NVIDIA 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

We invest in a variety of financial instruments, consisting principally of investments in commercial paper, money market funds and

highly liquid debt securities of corporations, municipalities and the United States government and its agencies. These investments are

denominated in United States dollars.

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS No.

115, Accounting for Certain Investments in Debt and Equity Securities. All of the cash equivalents and marketable securities are

treated as "available−for−sale" under SFAS No. 115. Investments in both fixed rate and floating rate interest earning instruments carry

a degree of interest rate risk. Fixed rate securities may have their market value adversely impacted due to a rise in interest rates, while

floating rate securities may produce less income than expected if interest rates fall. Due in part to these factors, our future investment

income may fall short of expectations due to changes in interest rates or we may suffer losses in principal if forced to sell securities

that decline in market value due to changes in interest rates. However, because we classify our debt securities as "available−for−sale,"

no gains or losses are recognized due to changes in interest rates unless such securities are sold prior to maturity. These securities are

reported at fair value with the related unrealized gains and losses included in accumulated other comprehensive income, a component

of stockholders' equity, net of tax.

As of January 30, 2005, we performed a sensitivity analysis on our floating and fixed rate financial investments. According to our

analysis, parallel shifts in the yield curve of both +/−50 basis points would result in changes in fair market values for these

investments of approximately $2.9 million.

Exchange Rate Risk

We consider our direct exposure to foreign exchange rate fluctuations to be minimal. Currently, sales and arrangements with

third−party manufacturers provide for pricing and payment in United States dollars, and therefore are not subject to exchange rate

fluctuations. To date, we have not engaged in any currency hedging activities, although we may do so in the future. Fluctuations in

currency exchange rates could harm our business in the future.

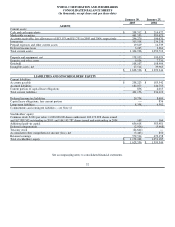

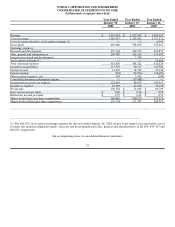

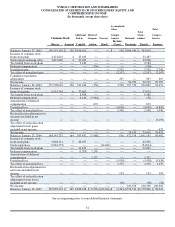

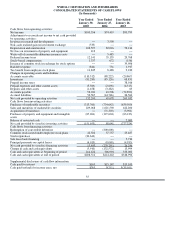

ITEM 8. CONSOLIDATED FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information required by this item is set forth in our consolidated financial statements and notes thereto included in this Annual

Report.

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

Not applicable.

ITEM 9A. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Based on their evaluation as of January 30, 2005, our management, including our Chief Executive Officer and Chief Financial Officer,

have concluded that our disclosure controls and procedures (as defined in Rule 13a−15(e) under the Securities Exchange Act of 1934,

or the Exchange Act) were effective to ensure that the material information required to be disclosed by us in this Annual Report on

Form 10−K was recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange

Commission's rules and instructions for Form 10−K.

Management's Annual Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is

defined in Exchange Act Rule 13a−15(f). Under the supervision and with the participation of our management, including our Chief

Executive Officer and Chief Financial Officer, we conducted an evaluation of the effectiveness of our internal control over financial

reporting as of January 30, 2005 based on the criteria set forth in Internal Control − Integrated Framework issued by the Committee

of Sponsoring Organizations of the Treadway Commission. Based on our evaluation under the criteria set forth in Internal Control −−

Integrated Framework, our management concluded that our internal control over financial reporting was effective as of January 30,

2005.

45