NVIDIA 2005 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2005 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

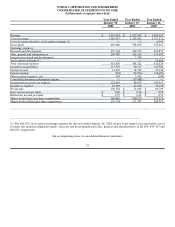

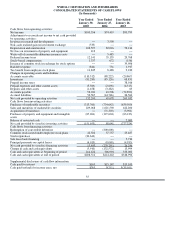

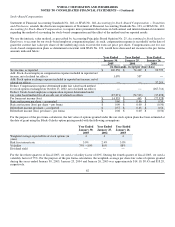

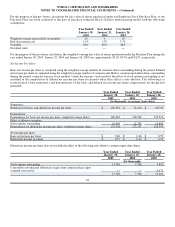

NVIDIA CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

Year Ended Year Ended Year Ended

January 30, January 25, January 26,

2005 2004 2003

Cash flows from operating activities:

Net income $100,356 $74,419 $90,799

Adjustments to reconcile net income to net cash provided

by operating activities:

In−process research and development −− 3,500 −−

Non−cash realized gain on investment exchange (533) −− −−

Depreciation and amortization 102,597 82,016 58,216

Net loss on retirements of property and equipment 412 −− −−

Write−off of convertible debenture issuance costs −− 5,485 −−

Deferred income taxes 12,141 55,135 29,768

Stock−based compensation 1,337 672 (156)

Issuance of common stock in exchange for stock options −− −− 39,906

Bad debt expense (844) 731 1,917

Tax benefit from employee stock plans 11,845 8,488 9,180

Changes in operating assets and liabilities:

Accounts receivable (110,312) (88,222) (20,867)

Inventories (81,280) (85,126) 68,831

Prepaid income taxes −− −− 38,016

Prepaid expenses and other current assets (5,569) (2,698) (4,315)

Deposits and other assets (1,458) (3,482) 63

Accounts payable 52,941 43,506 (72,890)

Accrued liabilities 50,567 (44,746) 26,564

Net cash provided by operating activities 132,200 49,678 265,032

Cash flows from investing activities:

Purchases of marketable securities (313,760) (734,642) (639,500)

Sales and maturities of marketable securities 229,068 1,021,590 422,200

Acquisition of businesses −− (71,303) (3,901)

Purchases of property and equipment and intangible

assets (67,261) (127,604) (63,123)

Release of restricted cash −− −− 7,000

Net cash provided by (used in) investing activities (151,953) 88,041 (277,324)

Cash flows from financing activities:

Redemption of convertible debenture −− (300,000) −−

Common stock issued under employee stock plans 42,502 37,757 25,487

Stock repurchase (24,644) −− −−

Sale lease back financing −− −− 5,734

Principal payments on capital leases (4,015) (8,048) (4,935)

Net cash provided by (used in) financing activities 13,843 (270,291) 26,286

Change in cash and cash equivalents (5,910) (132,572) 13,994

Cash and cash equivalents at beginning of period 214,422 346,994 333,000

Cash and cash equivalents at end of period $208,512 $214,422 $346,994

Supplemental disclosures of cash flow information:

Cash paid for interest $163 $15,167 $15,100

Cash paid (refund) for income taxes, net $763 $(211) $(35,101)

55