NVIDIA 2004 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2004 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

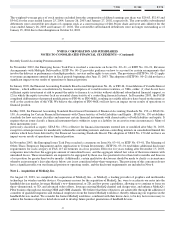

Principles of Consolidation

Our consolidated financial statements include the accounts of NVIDIA Corporation and its wholly owned subsidiaries. All material

intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of

contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the

reporting period. Actual results could differ from those estimates. On an on−going basis, we evaluate our estimates, including those

related to revenue recognition, accounts receivable, inventories and income taxes. These estimates are based on historical facts and

various other assumptions that we believe are reasonable.

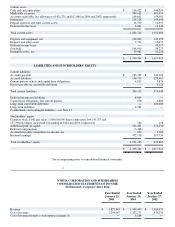

Cash and Cash Equivalents

We consider all highly liquid investments purchased with a maturity of three months or less at the time of purchase to be cash

equivalents. As of January 25, 2004, our cash and cash equivalents were $214.4 million, which consists of $143.7 million invested in

money market funds.

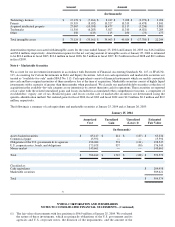

Marketable Securities

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS No.

115, Accounting for Certain Investments in Debt and Equity Securities. All of our cash equivalents and marketable securities are

treated as "available−for−sale" under SFAS No. 115. Cash equivalents consist of financial instruments which are readily convertible

into cash and have original maturities of three months or less at the time of acquisition. Marketable securities consist of highly liquid

investments with a maturity of greater than three months when purchased. We classify our marketable debt securities at the date of

acquisition in the available−for−sale category as our intention is to convert them into cash for operations. These securities are reported

at fair value with the related unrealized gains and losses included in accumulated other comprehensive income, a component of

stockholders’ equity, net of tax. Realized gains and losses on the sale of marketable securities are determined using the

specific−identification method.

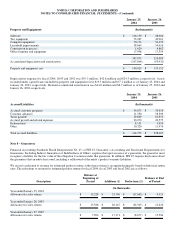

Inventories

Inventories are stated at the lower of cost, on a weighted average basis, or market. Write−downs to reduce the carrying value of

obsolete, slow moving and non−usable inventory to net realizable value are charged to cost of revenue.

43

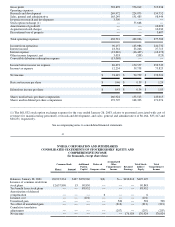

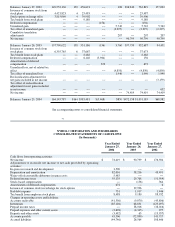

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (Continued)

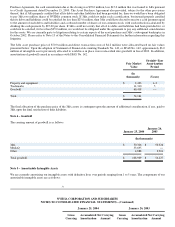

Property and Equipment

Property and equipment are stated at cost. Depreciation is computed using the straight−line method based on estimated useful lives,

generally three to five years. Depreciation expense includes the amortization of assets recorded under capital leases. Leasehold

improvements and assets recorded under capital leases are amortized over the shorter of the lease term or the estimated useful life of

the asset.

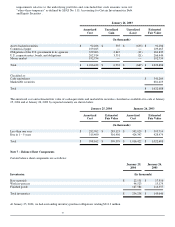

Debt Financing Costs

In connection with our convertible subordinated debenture, see Note 13, we incurred certain direct issuance costs from third parties

who performed services that assisted in the closing of the transaction. These issuance costs were included in our consolidated balance

sheet under "deposits and other assets" and were amortized on a straight line basis over the term of the financing. On October 24,

2003, we fully redeemed the convertible subordinated debenture. In connection with the redemption, we recorded a $13.1 million

charge, which included $5.5 million of unamortized issuance costs.

Advertising Expenses

We expense advertising costs in the period in which they are incurred. Advertising expenses for fiscal 2004, 2003 and 2002 were

approximately $11.3 million, $6.8 million and $4.6 million, respectively.

Stock Split

In August 2001, our Board of Directors approved a two−for−one stock split of our common stock for stockholders of record on