NVIDIA 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

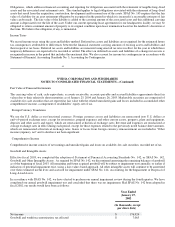

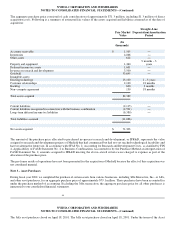

For the purpose of the pro forma calculation the fair value of shares purchased under our Employee Stock Purchase Plan, or the

Purchase Plan, has been estimated at the date of purchase using the Black−Scholes option pricing model with the following

assumptions:

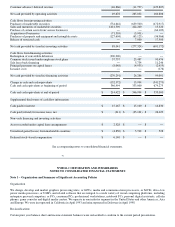

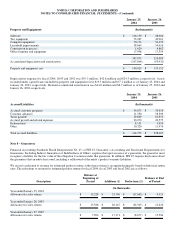

Year Ended Year Ended Year Ended

January 25, January 26, January 27,

2004 2003 2002

Weighted average expected life of stock options (in

months) 9 10 6

Risk free interest rate 1.7% 3.7% 4.7%

Volatility 80% 88% 83%

Dividend yield −− −− −−

47

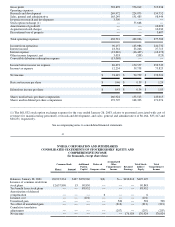

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

For the purpose of the pro forma calculation the weighted−average fair value of shares purchased under the Purchase Plan during the

year ended January 25, 2004, January 26, 2003 and January 27, 2002 was approximately $3.76, $14.27 and $8.79, respectively.

