NVIDIA 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

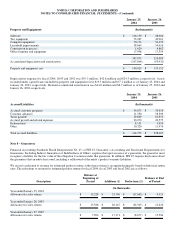

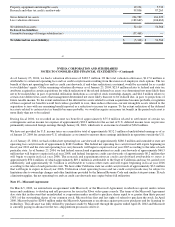

Note 12 − Discontinued Use of Property

We moved into our new headquarters in June 2001 and was still obligated to pay rent for a portion of our previous office space. Since

relocating, we have been unable to secure a subtenant for our previous office space due to the decrease in demand for commercial

rental space as a result of the declining economy. We recorded a loss of approximately $3.7 million during fiscal 2002 for the

remaining costs related to the preexisting lease, including rental payments, capitalized leasehold improvements, and furniture and

fixtures, as the leased property or improvements have no substantive future use or benefit. In December 2001, we filed a complaint

against Extreme Networks Inc., the sublessor of the property, seeking payment of lease payments and other property charges for the

period of July 2001 through December 2001 and seeking a declaration that we are not liable for any future payments under the lease.

In July, 2003, we settled the matter with Extreme Networks and in August, 2003, the complaint was dismissed with prejudice.

Note 13 − Financial Arrangements, Commitments and Contingencies

Convertible Subordinated Debentures

In October 2000, we sold $300.0 million of convertible subordinated debentures, or the Notes, due October 15, 2007 in a public

offering. Proceeds from the offering were approximately $290.8 million after deducting underwriting discounts, commissions and

offering expenses. Issuance costs related to the offering totaled $9.2 million and were amortized to interest expense over the term of

the Notes. Interest on the Notes accrued at the rate of 4¾% per annum and was payable semiannually in arrears on April 15 and

October 15 of each year, commencing April 15, 2001. Interest expense, excluding the amortization of issuance costs, related to the

Notes for fiscal 2004, 2003 and 2002 was $10.4 million, $14.2 million and $14.2 million, respectively. The Notes were redeemable at

our option on or after October 20, 2003 and were also convertible at the option of the holder at any time prior to the close of business

on the maturity date, unless previously redeemed or repurchased, into shares of common stock at a conversion price of $46.36 per

share, subject to adjustment in certain circumstances.

59

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

On October 24, 2003, we fully redeemed the Notes. The aggregate principal amount of the Notes outstanding was $300.0 million,

which included $18.6 million of Notes that we had purchased in the open market during the three months ended October 26, 2003.

The redemption price was equal to approximately 102.7% of the outstanding principal amount of the Notes, plus accrued and unpaid

interest up to, but excluding, the redemption date. In connection with the redemption of the Notes, we recorded a charge in our

consolidated income statement of approximately $13.1 million, which included a $7.6 million redemption premium and $5.5 million

of unamortized issuance costs.

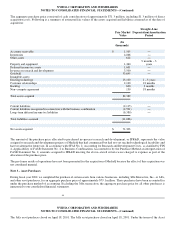

Lease Obligations

Our headquarters complex is located on a leased site in Santa Clara, California and is comprised of five buildings. The related leases

expire in 2012 and each includes two seven−year renewals at our option. Future minimum lease payments under these operating leases

total approximately $193.8 million over the remaining terms of the leases and are included in the future minimum lease payment

schedule below.

In addition to the commitment of our headquarters, we have other office facilities under operating leases expiring through fiscal 2013.

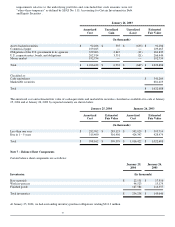

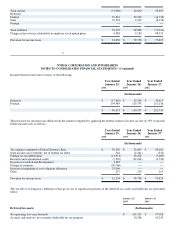

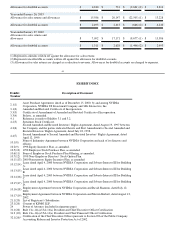

Future minimum lease payments under our noncancelable capital and operating leases as of January 25, 2004, are as follows:

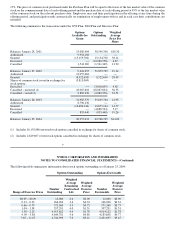

Year ending January: Operating Capital

(In thousands)

2005 $ 24,635 $ 4,179

2006 24,887 868

2007 25,063 −−

2008 25,500 −−

2009 25,125 −−

2010 and thereafter 81,032 −−

Total $ 206,242 5,047

Less amount representing interest at rates ranging from 5% − 10% (176)

Present value of minimum lease payments 4,871

Less current portion 4,015