NVIDIA 2004 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

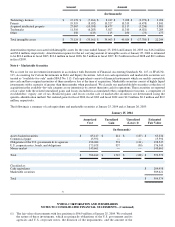

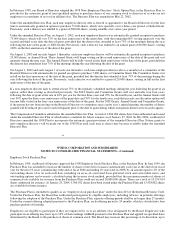

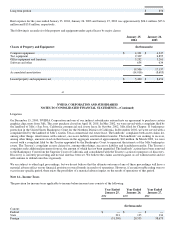

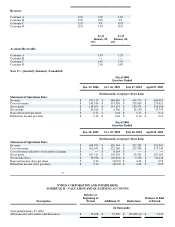

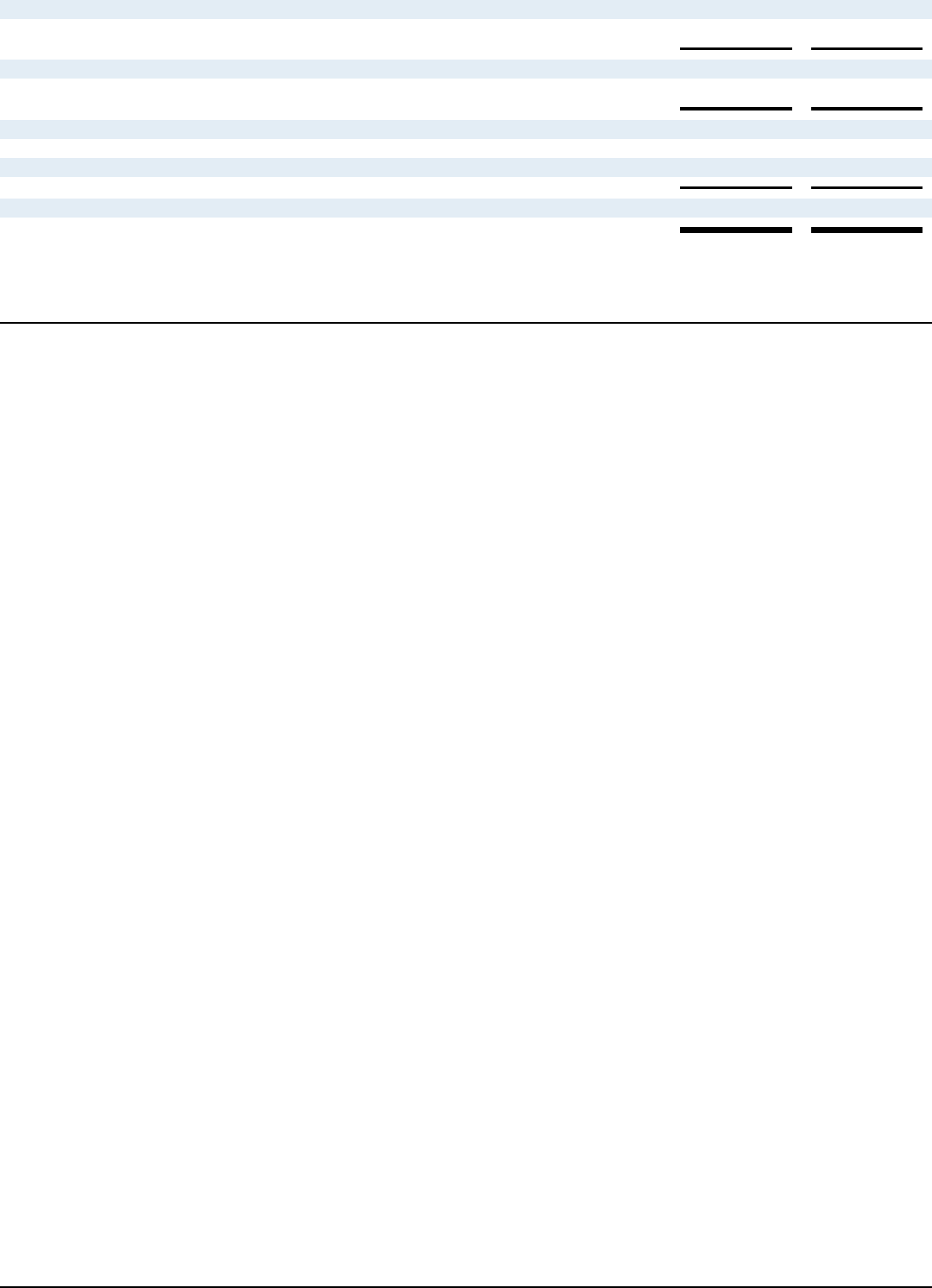

Property, equipment and intangible assets 19,194 5,733

Research and other tax credit carryforwards 99,806 87,265

Gross deferred tax assets 234,789 161,229

Less valuation allowance (182,669) (106,663)

Net deferred tax assets 52,120 54,566

Deferred tax liabilities:

