NVIDIA 2005 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2005 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

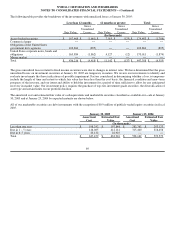

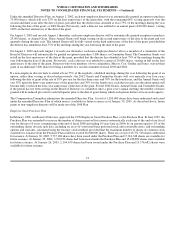

Note 13 − Income Taxes

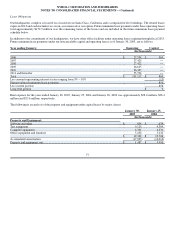

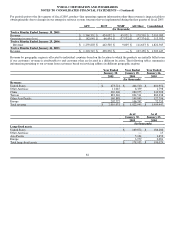

The provision for income taxes applicable to income before income taxes consists of the following:

Year Ended Year Ended Year Ended

January 30, January 25, January 26,

2005 2004 2003

(In thousands)

Current:

Federal $ −− $ −− $ −−

State 355 221 135

Foreign 8,826 (51,590) 20,555

Total current 9,181 (51,369) 20,690

Deferred:

Federal 4,683 19,861 20,569

State (620) 35,274 9,319

Foreign −− −− −−

Total deferred 4,063 55,135 29,888

Charge in lieu of taxes attributable to employer stock option plans 11,845 8,488 9,180

Provision for income taxes $ 25,089 $ 12,254 $ 59,758

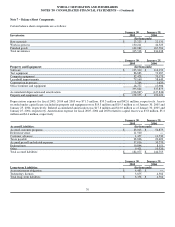

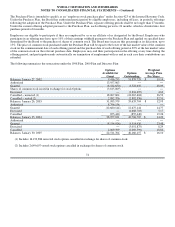

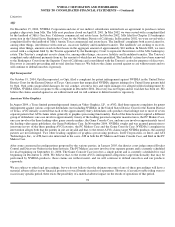

Income before income taxes consists of the following:

Year Ended Year Ended Year Ended

January 30, January 25, January 26,

2005 2004 2003

(In thousands)

Domestic $ 9,556 $ (17,816) $ 20,764

Foreign 115,889 104,489 129,793

$ 125,445 $ 86,673 $ 150,557

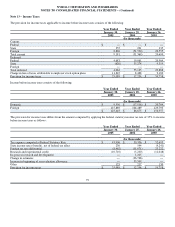

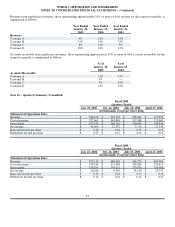

The provision for income taxes differs from the amount computed by applying the federal statutory income tax rate of 35% to income

before income taxes as follows:

Year Ended Year Ended Year Ended

January 30, January 25, January 26,

2005 2004 2003

(In thousands)

Tax expense computed at Federal Statutory Rate $ 43,906 $ 30,336 $ 52,695

State income taxes (benefit), net of federal tax effect 230 544 (4,241)

Foreign tax rate differential (8,462) (11,671) 23,222

Research and experimental credit (10,710) (5,230) (12,048)

In−process research and development −− 1,225 −−

Change in estimates −− (36,766) −−

Increase in beginning of year valuation allowance −− 33,599 −−

Other 125 217 130

Provision for income taxes $ 25,089 $ 12,254 $ 59,758

79