NVIDIA 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

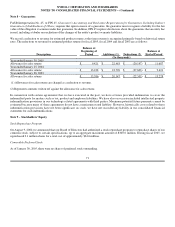

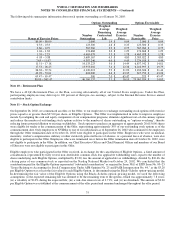

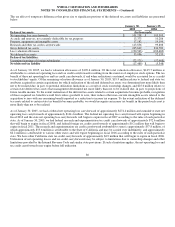

The American Jobs Creation Act of 2004 was signed into law on October 22, 2004. This act creates a temporary incentive for United

States multinationals to repatriate accumulated income earned outside the United States at a federal effective tax rate of 5.25%. On

December 21, 2004, the Financial Accounting Standards Board, or FASB, issued FASB Staff Position No. FAS 109−2, Accounting

and Disclosure Guidance for the Foreign Earnings Repatriation Provision within the American Jobs Creation Act of 2004, which

allows an enterprise time beyond the financial reporting period of enactment to evaluate the effect of the Act on its plan for

reinvestment or repatriation of foreign earnings We have started an evaluation of the effects of the repatriation provision; however, we

do not expect to be able to complete this evaluation until after Congress or the Treasury Department provide additional clarifying

language on key elements of the provision. We have not provided for United States income taxes on a cumulative total of

approximately $174.7 million of undistributed earnings as of January 30, 2005 for certain non−United States subsidiaries as we

intended to reinvest these earnings indefinitely in operations outside of the United States. We are currently in the process of evaluating

whether or not, and to what extent, if any, this provision may benefit us. We expect to complete such evaluation before the end of our

fiscal 2006. The range of possible amounts that we are considering for repatriation under this provision is between zero and $500

million. The potential range of related income tax expense is between zero and $27 million.

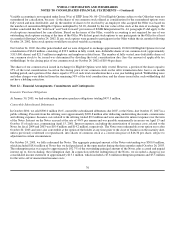

Note 14 − Microsoft Agreement

On March 5, 2000, we entered into an agreement with Microsoft Corporation, or the Microsoft Agreement, in which we agreed, under

certain terms and conditions, to develop and sell processors for use in the Xbox video game console. The terms of the Microsoft

Agreement also state that in the event that an individual or corporation makes an offer to purchase shares equal to or greater than thirty

percent (30%) of the outstanding shares of our common stock, Microsoft has first and last rights of refusal to purchase the stock.

We were engaged with Microsoft Corporation, or Microsoft, in discussions related to pricing and volumes of the Xbox platform

processors. The Microsoft Agreement contemplated the use of a third party to resolve disputed matters, and on April 23, 2002

Microsoft submitted the pricing dispute to binding arbitration. On February 6, 2003, NVIDIA and Microsoft announced that

arbitration was over and the companies had settled all issues related to pricing of the Microsoft Xbox platform processors. In addition

to resolving this pricing dispute, we have agreed to collaborate with Microsoft on future cost reductions for the Xbox, together the

Microsoft Settlement. As a result of the Microsoft Settlement, we recorded $40.4 million in additional revenue in the fourth quarter of

fiscal 2003.

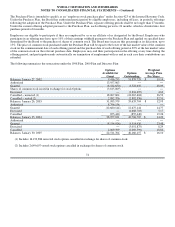

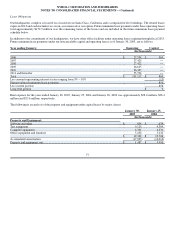

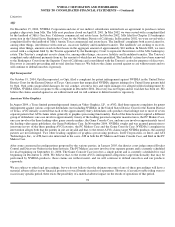

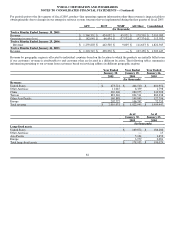

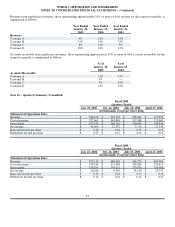

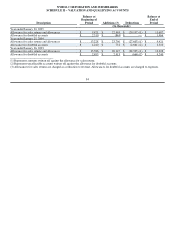

Note 15 − Segment Information

During the second quarter of fiscal 2005, our chief operating decision maker, the Chief Executive Officer, began reviewing financial

information presented on an operating segment basis for purposes of making operating decisions and assessing financial performance.

We now report three product−line operating segments: the GPU business, which is composed of products that support desktop PCs,

notebook PCs and professional workstations; the MCP business, which is composed of NVIDIA nForce and Xbox products; and the

WMP business, which supports handheld personal digital assistants and cellular phones. In addition to these operating segments, we

have the “All Other” category that includes human resources, legal, finance, general administration and corporate marketing expenses,

which total $101.4 million for fiscal 2005, that we do not allocate to our other operating segments. “All Other” also includes the

results of operations of other miscellaneous operating segments that are neither individually reportable, nor aggregated with another

operating segment. Revenue in the “All Other” category is primarily derived from sales of memory.

We do not identify or allocate assets by operating segment. Operating segments do not record intersegment revenue, and, accordingly,

there is none to be reported. The accounting policies for segment reporting are the same as for our company as a whole.

81