Unremitted earnings of foreign subsidiary(ies) (57,468) −−

Net deferred tax asset (liability) $ (5,348) $ 54,566

62

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

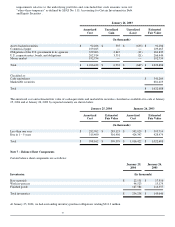

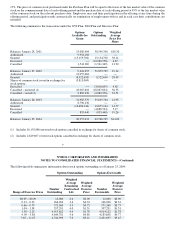

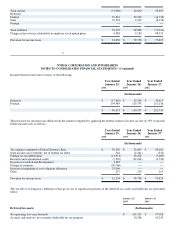

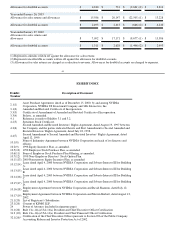

As of January 25, 2004, we had a valuation allowance of $182.7 million. Of the total valuation allowance, $117.0 million is

attributable to certain net operating loss and tax credit carryforwards resulting from the exercise of employee stock options. The tax

benefit of these net operating loss and tax credit carryforwards, if and when realization is sustained, would be accounted for as a credit

to stockholders' equity. Of the remaining valuation allowance as of January 25, 2004, $21.4 million relates to federal and state tax

attributes acquired in certain acquisitions for which realization of the related deferred tax assets was determined not more likely than

not to be realized due, in part, to potential utilization limitations as a result of stock ownership changes, and $44.3 million relates to

certain state deferred tax assets that management determined not more likely than not to be realized due, in part, to projections of

future taxable income. To the extent realization of the deferred tax assets related to certain acquisitions becomes probable, recognition

of these acquired tax benefits would first reduce goodwill to zero, then reduce other non−current intangible assets related to the

acquisition to zero with any remaining benefit reported as a reduction to income tax expense. To the extent realization of the deferred

tax assets related to certain state tax benefits becomes probable, we would recognize an income tax benefit in the period such asset is

more likely than not to be realized.

During fiscal 2004, we recorded an income tax benefit of approximately $75.0 million related to settlement of certain tax

contingencies and an income tax expense of approximately $38.2 million for the accrual of U.S. deferred income taxes on previous

permanently reinvested foreign earnings through January 26, 2003, which nets to an income tax benefit of $36.8 million.

We have not provided for U.S. income taxes on a cumulative total of approximately $152.5 million of undistributed earnings as of as

of January 25, 2004 for certain non−U.S. subsidiaries as we intend to reinvest these earnings indefinitely in operations outside the U.S.

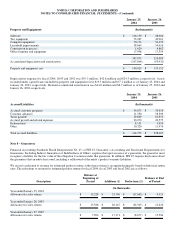

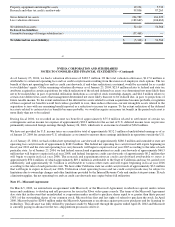

As of January 25, 2004, we had a federal net operating loss carryforward of approximately $280.3 million and cumulative state net

operating loss carryforwards of approximately $162.2 million. The federal net operating loss carryforward will expire beginning in

fiscal year 2012 and the state net operating loss carryforwards will begin to expire in fiscal year 2005 according to the rules of each

particular state. As of January 25, 2004, we had federal research and experimentation tax credit carryforwards of approximately $60.3

million that will begin to expire in fiscal year 2008; and federal foreign tax credit carryforwards of approximately $0.2 million that

will begin to expire in fiscal year 2006. The research and experimentation tax credit carryforward attributable to states is

approximately $50.4 million, of which approximately $49.1 million is attributable to the State of California and may be carried over

indefinitely, and approximately $1.3 million is attributable to various other states and will expire beginning in fiscal year 2016

according to the rules of each particular state. We have other California state tax credit carryforwards of approximately $3.3 million

that will begin to expire in fiscal year 2006. Utilization of net operating losses and tax credit carryforwards may be subject to

limitations due to ownership changes and other limitations provided by the Internal Revenue Code and similar state provisions. If such

a limitation applies, the net operating loss and tax credit carryforwards may expire before full utilization.

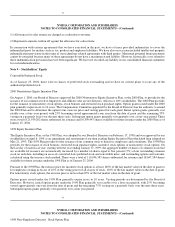

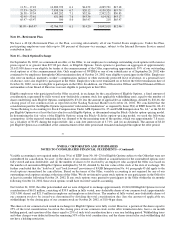

Note 15 – Microsoft Agreement

On March 5, 2000, we entered into an agreement with Microsoft, or the Microsoft Agreement, in which we agreed, under certain

terms and conditions, to develop and sell processors for use in the Xbox video game console. The terms of the Microsoft Agreement

also state that in the event that an individual or corporation makes an offer to purchase shares equal to or greater than thirty percent

(30%) of the outstanding shares of our common stock, Microsoft has first and last rights of refusal to purchase the stock. In April

2000, Microsoft paid us $200.0 million under the Microsoft Agreement as an advance against processor purchases and for licensing its

technology. This advance was fully utilized by purchases made by Microsoft through the quarter ended April 28, 2002 and Microsoft

is currently paying in advance for the two−chip platform processors sold to it.

63