NVIDIA 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

Concentration of Credit Risk

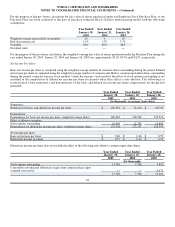

Financial instruments that potentially subject us to concentrations of credit risk consist primarily of cash equivalents, marketable

securities and trade accounts receivable. All marketable securities are held in our name, managed by several investment managers and

held by one major financial institution under a custodial arrangement. Two customers accounted for approximately −−27% of our

accounts receivable balance at January 30, 2005. We perform ongoing credit evaluations of our customers' financial condition and

maintain an allowance for potential credit losses. This allowance consists of an amount identified for specific customers and an

amount based on overall estimated exposure. Our overall estimated exposure excludes amounts covered by credit insurance and letters

of credit.

Impairment of Long−Lived Assets

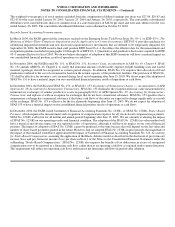

In accordance with Statement of Financial Accounting Standards No. 144, or SFAS No. 144, Accounting for the Impairment or

Disposal of Long−Lived Assets, long−lived assets, such as property and equipment and intangible assets subject to amortization, are

reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be

recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of an asset to estimated

undiscounted future cash flows expected to be generated by the asset. If the carrying amount of an asset exceeds its estimated future

cash flows, an impairment charge is recognized for the amount by which the carrying amount of the asset exceeds the fair value of the

asset. Fair value is determined based on the estimated discounted future cash flows expected to be generated by the asset. Assets and

liabilities to be disposed of would be separately presented in the consolidated balance sheet and the assets would be reported at the

lower of the carrying amount or fair value less costs to sell, and would no longer be depreciated.

Rent Expense

We recognize rent expense on a straight−line basis over the lease period and have accrued for rent expense incurred, but not paid.

Accounting for Asset Retirement Obligations

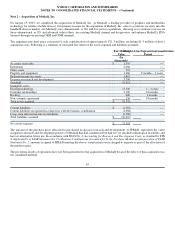

In fiscal 2004, we adopted Statement of Financial Accounting Standards No. 143, or SFAS No. 143, Accounting for Asset Retirement

Obligations, which addresses financial accounting and reporting for obligations associated with the retirement of tangible long−lived

assets and the associated asset retirement costs. SFAS No. 143 applies to legal obligations associated with the retirement of long−lived

assets that result from the acquisition, construction, development and/or normal use of the assets. SFAS No. 143 requires that the fair

value of a liability for an asset retirement obligation be recognized in the period in which it is incurred if a reasonable estimate of fair

value can be made. The fair value of the liability is added to the carrying amount of the associated asset and this additional carrying

amount is depreciated over the life of the asset. During fiscal 2005, we completed leasehold improvements at our headquarters facility

in Santa Clara, California and recorded a liability of $4.5 million to return the property to its original condition upon lease termination

in fiscal year 2013.

Income Taxes

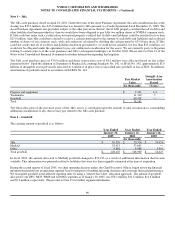

Statement of Financial Accounting Standards No. 109, or SFAS No. 109, Accounting for Income Taxes, establishes financial

accounting and reporting standards for the effect of income taxes. In accordance with SFAS No. 109, we recognize federal, state and

foreign current tax liabilities or assets based on our estimate of taxes payable or refundable in the current fiscal year by tax

jurisdiction. We also recognize federal, state and foreign deferred tax assets or liabilities, as appropriate, for our estimate of future tax

effects attributable to temporary differences and carryforwards; and we record a valuation allowance to reduce any deferred tax assets

by the amount of any tax benefits that, based on available evidence and judgment, are not expected to be realized.

60