Porsche 2007 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2007 Porsche annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

175

3. Liquidity risk

Porsche mainly generates liquidity through its business operations, external financing and the

securitization of receivables. The funds are chiefly used to finance working capital and capital

expenditures and to cover the finance requirements of the leasing and hire purchase business.

As a rule, the Group’s leasing and hire purchase business is financed to a large extent by debt

capital and the sale of receivables from the financial services business (securitizations).

Porsche manages the Group’s liquidity by maintaining sufficient cash and cash equivalents and

lines of credits at banks in addition to cash inflows from operating activities. Its liquid assets

consist of cash and cash equivalents as well as highly liquid securities.

Operative liquidity management comprises a cash concentration process in which cash and

cash equivalents are pooled on a daily basis. This allows liquidity surpluses and shortages to

be managed in line with the requirements of the Group as a whole as well as of individual group

entities. The maturities of financial assets and financial liabilities as well as estimates of cash

flows from operating activities are included in short and medium-term liquidity management.

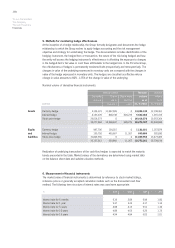

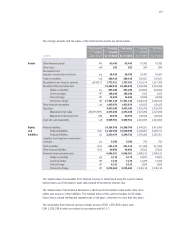

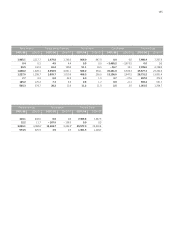

The table below shows the undiscounted contractually agreed cash outflows from the financial

instruments.

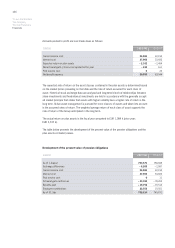

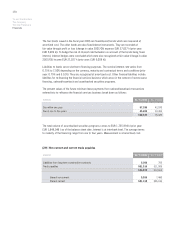

Maturity analysis of undiscounted cash outflows from financial instruments:

The derivatives include all cash outflows from derivative financial instruments with a negative

balance. They are mostly derivatives for which gross settlement has been agreed or stock options.

For economic purposes, it is generally possible to allocate cash inflows of the same amount to

these payments. These cash inflows are not shown in the maturities analysis. If the cash inflows

were considered, the cash outflows presented in the maturities analysis would be significantly

lower.

Remaining contractual maturities

EUR000

Within

one year

Within one

to five years

In more than

five years

Total

31/7/2008

Financial liabilities 13,102,794 2,945,262 1,349,481 17,397,537

Trade payables 578,489 3,027 0581,516

Other financial liabilities 87,334 3,528 090,862

Derivative financial instruments 7,853,600 136,527 497 7,990,624

21,622,217 3,088,344 1,349,978 26,060,539

31/7/2007

Financial liabilities 3,159,392 3,116,404 1,445,931 7,721,727

Trade payables 504,428 7,480 0511,908

Other financial liabilities 17,722 2,154 150 20,026

Derivative financial instruments 3,672,695 82,878 14,236 3,769,809

7,354,237 3,208,916 1,460,317 12,023,470