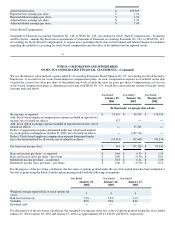

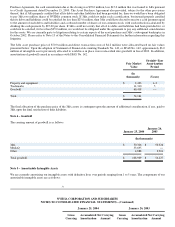

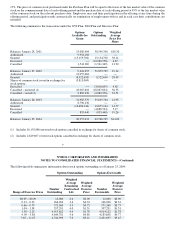

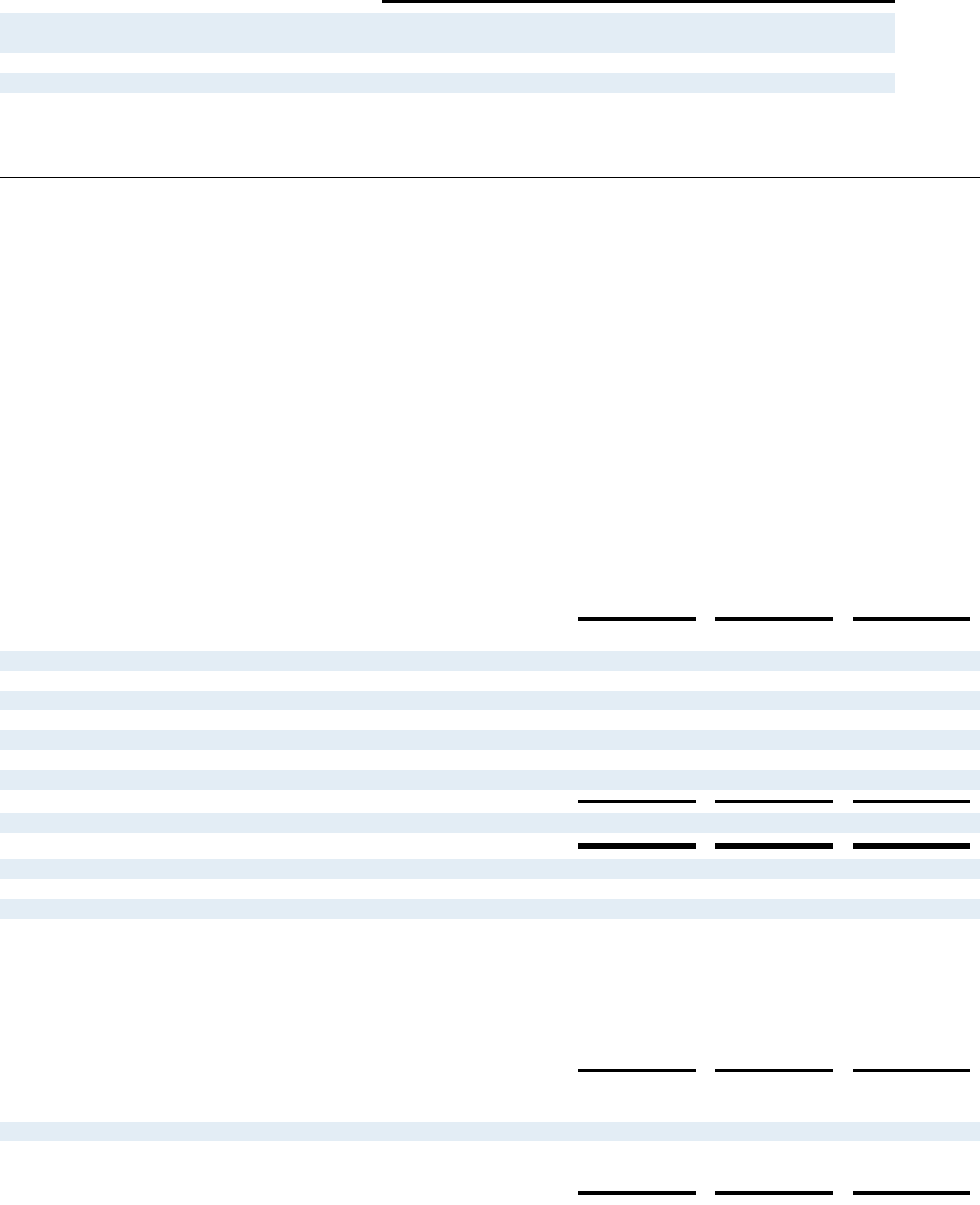

Net Income Per Share

Basic net income per share is computed using the weighted average number of common shares outstanding during the period. Diluted

net income per share is computed using the weighted average number of common and dilutive common equivalent shares outstanding

during the period, using the as−if−converted method for the convertible debentures and the treasury stock method for stock options.

Under the as−if−converted method and the treasury stock method, the convertible debentures and the effect of stock options

outstanding, respectively, are not included in the computation of diluted net income per share for periods when their effect is

anti−dilutive. The following is a reconciliation of the numerators and denominators of the basic and diluted net income per share

computations for the periods presented.

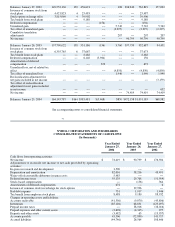

Year Ended Year Ended Year Ended

January 25, January 26, January 27,

2004 2003 2002

(In thousands, except per share data)

Numerator:

Numerator for basic and diluted net income per share $ 74,419 $ 90,799 $ 176,924

Denominator:

Denominator for basic net income per share, weighted average shares 160,924 153,513 143,015

Effect of dilutive securities:

Stock options outstanding 11,783 14,880 28,059

Denominator for diluted net income per share, weighted average shares 172,707 168,393 171,074

Net income per share:

Basic net income per share $ 0.46 $ 0.59 $ 1.24

Diluted net income per share $ 0.43 $ 0.54 $ 1.03

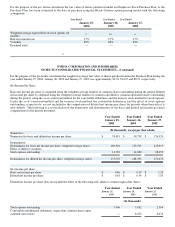

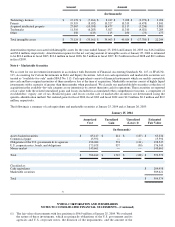

Diluted net income per share does not include the effect of the following anti−dilutive common equivalent shares:

Year Ended Year Ended Year Ended

January 25, January 26, January 27,

2004 2003 2002

(In thousands)

Stock options outstanding 7,906 5,892 2,504

Convertible subordinated debentures (equivalent common shares upon

assumed conversion) −− 6,472 6,472