Porsche 2007 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2007 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

149

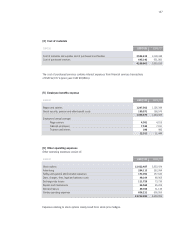

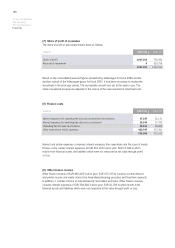

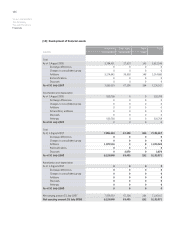

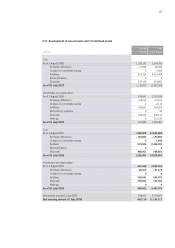

[10] Income tax expense

The income tax expense disclosed comprises the following:

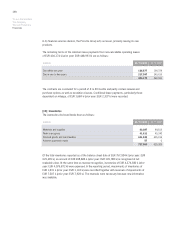

An average income tax rate of 30% (prior year: 39%) applies for the German entities as a result of

the 2008 company tax reform act. The income tax rates applied for foreign entities range between

0% and 41% (prior year: between 0% and 41%). The reduction in tax rate was already considered

when determining the deferred taxes of the German companies in the prior year. In the Porsche

Group as a whole, changes in tax rates led to a revaluation of deferred taxes and thus a tax ex-

pense of EUR 629 k (prior year: EUR 25,932 k).

The current tax expense was reduced by EUR 1,306 k (prior year: EUR 778 k) owing to previously

unused tax losses and tax credits. This did not lead to any changes for deferred taxes in either

reporting period.

The write-ups of deferred taxes in the reporting year amounted to EUR 954 k (prior year:

EUR 7,760 k) and write-downs on deferred taxes amounted to EUR 0 k (prior year: EUR 149 k).

There are unused tax losses of EUR 32,160 k (prior year: EUR 15,685 k), for which no de-

ferred tax assets have been recorded. Of the unused tax losses, an amount of EUR 29,900 k

(prior year: EUR 15,685 k) can be carried forward indefinitely, while an amount of EUR 2,260 k

(prior year: EUR 0 k) has to be used in the next ten years.

Deferred tax assets totaling EUR 8,386 k (prior year: EUR 5,820 k) were recognized on unused

tax losses and of EUR 18 k (prior year: EUR 12 k) on unused tax credits. No deferred taxes were

recorded on retained profits at subsidiaries of EUR 33,190 k (prior year: EUR 26,159 k), as these

profits are mainly to be used for the expansion of business activities at the different locations. It

was decided not to determine the potential tax effects on unretained profits as the effort involved

would have been unreasonably high.

EUR000 2007/08 2006/07

Current taxes 1,943,075 1,135,019

thereof income relating to other periods – 718 – 70,048

Deferred taxes 233,925 479,981

2,177,000 1,615,000