Porsche 2007 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2007 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210

|

|

135

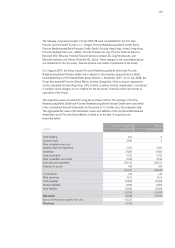

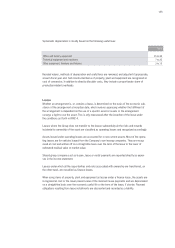

Systematic depreciation is mostly based on the following useful lives:

Residual values, methods of depreciation and useful lives are reviewed, and adjusted if appropriate,

at each fiscal year end. Self-constructed items of property, plant and equipment are recognized at

cost of conversion. In addition to directly allocable costs, they include a proportionate share of

production-related overheads.

Leases

Whether an arrangement is, or contains a lease, is determined on the basis of the economic sub-

stance of the arrangement at inception date, which involves appraising whether the fulfillment of

the arrangement is dependent on the use of a specific asset or assets or the arrangement

conveys a right to use the asset. This is only reassessed after the inception of the lease under

the conditions set forth in IFRIC 4.

Leases where the Group does not transfer to the lessee substantially all the risks and rewards

incidental to ownership of the asset are classified as operating leases and recognized accordingly.

Assets leased under operating leases are accounted for in non-current assets. Most of the opera-

ting leases are for vehicles leased from the Company’s own leasing companies. They are recog-

nized at cost and written off on a straight-line basis over the term of the lease to the lower of

estimated residual value or market value.

Should group companies act as lessee, lease or rental payments are reported directly as expen-

ses in the income statement.

Leases under which all the opportunities and risks associated with ownership are transferred, on

the other hand, are classified as finance leases.

When using items of property, plant and equipment as lessee under a finance lease, the assets are

recognized at cost or the lower present value of the minimum lease payments and are depreciated

on a straight-line basis over the economic useful life or the term of the lease, if shorter. Payment

obligations resulting from lease installments are discounted and recorded as a liability.

Years

Office and factory equipment 25 to 40

Technical equipment and machines 7 to 20

Other equipment, furniture and fixtures 3 to 13