Porsche 2007 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2007 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.140

To our shareholders

The Company

The new Panamera

Financials

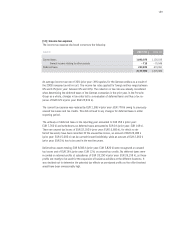

Current taxes

Current income tax assets and liabilities for the current and prior periods are measured at the

amount expected to be recovered from or paid to the taxation authorities. The tax rates and tax

laws used to compute the amount are those that are enacted or substantively enacted by the

balance sheet date. Adequate provision was made for future possible tax obligations, where

discernable, considering a large number of factors such as the interpretation, commentary and

court rulings on the pertinent tax legislation as well as past experience.

Current tax relating to items recognized directly in equity is recognized in equity and not in the

income statement.

Hybrid capital

Based on the bond conditions of the hybrid capital issued, this is accounted for as an equity

component of the Group in accordance with IAS 32. This means that the deductible interest is

not disclosed under interest expenses but treated like a dividend obligation to the shareholders.

Any capital procurement costs are deducted directly from the hybrid capital taking tax effects

into account.

Pension provisions

In accordance with IAS 19, provisions for pension obligations for defined benefit plans are

measured for actuarial purposes using the prescribed projected unit credit method. This method

considers not only the pensions and future claims known on the balance sheet date but also future

anticipated increases in salaries and pensions. If pension obligations are reinsured using plan

assets they are disclosed net. The calculation is based on actuarial opinions taking account of

biometric assumptions. The Company uses the corridor rule to measure the pension commitments

and determine the pension expenses. Actuarial gains and losses are not taken into account pro-

vided they do not exceed ten percent of the commitment or ten percent of the fair value of the

existing plan assets. From the following fiscal year, the amount in excess of the corridor is dis-

tributed over the average residual service period of the active workforce and recognized. Past

service cost is recognized on a straight-line basis over the average period until the benefits be-

come vested. If the benefits are already vested immediately following the introduction of, or chan-

ges to, a pension plan, past service cost is recognized immediately in profit or loss. Service cost

is disclosed in personnel expenses while the interest portion of the addition to the provision and

income from plan assets is recorded in the financial result. The interest rate used to discount

provisions is determined on the basis of the return on long-term high-quality corporate bonds on

the balance sheet date.

Other provisions

Other provisions are recognized if a past event has led to a current legal or constructive obligation

to third parties which is expected to lead to a future outflow of resources that can

be estimated reliably. Provisions for warranty claims are set up taking account of the past or

estimated future claims pattern. Non-current provisions are stated at their settlement amount

discounted to balance sheet date. The settlement amount also includes the estimated cost

increases. The interest rate used is a pre-tax rate that reflects current market assessments

of the time value of money and the risks specific to the liability. The expense resulting from

the unwinding of the interest rate is recognized in finance cost.