foreign currency

transactions in the course of ordinary operations, from financing and from investing activities. It is

the objective of the Group’s central treasury department to manage and thus minimize these finan-

cial risks to the Group’s continued existence and earnings power by entering into hedges for the

Group. Guidelines are issued to govern discretionary decisions and internal controls and avoid a

concentration of risk. The nature and volume of hedging transactions is generally chosen with

regard to the underlying contract. Hedging transactions may only be concluded to hedge existing

underlyings or forecast transactions. Only financial instruments approved by type and volume may

be entered into with approved counterparties.

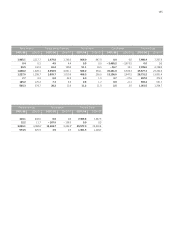

The Porsche Group uses two methods to present market price risks from primary and derivative

financial statements in accordance with IFRS 7. The market price risks for interest and currency

hedges are determined using a sensitivity analysis. A value-at-risk model is used for stock price

risks and asset management risks. In the value-at-risk calculation, a historical simulation is used

to determine the potential change in market price. In the sensitivity analyses, risk variables within

each of the market price risks are varied in order to determine the effect on equity and earnings.

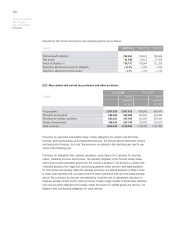

4.2 Foreign currency risk

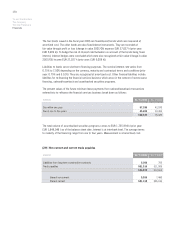

Currency risks from current receivables, liabilities and debts as well as from forecast transactions

are hedged with forward exchange contracts, currency options or combined options to the extent

that this makes economic sense. Hedges for value fluctuations in future cash flows from forecast

transactions mainly relate to planned sales in foreign currency. As of 31 July 2008, currency hed-

ges are in place in particular for the major currencies US dollar, pound sterling and Japanese yen.

All currencies other than the functional currency in which the Porsche Group enters into financial

instruments are relevant risk variables for the purpose of the sensitivity analyses within the

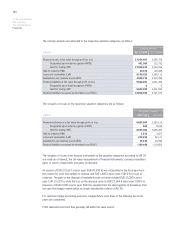

meaning of IFRS 7. If the respective functional currencies against the other currencies as of 31

July 2008 had been valued 10% higher, the reserve in equity would have been EUR 967 million

higher (prior year: EUR 852 million). If the respective functional currencies against the other

currencies as of 31 July 2008 had been valued 10% lower, the reserve in equity would have been

EUR 777 million lower (prior year: EUR 435 million). If the respective functional currencies against

the other currencies as of 31 July 2008 had been valued 10% higher, the profit would have been

EUR 117 million lower (prior year: EUR 150 million). If the respective functional currencies against

the other currencies as of 31 July 2008 had been valued 10% lower, the profit would have been

EUR 23 million higher (prior year: EUR 14 million).

Under IFRS, changes in value are to be recorded in profit or loss to the extent that they do not

compensate for the changes in value of future payments from the hedged underlyings. At Porsche,

this mainly relates to the write-downs to acquisition cost of the options contained in the portfolio.

As these acquisition costs have to be recognized to profit and loss at the latest when the under-

lying occurs, the risks with profit and loss effect described above merely bring forward future

expenses or income.