NVIDIA 2004 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

we determine that payment of these amounts is unnecessary or if the recorded tax liability is less than our current assessment, we may

be required to recognize an income tax benefit or additional income tax expense in our financial statements, accordingly.

15

As of January 25, 2004, we had a valuation allowance of $182.7 million. Of the total valuation allowance, $117.0 million is

attributable to certain net operating loss and tax credit carryforwards resulting from the exercise of employee stock options. The tax

benefit of these net operating loss and tax credit carryforwards, if and when realization is sustained, will be accounted for as a credit to

stockholders' equity. Of the remaining valuation allowance at January 25, 2004, $21.4 million relates to federal and state tax attributes

acquired in certain acquisitions for which realization of the related deferred tax assets was determined not more likely than not to be

realized due, in part, to potential utilization limitations as a result of ownership changes; and $44.3 million relates to certain state

deferred tax assets that management determined not more likely than not to be realized due, in part, to projections of future taxable

income. To the extent realization of the deferred tax assets related to certain acquisitions becomes probable, recognition of these tax

benefits would first reduce goodwill to zero, then reduce other non−current intangible assets related to the acquisition to zero with any

remaining benefit reported as a reduction to income tax expense. To the extent realization of the deferred tax assets related to certain

state tax benefits becomes probable, we would recognize an income tax benefit in the period such asset is more likely than not to be

realized.

Contingencies

We are subject to the possibility of various loss contingencies arising in the ordinary course of business. We consider the likelihood of

loss or impairment of an asset or the incurrence of a liability, as well as our ability to reasonably estimate the amount of loss in

determining loss contingencies. An estimated loss contingency is accrued when it is probable that an asset has been impaired or a

liability has been incurred and the amount of loss can be reasonably estimated. We regularly evaluate current information available to

us to determine whether such accruals should be adjusted and whether new accruals are required.

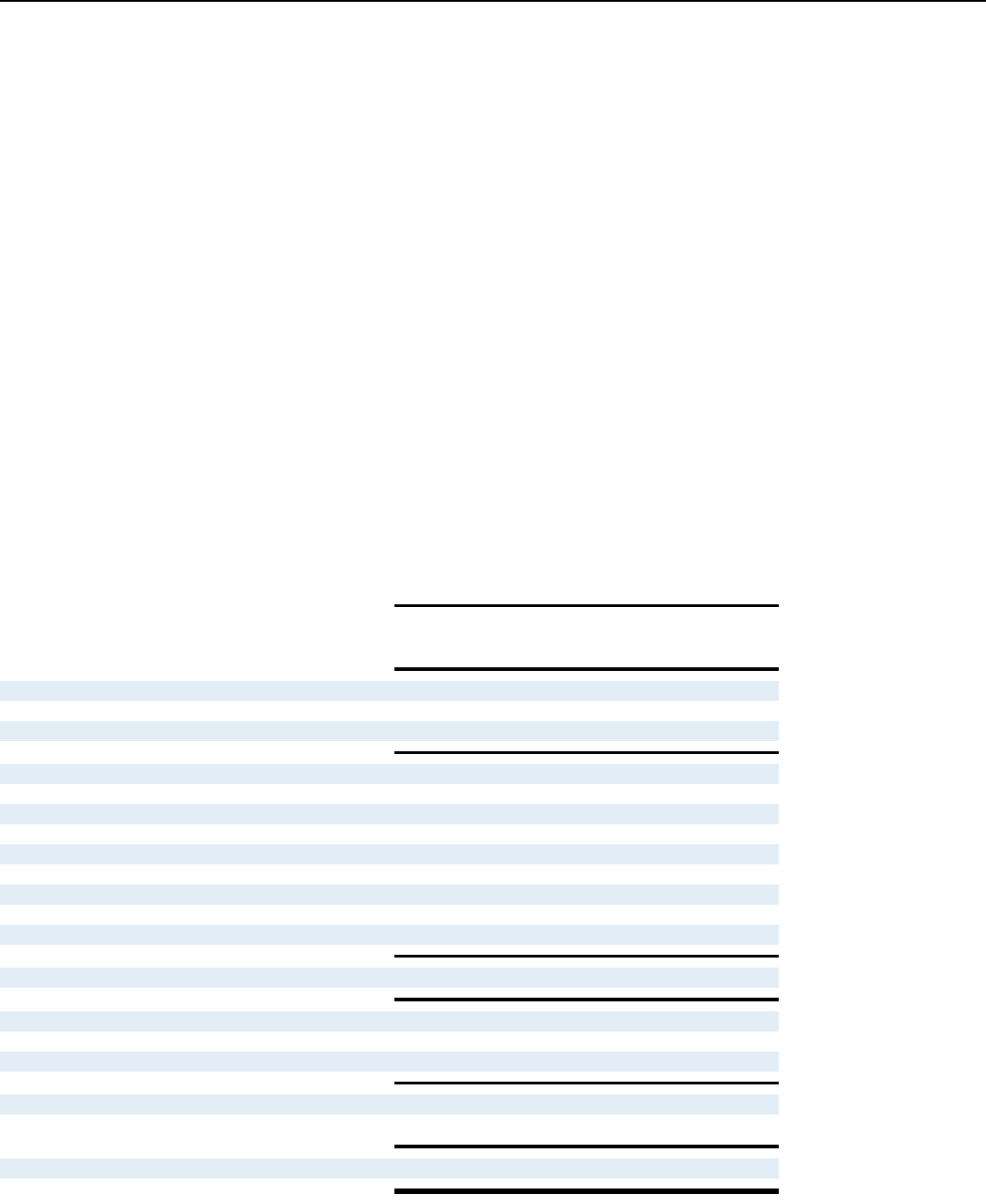

Results of Operations

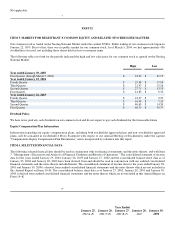

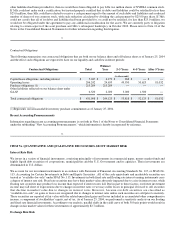

The following table sets forth, for the periods indicated, certain items in our consolidated statements of income expressed as a

percentage of revenue.

Year Ended

January 25, January 26, January 27,

2004 2003 2002

Revenue 100.0% 100.0% 100.0%

Cost of revenue 71.0 69.5 62.1

Cost of revenue related to stock option exchange −− 0.3 −−

Gross profit 29.0 30.2 37.9

Operating expenses:

Research and development 14.8 11.8 11.3

Sales, general and administrative 9.1 7.9 7.2

In−process research and development 0.2 −− −−

Stock option exchange −− 2.9 −−

Amortization of goodwill 0.0 0.0 0.7

Acquisition related charges 0.0 0.0 0.7

Discontinued use of property 0.0 0.0 0.3

Total operating expenses 24.1 22.6 20.2

Income from operations 4.9 7.6 17.7

Interest and other income, net 0.5 0.3 0.8

Convertible debenture redemption expense (0.7) 0.0 0.0

Income before income tax expense 4.7 7.9 18.5

Income tax expense 0.6 3.1 5.5

Net income 4.1 % 4.8 % 13.0 %

16