NVIDIA 2005 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2005 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

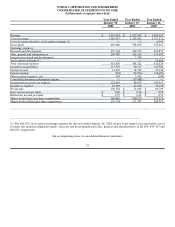

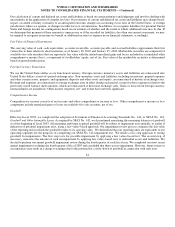

Stock−Based Compensation

Statement of Financial Accounting Standards No. 148, or SFAS No. 148, Accounting for Stock−Based Compensation − Transition

and Disclosure, amends the disclosure requirements of Statement of Financial Accounting Standards No. 123, or SFAS No. 123,

Accounting for Stock−Based Compensation, to require more prominent disclosures in both annual and interim financial statements

regarding the method of accounting for stock−based compensation and the effect of the method used on reported results.

We use the intrinsic value method, as prescribed by Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to

Employees, to account for our stock−based employee compensation plans. As such, compensation expense is recorded if on the date of

grant the current fair value per share of the underlying stock exceeds the exercise price per share. Compensation cost for our

stock−based compensation plans as determined consistent with SFAS No. 123, would have decreased net income to the pro forma

amounts indicated below:

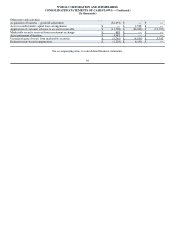

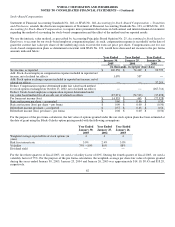

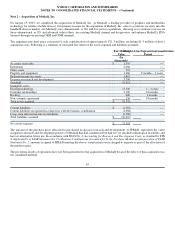

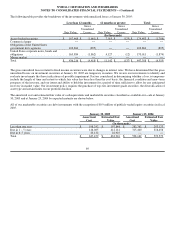

Year Ended Year Ended Year Ended

January 30, January 25, January 26,

2005 2004 2003

(In thousands, except per share data)

Net income, as reported $ 100,356 $ 74,419 $ 90,799

Add: Stock−based employee compensation expense included in reported net

income, net of related tax effects 1,070 537 −−

Add: Stock option exchange expense included in reported net income, net of

related tax effects −− −− 37,285

Deduct: Compensation expense determined under fair value based method

for stock options exchanged on October 25, 2002, net of related tax effects −− −− (167,714)

Deduct: Stock−based employee compensation expense determined under

fair value based method for all awards, net of related tax effects (87,071) (74,513) (37,698)

Pro forma net income (loss) $ 14,355 $ 443 $ (77,328)

Basic net income per share − as reported $ 0.60 $ 0.46 $ 0.59

Basic net income (loss) per share − pro forma $ 0.09 $ 0.00 $ (0.50)

Diluted net income per share − as reported $ 0.57 $ 0.43 $ 0.54

Diluted net income (loss) per share − pro forma $ 0.08 $ 0.00 $ (0.50)

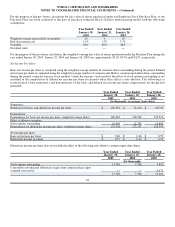

For the purpose of the pro forma calculation, the fair value of options granted under the our stock option plans has been estimated at

the date of grant using the Black−Scholes option pricing model with the following assumptions:

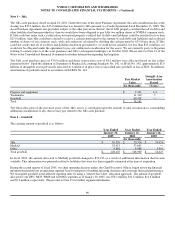

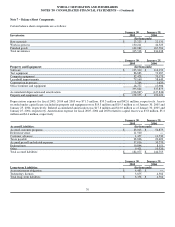

Year Ended Year Ended Year Ended

January 30, January 25, January 26,

2005 2004 2003

Weighted average expected life of stock options (in

years) 444

Risk free interest rate 3.0% 2.4% 3.8%

Volatility 75% − 80% 80% 88%

Dividend yield −− −− −−

For the first three quarters of fiscal 2005, we used a volatility factor of 80%. During the fourth quarter of fiscal 2005, we used a

volatility factor of 75%. For the purpose of the pro forma calculation, the weighted−average per share fair value of options granted

during the years ended January 30, 2005, January 25, 2004 and January 26, 2003 was approximately $14.10, $9.43 and $18.29,

respectively.

62